We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of September 30th. In this article, we look at what those funds think of Solar Capital Ltd. (NASDAQ:SLRC) based on that data.

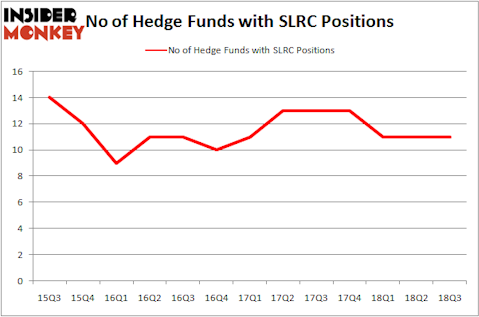

Hedge fund interest in Solar Capital Ltd. (NASDAQ:SLRC) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare SLRC to other stocks including Regis Corporation (NYSE:RGS), Seacor Holdings, Inc. (NYSE:CKH), and Inspire Medical Systems, Inc. (NYSE:INSP) to get a better sense of its popularity.

In the financial world there are a large number of signals stock market investors use to analyze publicly traded companies. A duo of the less known signals are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the best picks of the best money managers can beat the broader indices by a significant margin (see the details here).

We’re going to analyze the recent hedge fund action regarding Solar Capital Ltd. (NASDAQ:SLRC).

Hedge fund activity in Solar Capital Ltd. (NASDAQ:SLRC)

At Q3’s end, a total of 11 of the hedge funds tracked by Insider Monkey were bullish on this stock, no change from the second quarter of 2018. By comparison, 13 hedge funds held shares or bullish call options in SLRC heading into this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Clough Capital Partners was the largest shareholder of Solar Capital Ltd. (NASDAQ:SLRC), with a stake worth $21.1 million reported as of the end of September. Trailing Clough Capital Partners was Arrowstreet Capital, which amassed a stake valued at $10.8 million. Polar Capital, McKinley Capital Management, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Coe Capital Management. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Gillson Capital).

Let’s now take a look at hedge fund activity in other stocks similar to Solar Capital Ltd. (NASDAQ:SLRC). We will take a look at Regis Corporation (NYSE:RGS), Seacor Holdings, Inc. (NYSE:CKH), Inspire Medical Systems, Inc. (NYSE:INSP), and Ascena Retail Group Inc (NASDAQ:ASNA). This group of stocks’ market values resemble SLRC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RGS | 15 | 138608 | 1 |

| CKH | 19 | 149477 | 1 |

| INSP | 13 | 173882 | 0 |

| ASNA | 21 | 147302 | 6 |

| Average | 17 | 152317 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $152 million. That figure was $58 million in SLRC’s case. Ascena Retail Group Inc (NASDAQ:ASNA) is the most popular stock in this table. On the other hand Inspire Medical Systems, Inc. (NYSE:INSP) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks Solar Capital Ltd. (NASDAQ:SLRC) is even less popular than INSP. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.