Madison Investments, an investment advisor, released its “Madison Investors Fund” third quarter 2023 investor letter. A copy of the same can be downloaded here. In the third quarter, Fund (class Y) declined -1.3% compared to a -3.3% decline for the S&P 500 Index benchmark. In addition, you can check the top 5 holdings of the fund to know its best picks in 2023.

Madison Investors Fund highlighted stocks like Texas Instruments Incorporated (NASDAQ:TXN) in the third quarter 2023 investor letter. Headquartered in Dallas, Texas, Texas Instruments Incorporated (NASDAQ:TXN) designs and manufactures semiconductors. On October 27, 2023, Texas Instruments Incorporated (NASDAQ:TXN) stock closed at $143.12 per share. One-month return of Texas Instruments Incorporated (NASDAQ:TXN) was -11.33%, and its shares lost 11.71% of their value over the last 52 weeks. Texas Instruments Incorporated (NASDAQ:TXN) has a market capitalization of $129.982 billion.

Madison Investors Fund made the following comment about Texas Instruments Incorporated (NASDAQ:TXN) in its Q3 2023 investor letter:

“We purchased shares in Texas Instruments Incorporated (NASDAQ:TXN) and Agilent Technologies. Texas Instruments is a leading supplier of analog and embedded semiconductors which convert and amplify signals, manage and distribute power, and process data. It is a highly profitable business with a terrific growth runway, strong competitive advantages, and large opportunities for reinvestment at very attractive returns. The company combines considerable manufacturing scale with incredible intangible advantages across intellectual property derived from its engineering talent, and a reputation for meeting every customer need. We also like that its chips are very challenging for customers to respecify once placed in a product and are a very low cost of the total value of the end product, a combination which creates considerable switching costs, in our view. This set of advantages has enabled Texas Instruments to generate returns on invested capital in the top decile of the S&P 500.

As impressed as we are with the set of competitive advantages and culture at Texas Instruments, we are equally optimistic on the outlook for the end markets it serves. Automotive and industrial markets comprise nearly two-thirds of revenue and are increasingly embracing digital technologies. Common use cases include driver assistance, electric vehicles, factory automation, electric grid infrastructure, and smart home products – just to name a few. Texas Instruments’ semiconductors enable these advancements of the analog economy, which we believe is still in the early stages. To capitalize on this long-term opportunity, Texas Instruments is embarking on an aggressive capital investment program to build out the internal manufacturing capacity to meet anticipated demand. While this is pressuring free cash flow in the near term, we believe these investments will generate very attractive returns on that capital outlay. The combination of weak demand in its consumer end markets combined with uncertainty regarding the capital investment plan created an opportunity to initiate a position in Texas Instruments during the quarter at a price below our assessment of intrinsic value.”

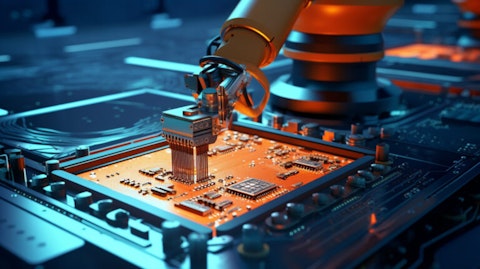

A robotic arm in the process of assembling a complex circuit board – showing the industrial scale the company operates at.

Texas Instruments Incorporated (NASDAQ:TXN) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 56 hedge fund portfolios held Texas Instruments Incorporated (NASDAQ:TXN) at the end of second quarter which was 52 in the previous quarter.

We discussed Texas Instruments Incorporated (NASDAQ:TXN) in another article and shared the list of best technology dividend stocks to buy. In addition, please check out our hedge fund investor letters Q3 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- Top 20 Most Expensive Cities To Live In California

- 15 Best Car Insurance Companies of 2023

- 17 Largest Media Companies in the World in 2023

Disclosure: None. This article is originally published at Insider Monkey.