Aristotle Capital Management, LLC, an investment management company, released its “Aristotle Global Equity Fund” second quarter 2022 investor letter. A copy of the same can be downloaded here. In the second quarter, the fund returned -13.17% at NAV compared to a -15.66% return for the MSCI ACWI Index and -16.19% return for the MSCI World Index. In addition, you can check the top 5 holdings of the fund to know its best picks in 2022.

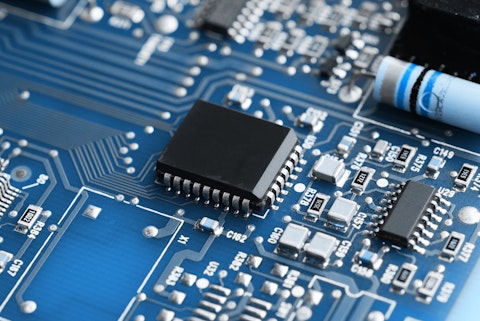

Aristotle Capital discussed stocks like Microchip Technology Incorporated (NASDAQ:MCHP) in the second quarter 2022 investor letter. Headquartered in Chandler, Arizona, Microchip Technology Incorporated (NASDAQ:MCHP) engages in the business of secure embedded control solutions. On October 6, 2022, Microchip Technology Incorporated (NASDAQ:MCHP) stock closed at $67.12 per share. One-month return of Microchip Technology Incorporated (NASDAQ:MCHP) was 0.24% and its shares lost 8.14% of their value over the last 52 weeks. Microchip Technology Incorporated (NASDAQ:MCHP) has a market capitalization of $37.083 billion.

Here is what Aristotle Capital specifically said about Microchip Technology Incorporated (NASDAQ:MCHP) in its Q2 2022 investor letter:

“Microchip Technology Incorporated (NASDAQ:MCHP), the microcontroller (MCU) and analog semiconductor producer, was also a primary detractor for the period. Shares declined during the quarter despite strong fundamentals, as the company posted its fifth consecutive quarter of record revenues. After years of industry consolidation and cost cutting, led by Microchip’s disciplined and frugal executives, the business is executing on our catalyst of enhanced profitability, with operating margins exceeding 40%. FREE cash flow generation has continued to improve, allowing the company to pay out $1.6 billion in dividends and repurchase $426 million shares since fiscal year 2019. Having paid down $5 billion in debt during the same period, Microchip’s credit rating was upgraded to investment grade in 2021, reflecting its higher-quality balance sheet. While we recognize Microchip operates in a cyclical industry, we admire the company’s history of strong FREE cash flow generation through the cycles. Moreover, our conviction remains in Microchip’s ability to grow its market share while uniquely benefiting from the secular trend of expanded usage of MCUs across segments that include 5G products, Internet of Things (IoT), data centers, electric vehicles and autonomous driving systems.”

Portogas D Ace/Shutterstock.com

Microchip Technology Incorporated (NASDAQ:MCHP) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 41 hedge fund portfolios held Microchip Technology Incorporated (NASDAQ:MCHP) at the end of the second quarter which was 42 in the previous quarter.

We discussed Microchip Technology Incorporated (NASDAQ:MCHP) in another article and shared the list of tech stocks gaining value after earnings. In addition, please check out our hedge fund investor letters Q2 2022 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

Disclosure: None. This article is originally published at Insider Monkey.