Ariel Investments, an investment management company, released its “Ariel Small-Cap Value Fund” third-quarter investor letter. A copy of the same can be downloaded here. In the third quarter, the fund declined -8.03% gross of fees, underperforming the Russell 2000 Value Index and the Russell 2000 Index, which returned -4.61% and -2.19%, respectively. Inflation, the Russia-Ukraine war, energy prices, and Federal Reserve actions affected the business and investor confidence in the quarter. In addition, you can check the top 5 holdings of the fund to know its best picks in 2022.

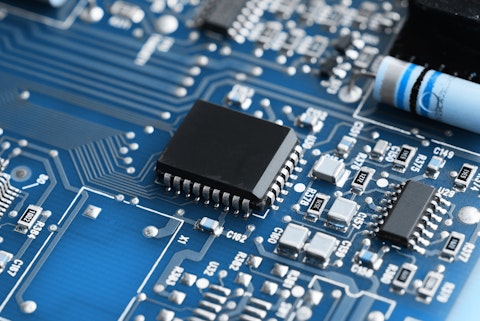

Ariel Investment highlighted stocks like Littelfuse, Inc. (NASDAQ:LFUS) in the Q3 investor letter. Headquartered in Chicago, Illinois, Littelfuse, Inc. (NASDAQ:LFUS) is a circuit protection, power control, and sensing products manufacturer. On December 2, 2022, Littelfuse, Inc. (NASDAQ:LFUS) stock closed at $247.43 per share. One-month return of Littelfuse, Inc. (NASDAQ:LFUS) was 14.49%, and its shares lost 19.57% of their value over the last 52 weeks. Littelfuse, Inc. (NASDAQ:LFUS) has a market capitalization of $6.125 billion.

Ariel Investment made the following comment about Littelfuse, Inc. (NASDAQ:LFUS) in its Q3 2022 investor letter:

“Shares of leading supplier of circuit protection products Littelfuse, Inc. (NASDAQ:LFUS) also came under pressure in the period. LFUS delivered another solid quarter of financial results, however forward-looking guidance suggests moderating growth in its core Electronics business. Additionally, management anticipates near-term margin headwinds from unfavorable currency exchange rates, Covid-19 lockdowns in China and slowing demand for personal electronics. Longer-term, we believe LFUS remains well positioned to leverage the global mega trends of a safer, greener and increasingly connected world, as it executes on its long-term strategy to drive double-digit sales and earnings growth.”

Portogas D Ace/Shutterstock.com

Littelfuse, Inc. (NASDAQ:LFUS) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 27 hedge fund portfolios held Littelfuse, Inc. (NASDAQ:LFUS) at the end of the third quarter, which was 20 in the previous quarter.

We discussed Littelfuse, Inc. (NASDAQ:LFUS) in another article and shared Vulcan Value Partners’ views on the company. In addition, please check out our hedge fund investor letters Q3 2022 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 25 Smartest Countries in the World

- 25 Richest People in the World

- 12 Biggest Generator Companies in the World

Disclosure: None. This article is originally published at Insider Monkey.