Investment management company First Pacific Advisors recently released its “FPA Crescent Fund” second quarter 2023 investor letter. A copy of the same can be downloaded here. In the second quarter, the fund (Institutional Class) gained 6.29%. It gained 16.13% in the trailing twelve months. The fund has captured 97.6% of the MSCI ACWI Index’s return over the past 12 months outperforming the average net risk of 73.8%. Crescent’s top and bottom performers had a significant impact on its return, with the top five contributing 6.19% and the bottom five detracting 1.54% in the previous twelve months. In addition, you can check the top 5 holdings of the fund to know its best picks in 2023.

FPA Crescent Fund highlighted stocks like Broadcom Inc. (NASDAQ:AVGO) in the second quarter 2023 investor letter. Headquartered in San Jose, California, Broadcom Inc. (NASDAQ:AVGO) is a semiconductor devices supplier. On September 12, 2023, Broadcom Inc. (NASDAQ:AVGO) stock closed at $844.52 per share. One-month return of Broadcom Inc. (NASDAQ:AVGO) was 0.24%, and its shares gained 67.68% of their value over the last 52 weeks. Broadcom Inc. (NASDAQ:AVGO) has a market capitalization of $354.598 billion.

FPA Crescent Fund made the following comment about Broadcom Inc. (NASDAQ:AVGO) in its Q2 2023 investor letter:

“In contrast to our short-lived ownership of Open Text, Broadcom Inc. (NASDAQ:AVGO) has been a holding for just short of five years. At the time of our original purchase, the company was primarily focused on driving organic growth in its existing semiconductor franchises and acquiring new ones when the opportunity presented itself. As potential acquisition candidates in the industry became scarce, management, led by highly regarded Hock Tan, pivoted to set their sights on the software industry, culminating in several acquisitions. Unlike Open Text, in this instance, after multiple discussions with senior management, we found ourselves comfortable with the company’s new strategy after re-examining the investment implications. We are glad we did, as it would be an understatement to say that Broadcom has gone from strength to strength over the past five years, improving operating margins, aggressively repurchasing shares, and increasing the dividend, all the while continuing to execute its M&A strategy flawlessly.”

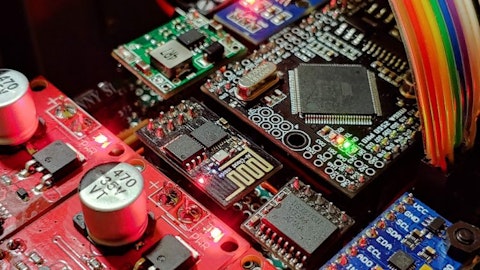

electronics-6055226_1280

Broadcom Inc. (NASDAQ:AVGO) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 72 hedge fund portfolios held Broadcom Inc. (NASDAQ:AVGO) at the end of second quarter which was 72 in the previous quarter.

We discussed Broadcom Inc. (NASDAQ:AVGO) in another article and shared Carillon Eagle Growth & Income Fund’s views on the company. In addition, please check out our hedge fund investor letters Q2 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 16 Best-Selling Champagne Brands in the World

- 30 Countries With The Highest Suicide Rates In The World

- Long-Term Returns of Billionaire Barry Rosenstein’s Activist Targets

Disclosure: None. This article is originally published at Insider Monkey.