One of the funds we track at Insider Monkey is Jericho Capital Asset Management, led by Josh Resnick. Even though Jericho mostly stays under the radar of the general public, it should be followed closer, since it manages to generate very strong returns. Since its inception in 2009 through 2014, the fund generated returns of around 154%, outperforming both the S&P 500 and many of its other hedge fund peers. According to its 13F filing for the end of June, Jericho had an equity portfolio worth $1.82 billion, mainly invested in Technology and Consumer Discretionary stocks, which amassed around 50% and 33% of the portfolio.

According to our calculations that took into account Jericho’s long positions in companies worth at least $1.0 billion, Jericho’s equity portfolio posted a third-quarter return of 12.35% from the 22 “relevant” positions out of a total of 23 holdings it reported in the 13F filing for the end of June. In this article, let’s take a closer look at Jericho Capital’s investments in Kellogg Company (NYSE:K), The Madison Square Garden Co (NASDAQ:MSG), Zendesk Inc (NYSE:ZEN), and Dicks Sporting Goods Inc (NYSE:DKS).

In Kellogg Company (NYSE:K), Jericho Capital initiated a stake during the second quarter and reported ownership of 2.29 million shares worth $187.34 million as of the end of June. The move was untimely, as the stock lost 4.5% during the third quarter and slid by another 5.5% since the end of September. Overall, the number of funds tracked by us long Kellog inched down by 4% to 27. Jericho held the largest stake, followed by Adage Capital Management which amassed $157.6 millions worth of shares. Moreover, Columbus Circle Investors, Pzena Investment Management, and Thrax Management were also bullish on Kellogg Company (NYSE:K).

Follow Kellanova (NYSE:K)

Follow Kellanova (NYSE:K)

Receive real-time insider trading and news alerts

wrangler/Shutterstock.com

Jericho’s investment in The Madison Square Garden Co (NASDAQ:MSG) also didn’t pay off quite well as the stock inched down by 1.8% between July and September. During the second quarter, the fund boosted its exposure to the company by 82% to 454,652 shares worth $78.43 million. Heading into the third quarter of 2016, a total of 31 of the hedge funds tracked by Insider Monkey held long positions in The Madison Square Garden Co (NASDAQ:MSG), unchanged over the quarter. Among these funds, Mason Capital Management, which reported holding $172.9 million worth of stock as of the end of June, was the largest shareholders. It was followed by First Eagle Investment Management with a $160.6 million position. Other investors bullish on the company included GAMCO Investors, Ariel Investments, and Long Pond Capital.

Follow Msg Networks Inc. (NYSE:MSGN)

Follow Msg Networks Inc. (NYSE:MSGN)

Receive real-time insider trading and news alerts

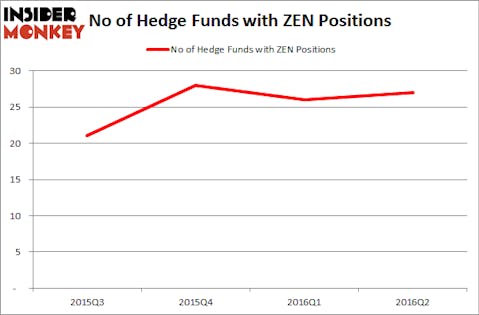

On the other hand, in Zendesk Inc (NYSE:ZEN), Jericho cut its stake by 33% over the quarter to 2.95 million shares valued at $77.87 million at the end of June. In the following three months, the stock advanced by 16.4%. Overall, 27 funds from our database held shares of Zendesk at the end of the second quarter, down by one from the end of March. Alex Sacerdote’s Whale Rock Capital Management had the most valuable position in Zendesk Inc (NYSE:ZEN), worth close to $95.9 million. Columbus Circle Investors, Polar Capital, and Crosslink Capital also reported valuable positions in the company as of the end of June.

Follow Zendesk Inc. (NYSE:ZEN)

Follow Zendesk Inc. (NYSE:ZEN)

Receive real-time insider trading and news alerts

Another new position in Jericho Capital’s equity portfolio was represented by Dicks Sporting Goods Inc (NYSE:DKS), in which Jericho amassed a $58.08 million holding containing 1.29 million shares during the second quarter. Buying the stock was a right move, as it surged by over 26% in the following three months. Aside from Jericho, 25 other funds from our database also benefited from Dicks Sporting Goods’ third-quarter growth. Among these funds, Glenhill Advisors held the most valuable stake in Dicks Sporting Goods Inc (NYSE:DKS), which was worth $86.5 millions at the end of the second quarter. On the second spot was Hoplite Capital Management which amassed $84.8 millions worth of shares. Moreover, Citadel Investment Group, Scopus Asset Management, and Jericho Capital Asset Management were also bullish on Dicks Sporting Goods Inc (NYSE:DKS).

Follow Dick's Sporting Goods Inc. (NYSE:DKS)

Follow Dick's Sporting Goods Inc. (NYSE:DKS)

Receive real-time insider trading and news alerts

Disclosure: none