World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

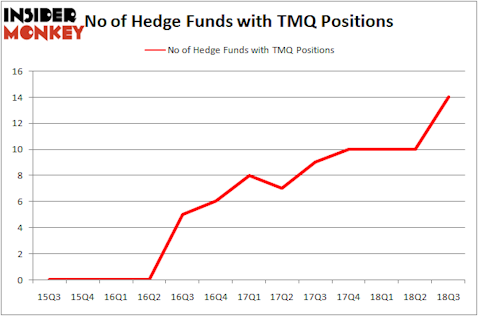

Trilogy Metals Inc. (NYSE:TMQ) shareholders have witnessed an increase in activity from the world’s largest hedge funds recently. TMQ was in 14 hedge funds’ portfolios at the end of September. There were 10 hedge funds in our database with TMQ holdings at the end of the previous quarter. Our calculations also showed that TMQ isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a look at the key hedge fund action encompassing Trilogy Metals Inc. (NYSE:TMQ).

Hedge fund activity in Trilogy Metals Inc. (NYSE:TMQ)

At the end of the third quarter, a total of 14 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 40% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in TMQ over the last 13 quarters. With the smart money’s capital changing hands, there exists a select group of key hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

More specifically, Baupost Group was the largest shareholder of Trilogy Metals Inc. (NYSE:TMQ), with a stake worth $26 million reported as of the end of September. Trailing Baupost Group was Paulson & Co, which amassed a stake valued at $23.1 million. Selz Capital, Millennium Management, and Governors Lane were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, specific money managers have been driving this bullishness. Governors Lane, managed by Isaac Corre, created the largest position in Trilogy Metals Inc. (NYSE:TMQ). Governors Lane had $4.4 million invested in the company at the end of the quarter. Zach Schreiber’s Point State Capital also initiated a $3.5 million position during the quarter. The other funds with new positions in the stock are ZilvinasáMecelis’s Covalis Capital, Eric Sprott’s Sprott Asset Management, and Michael Platt and William Reeves’s BlueCrest Capital Mgmt..

Let’s also examine hedge fund activity in other stocks similar to Trilogy Metals Inc. (NYSE:TMQ). We will take a look at Modern Media Acquisition Corp. (NASDAQ:MMDM), Servicesource International Inc (NASDAQ:SREV), Civista Bancshares, Inc. (NASDAQ:CIVB), and ACNB Corporation (NASDAQ:ACNB). This group of stocks’ market caps match TMQ’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MMDM | 9 | 19079 | 0 |

| SREV | 16 | 73191 | 3 |

| CIVB | 9 | 34359 | 1 |

| ACNB | 1 | 2645 | 0 |

| Average | 8.75 | 32319 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.75 hedge funds with bullish positions and the average amount invested in these stocks was $32 million. That figure was $92 million in TMQ’s case. Servicesource International Inc (NASDAQ:SREV) is the most popular stock in this table. On the other hand ACNB Corporation (NASDAQ:ACNB) is the least popular one with only 1 bullish hedge fund positions. Trilogy Metals Inc. (NYSE:TMQ) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard SREV might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.