Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth depends on it. Regardless of the various methods used by elite investors like David Tepper and Dan Loeb, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space.

Is The Middleby Corporation (NASDAQ:MIDD) ready to rally soon? Money managers are becoming hopeful. The number of long hedge fund positions advanced by 3 lately. Our calculations also showed that MIDD isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s view the new hedge fund action regarding The Middleby Corporation (NASDAQ:MIDD).

How are hedge funds trading The Middleby Corporation (NASDAQ:MIDD)?

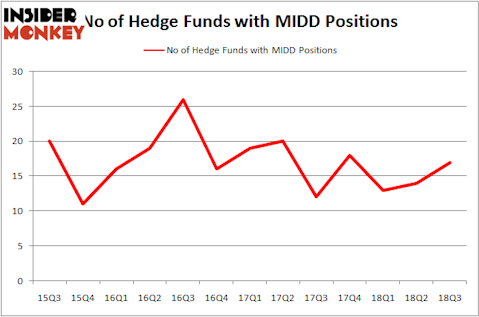

At the end of the third quarter, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 21% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in MIDD over the last 13 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Viking Global, managed by Andreas Halvorsen, holds the biggest position in The Middleby Corporation (NASDAQ:MIDD). Viking Global has a $311.5 million position in the stock, comprising 1.7% of its 13F portfolio. The second most bullish fund manager is Bares Capital Management, led by Brian Bares, holding a $251.7 million position; the fund has 7.1% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors with similar optimism consist of Greg Poole’s Echo Street Capital Management, Jeff Lignelli’s Incline Global Management and John Ku’s Manor Road Capital Partners.

As aggregate interest increased, specific money managers have been driving this bullishness. Manor Road Capital Partners, managed by John Ku, assembled the biggest position in The Middleby Corporation (NASDAQ:MIDD). Manor Road Capital Partners had $35.6 million invested in the company at the end of the quarter. Mark Kingdon’s Kingdon Capital also initiated a $13.3 million position during the quarter. The other funds with brand new MIDD positions are Louis Bacon’s Moore Global Investments, Noam Gottesman’s GLG Partners, and Mike Vranos’s Ellington.

Let’s check out hedge fund activity in other stocks similar to The Middleby Corporation (NASDAQ:MIDD). We will take a look at ADT Inc. (NYSE:ADT), Sabre Corporation (NASDAQ:SABR), Flowserve Corporation (NYSE:FLS), and Gerdau SA (NYSE:GGB). This group of stocks’ market valuations are closest to MIDD’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ADT | 19 | 147423 | 4 |

| SABR | 31 | 605722 | 6 |

| FLS | 13 | 329809 | -1 |

| GGB | 15 | 243035 | -5 |

| Average | 19.5 | 331497 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.5 hedge funds with bullish positions and the average amount invested in these stocks was $331 million. That figure was $816 million in MIDD’s case. Sabre Corporation (NASDAQ:SABR) is the most popular stock in this table. On the other hand Flowserve Corporation (NYSE:FLS) is the least popular one with only 13 bullish hedge fund positions. The Middleby Corporation (NASDAQ:MIDD) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard SABR might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.