During the first half of the fourth quarter the Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by about 4 percentage points as investors worried over the possible ramifications of rising interest rates. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of Spirit AeroSystems Holdings, Inc. (NYSE:SPR) and see how the stock is affected by the recent hedge fund activity.

Is Spirit AeroSystems Holdings, Inc. (NYSE:SPR) worth your attention right now? Money managers are becoming more confident. The number of bullish hedge fund positions improved by 2 lately. Our calculations also showed that SPR isn’t among the 30 most popular stocks among hedge funds.

To most traders, hedge funds are perceived as unimportant, old financial tools of yesteryear. While there are more than 8,000 funds with their doors open today, We look at the crème de la crème of this group, approximately 700 funds. These hedge fund managers shepherd most of all hedge funds’ total capital, and by watching their top stock picks, Insider Monkey has come up with many investment strategies that have historically outperformed Mr. Market. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by 6 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to check out the new hedge fund action regarding Spirit AeroSystems Holdings, Inc. (NYSE:SPR).

How have hedgies been trading Spirit AeroSystems Holdings, Inc. (NYSE:SPR)?

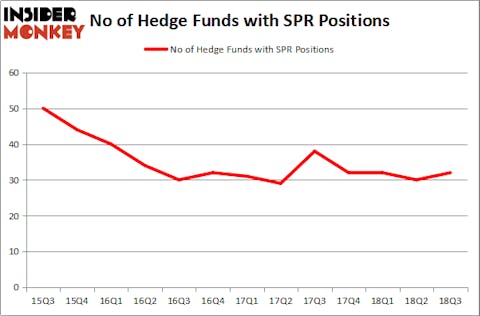

At the end of the third quarter, a total of 32 of the hedge funds tracked by Insider Monkey were long this stock, a change of 7% from the previous quarter. The graph below displays the number of hedge funds with bullish position in SPR over the last 13 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

The largest stake in Spirit AeroSystems Holdings, Inc. (NYSE:SPR) was held by Darsana Capital Partners, which reported holding $550 million worth of stock at the end of September. It was followed by Scopia Capital with a $491.5 million position. Other investors bullish on the company included Hound Partners, AQR Capital Management, and OZ Management.

With a general bullishness amongst the heavyweights, key hedge funds have been driving this bullishness. Bloom Tree Partners, managed by Alok Agrawal, created the most valuable position in Spirit AeroSystems Holdings, Inc. (NYSE:SPR). Bloom Tree Partners had $37.3 million invested in the company at the end of the quarter. James Woodson Davis’s Woodson Capital Management also made a $8.2 million investment in the stock during the quarter. The other funds with new positions in the stock are Louis Bacon’s Moore Global Investments, Dmitry Balyasny’s Balyasny Asset Management, and Bruce Kovner’s Caxton Associates LP.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Spirit AeroSystems Holdings, Inc. (NYSE:SPR) but similarly valued. We will take a look at Alleghany Corporation (NYSE:Y), Lamb Weston Holdings, Inc. (NYSE:LW), Zions Bancorporation, National Association (NASDAQ:ZION), and W.R. Berkley Corporation (NYSE:WRB). This group of stocks’ market values resemble SPR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| Y | 21 | 366277 | -3 |

| LW | 34 | 909479 | 5 |

| ZION | 32 | 797532 | -2 |

| WRB | 17 | 425023 | 1 |

| Average | 26 | 624578 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26 hedge funds with bullish positions and the average amount invested in these stocks was $625 million. That figure was $2.73 billion in SPR’s case. Lamb Weston Holdings, Inc. (NYSE:LW) is the most popular stock in this table. On the other hand W.R. Berkley Corporation (NYSE:WRB) is the least popular one with only 17 bullish hedge fund positions. Spirit AeroSystems Holdings, Inc. (NYSE:SPR) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard LW might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.