Hedge funds run by legendary names like Nelson Peltz and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant outperformance. That’s why we pay special attention to hedge fund activity in these stocks.

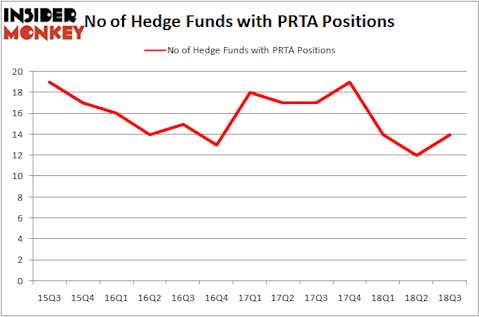

Is Prothena Corporation plc (NASDAQ:PRTA) going to take off soon? The smart money is becoming hopeful. The number of long hedge fund positions went up by 2 lately. Our calculations also showed that PRTA isn’t among the 30 most popular stocks among hedge funds. PRTA was in 14 hedge funds’ portfolios at the end of September. There were 12 hedge funds in our database with PRTA holdings at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s view the recent hedge fund action regarding Prothena Corporation plc (NASDAQ:PRTA).

What have hedge funds been doing with Prothena Corporation plc (NASDAQ:PRTA)?

At the end of the third quarter, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, a change of 17% from the previous quarter. The graph below displays the number of hedge funds with bullish position in PRTA over the last 13 quarters. With hedgies’ capital changing hands, there exists a select group of key hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

More specifically, Woodford Investment Management was the largest shareholder of Prothena Corporation plc (NASDAQ:PRTA), with a stake worth $156 million reported as of the end of September. Trailing Woodford Investment Management was Scopia Capital, which amassed a stake valued at $51.2 million. Palo Alto Investors, Millennium Management, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, some big names have been driving this bullishness. Renaissance Technologies, managed by Jim Simons, initiated the biggest position in Prothena Corporation plc (NASDAQ:PRTA). Renaissance Technologies had $0.8 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also made a $0.2 million investment in the stock during the quarter. The following funds were also among the new PRTA investors: Paul Tudor Jones’s Tudor Investment Corp and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Prothena Corporation plc (NASDAQ:PRTA) but similarly valued. These stocks are The Cato Corporation (NYSE:CATO), Spartan Motors Inc (NASDAQ:SPAR), Aberdeen Global Premier Properties Fund (NYSE:AWP), and Eaton Vance Senior Floating-Rate Fund (NYSE:EFR). All of these stocks’ market caps are similar to PRTA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CATO | 19 | 43807 | 3 |

| SPAR | 13 | 41380 | -3 |

| AWP | 1 | 788 | 0 |

| EFR | 2 | 915 | 1 |

| Average | 8.75 | 21723 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.75 hedge funds with bullish positions and the average amount invested in these stocks was $22 million. That figure was $246 million in PRTA’s case. The Cato Corporation (NYSE:CATO) is the most popular stock in this table. On the other hand Aberdeen Global Premier Properties Fund (NYSE:AWP) is the least popular one with only 1 bullish hedge fund positions. Prothena Corporation plc (NASDAQ:PRTA) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CATO might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.