Looking for stocks with high upside potential? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 5.7% in the 12 months ending October 26 (including dividend payments). Conversely, hedge funds’ 30 preferred S&P 500 stocks (as of June 2014) generated a return of 15.1% during the same 12-month period, with 53% of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like Party City Holdco Inc (NYSE:PRTY).

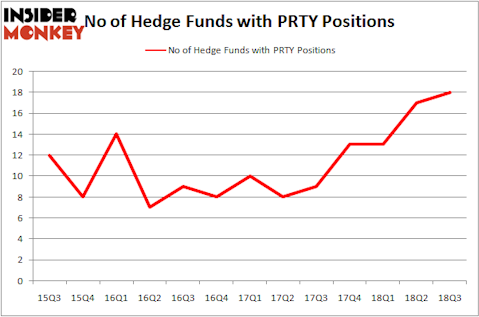

Is Party City Holdco Inc (NYSE:PRTY) a buy here? Hedge funds are in an optimistic mood. The number of long hedge fund positions advanced by 1 recently. Our calculations also showed that PRTY isn’t among the 30 most popular stocks among hedge funds. PRTY was in 18 hedge funds’ portfolios at the end of the third quarter of 2018. There were 17 hedge funds in our database with PRTY positions at the end of the previous quarter.

According to most investors, hedge funds are assumed to be unimportant, outdated financial vehicles of years past. While there are greater than 8,000 funds in operation at present, We hone in on the upper echelon of this club, around 700 funds. These hedge fund managers command the lion’s share of all hedge funds’ total capital, and by keeping an eye on their unrivaled equity investments, Insider Monkey has identified a few investment strategies that have historically exceeded Mr. Market. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by 6 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to review the fresh hedge fund action encompassing Party City Holdco Inc (NYSE:PRTY).

How are hedge funds trading Party City Holdco Inc (NYSE:PRTY)?

At Q3’s end, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 6% from one quarter earlier. By comparison, 13 hedge funds held shares or bullish call options in PRTY heading into this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Wilmot B. Harkey and Daniel Mack’s Nantahala Capital Management has the largest position in Party City Holdco Inc (NYSE:PRTY), worth close to $32.1 million, corresponding to 0.9% of its total 13F portfolio. Coming in second is Tiger Management, managed by Julian Robertson, which holds a $21.2 million position; the fund has 2.1% of its 13F portfolio invested in the stock. Some other peers that hold long positions contain David Rosen’s Rubric Capital Management, Benjamin A. Smith’s Laurion Capital Management and Noam Gottesman’s GLG Partners.

With a general bullishness amongst the heavyweights, specific money managers were leading the bulls’ herd. PDT Partners, managed by Peter Muller, established the most valuable position in Party City Holdco Inc (NYSE:PRTY). PDT Partners had $1.7 million invested in the company at the end of the quarter. Ken Heebner’s Capital Growth Management also made a $0.7 million investment in the stock during the quarter. The other funds with new positions in the stock are Sander Gerber’s Hudson Bay Capital Management, Brandon Haley’s Holocene Advisors, and Roger Ibbotson’s Zebra Capital Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Party City Holdco Inc (NYSE:PRTY) but similarly valued. We will take a look at State Auto Financial Corporation (NASDAQ:STFC), Sykes Enterprises, Incorporated (NASDAQ:SYKE), BlackRock Credit Allocation Income Trust (NYSE:BTZ), and Celestica Inc. (NYSE:CLS). All of these stocks’ market caps match PRTY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| STFC | 3 | 15345 | 0 |

| SYKE | 16 | 51727 | 3 |

| BTZ | 3 | 12330 | 0 |

| CLS | 17 | 195976 | 3 |

| Average | 9.75 | 68845 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.75 hedge funds with bullish positions and the average amount invested in these stocks was $69 million. That figure was $119 million in PRTY’s case. Celestica Inc. (NYSE:CLS) is the most popular stock in this table. On the other hand State Auto Financial Corporation (NASDAQ:STFC) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Party City Holdco Inc (NYSE:PRTY) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.