Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of September. At Insider Monkey, we follow over 700 of the best-performing investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is Nautilus, Inc. (NYSE:NLS), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

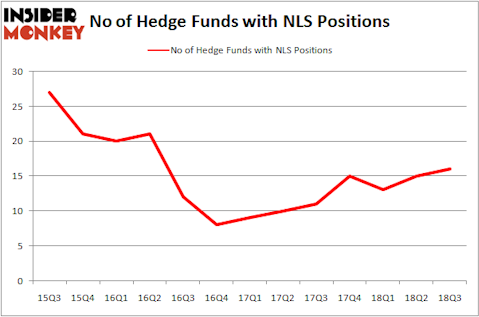

Nautilus, Inc. (NYSE:NLS) was in 16 hedge funds’ portfolios at the end of September. NLS investors should pay attention to an increase in hedge fund sentiment in recent months. There were 15 hedge funds in our database with NLS holdings at the end of the previous quarter. Our calculations also showed that NLS isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are plenty of methods shareholders employ to analyze stocks. Two of the best methods are hedge fund and insider trading activity. We have shown that, historically, those who follow the best picks of the best fund managers can outperform their index-focused peers by a healthy margin (see the details here).

Let’s take a peek at the key hedge fund action surrounding Nautilus, Inc. (NYSE:NLS).

How have hedgies been trading Nautilus, Inc. (NYSE:NLS)?

At the end of the third quarter, a total of 16 of the hedge funds tracked by Insider Monkey were long this stock, a change of 7% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in NLS over the last 13 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

Among these funds, Royce & Associates held the most valuable stake in Nautilus, Inc. (NYSE:NLS), which was worth $16.3 million at the end of the third quarter. On the second spot was Headlands Capital which amassed $15.4 million worth of shares. Moreover, AQR Capital Management, Skylands Capital, and Citadel Investment Group were also bullish on Nautilus, Inc. (NYSE:NLS), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, key hedge funds have been driving this bullishness. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, established the most valuable position in Nautilus, Inc. (NYSE:NLS). Arrowstreet Capital had $1.7 million invested in the company at the end of the quarter. Alec Litowitz and Ross Laser’s Magnetar Capital also made a $0.2 million investment in the stock during the quarter. The only other fund with a brand new NLS position is D. E. Shaw’s D E Shaw.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Nautilus, Inc. (NYSE:NLS) but similarly valued. We will take a look at Pimco Income Opportunity Fund (NYSE:PKO), Platinum Eagle Acquisition Corp. Units (NASDAQ:EAGLU), Azure Power Global Limited (NYSE:AZRE), and Citizens, Inc. (NYSE:CIA). This group of stocks’ market valuations match NLS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PKO | 1 | 3176 | -1 |

| EAGLU | 18 | 142362 | 1 |

| AZRE | 3 | 4152 | 0 |

| CIA | 3 | 714 | 1 |

| Average | 6.25 | 38 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.25 hedge funds with bullish positions and the average amount invested in these stocks was $38 million. That figure was $53 million in NLS’s case. Platinum Eagle Acquisition Corp. Units (NASDAQ:EAGLU) is the most popular stock in this table. On the other hand Pimco Income Opportunity Fund (NYSE:PKO) is the least popular one with only 1 bullish hedge fund positions. Nautilus, Inc. (NYSE:NLS) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard EAGLU might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.