The market has been volatile due to elections and the potential of another Federal Reserve rate increase. Small cap stocks have been on a tear, as the Russell 2000 ETF (IWM) has outperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points since the end of June. SEC filings and hedge fund investor letters indicate that the smart money seems to be getting back in stocks, and the funds’ movements is one of the reasons why small-cap stocks are red hot. In this article, we analyze what the smart money thinks of Mastercard Inc (NYSE:MA) and find out how it is affected by hedge funds’ moves.

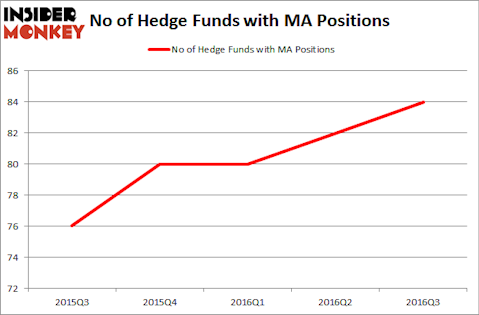

Is Mastercard Inc (NYSE:MA) a healthy stock for your portfolio? Hedge funds are betting on the stock. The number of long hedge fund positions rose by 2 in the third quarter. MA was in 84 hedge funds’ portfolios at the end of September. There were 82 hedge funds in our database with MA holdings at the end of the previous quarter. At the end of this article we will also compare MA to other stocks including United Parcel Service, Inc. (NYSE:UPS), Accenture Plc (NYSE:ACN), and NIKE, Inc. (NYSE:NKE) to get a better sense of its popularity.

Follow Mastercard Inc (NYSE:MA)

Follow Mastercard Inc (NYSE:MA)

Receive real-time insider trading and news alerts

To the average investor there are dozens of signals market participants put to use to size up stocks. A couple of the most under-the-radar signals are hedge fund and insider trading activity. We have shown that, historically, those who follow the top picks of the best money managers can outpace the market by a healthy margin (see the details).

Valeri Potapova / Shutterstock.com

Keeping this in mind, let’s take a glance at the new action surrounding Mastercard Inc (NYSE:MA).

What does the smart money think about Mastercard Inc (NYSE:MA)?

At Q3’s end, a total of 84 of the hedge funds tracked by Insider Monkey held long positions in this stock, up by 2% from one quarter earlier. With hedgies’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Tom Russo’s Gardner Russo & Gardner has the biggest position in Mastercard Inc (NYSE:MA), worth close to $994.8 million, amounting to 8.3% of its total 13F portfolio. The second largest stake is held by Viking Global, led by Andreas Halvorsen, holding a $782 million position; the fund has 3.4% of its 13F portfolio invested in the stock. Remaining members of the smart money with similar optimism contain Jim Simons’ Renaissance Technologies, Warren Buffett’s Berkshire Hathaway, and Charles Akre’s Akre Capital Management.

As industrywide interest jumped, some big names were breaking ground themselves. Samlyn Capital, managed by Robert Pohly, established the most valuable position in Mastercard Inc (NYSE:MA). Samlyn Capital had $119.4 million invested in the company at the end of the quarter. Gabriel Plotkin’s Melvin Capital Management also initiated a $61.1 million position during the quarter. The other funds with brand new MA positions are Ken Griffin’s Citadel Investment Group, Stuart Powers’ Hengistbury Investment Partners, and Louis Bacon’s Moore Global Investments.

Let’s also examine hedge fund activity in other stocks similar to Mastercard Inc (NYSE:MA). We will take a look at United Parcel Service, Inc. (NYSE:UPS), Accenture Plc (NYSE:ACN), NIKE, Inc. (NYSE:NKE), and SAP AG (ADR) (NYSE:SAP). This group of stocks’ market values are similar to MA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UPS | 40 | 1532311 | 7 |

| ACN | 37 | 757119 | -1 |

| NKE | 55 | 3720614 | -2 |

| SAP | 7 | 844681 | -2 |

As you can see these stocks had an average of 34.75 hedge funds with bullish positions and the average amount invested in these stocks was $1.71 billion. That figure was $7.48 billion in MA’s case. NIKE, Inc. (NYSE:NKE) is the most popular stock in this table, though far less popular than Mastercard. On the other hand, SAP AG (ADR) (NYSE:SAP) is the least popular one with only 7 hedge funds long the stock. Compared to these stocks Mastercard Inc (NYSE:MA) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None