We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of September 30th. In this article, we look at what those funds think of Independent Bank Group Inc (NASDAQ:IBTX) based on that data.

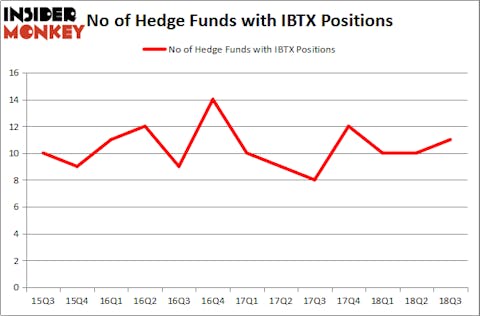

Is Independent Bank Group Inc (NASDAQ:IBTX) a buy right now? Investors who are in the know are buying. The number of bullish hedge fund positions advanced by 1 recently. Our calculations also showed that IBTX isn’t among the 30 most popular stocks among hedge funds. IBTX was in 11 hedge funds’ portfolios at the end of September. There were 10 hedge funds in our database with IBTX holdings at the end of the previous quarter.

If you’d ask most stock holders, hedge funds are viewed as worthless, outdated financial vehicles of the past. While there are greater than 8000 funds in operation at present, Our researchers look at the aristocrats of this group, about 700 funds. These investment experts orchestrate the lion’s share of the hedge fund industry’s total capital, and by shadowing their best investments, Insider Monkey has determined a number of investment strategies that have historically surpassed the broader indices. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s go over the fresh hedge fund action surrounding Independent Bank Group Inc (NASDAQ:IBTX).

What have hedge funds been doing with Independent Bank Group Inc (NASDAQ:IBTX)?

At the end of the third quarter, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 10% from the previous quarter. The graph below displays the number of hedge funds with bullish position in IBTX over the last 13 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Mendon Capital Advisors, managed by Anton Schutz, holds the biggest position in Independent Bank Group Inc (NASDAQ:IBTX). Mendon Capital Advisors has a $38.1 million position in the stock, comprising 3.4% of its 13F portfolio. On Mendon Capital Advisors’s heels is Citadel Investment Group, led by Ken Griffin, holding a $27.1 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Other members of the smart money with similar optimism comprise Israel Englander’s Millennium Management, Paul Marshall and Ian Wace’s Marshall Wace LLP and Paul Magidson, Jonathan Cohen. And Ostrom Enders’s Castine Capital Management.

Consequently, key money managers were leading the bulls’ herd. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, initiated the most valuable position in Independent Bank Group Inc (NASDAQ:IBTX). Marshall Wace LLP had $12.2 million invested in the company at the end of the quarter. Fred Cummings’s Elizabeth Park Capital Management also made a $6.6 million investment in the stock during the quarter. The other funds with new positions in the stock are Noam Gottesman’s GLG Partners and Michael Platt and William Reeves’s BlueCrest Capital Mgmt..

Let’s also examine hedge fund activity in other stocks similar to Independent Bank Group Inc (NASDAQ:IBTX). We will take a look at Inter Parfums, Inc. (NASDAQ:IPAR), Banner Corporation (NASDAQ:BANR), Pacira Pharmaceuticals Inc (NASDAQ:PCRX), and At Home Group Inc. (NYSE:HOME). This group of stocks’ market values are similar to IBTX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IPAR | 13 | 64895 | 0 |

| BANR | 20 | 109128 | 5 |

| PCRX | 25 | 689388 | 4 |

| HOME | 22 | 221719 | 1 |

| Average | 20 | 271283 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $271 million. That figure was $120 million in IBTX’s case. Pacira Pharmaceuticals Inc (NASDAQ:PCRX) is the most popular stock in this table. On the other hand Inter Parfums, Inc. (NASDAQ:IPAR) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks Independent Bank Group Inc (NASDAQ:IBTX) is even less popular than IPAR. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.