We can judge whether Genuine Parts Company (NYSE:GPC) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, research shows that these picks historically outperformed the market when we factor in known risk factors.

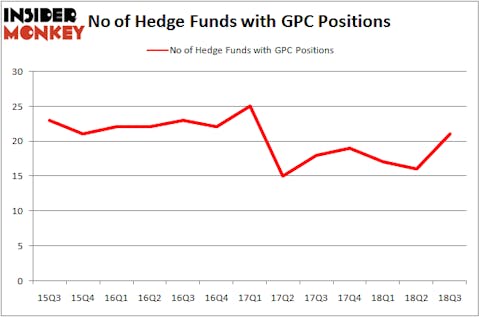

Genuine Parts Company (NYSE:GPC) was in 21 hedge funds’ portfolios at the end of the third quarter of 2018. GPC investors should be aware of an increase in enthusiasm from smart money lately. There were 16 hedge funds in our database with GPC positions at the end of the previous quarter. Our calculations also showed that GPC isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to analyze the new hedge fund action regarding Genuine Parts Company (NYSE:GPC).

What have hedge funds been doing with Genuine Parts Company (NYSE:GPC)?

At Q3’s end, a total of 21 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 31% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards GPC over the last 13 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

More specifically, GAMCO Investors was the largest shareholder of Genuine Parts Company (NYSE:GPC), with a stake worth $150.6 million reported as of the end of September. Trailing GAMCO Investors was Millennium Management, which amassed a stake valued at $36 million. Two Sigma Advisors, Renaissance Technologies, and Gotham Asset Management were also very fond of the stock, giving the stock large weights in their portfolios.

Consequently, some big names have been driving this bullishness. Millennium Management, managed by Israel Englander, established the largest position in Genuine Parts Company (NYSE:GPC). Millennium Management had $36 million invested in the company at the end of the quarter. Joel Greenblatt’s Gotham Asset Management also initiated a $17.2 million position during the quarter. The following funds were also among the new GPC investors: Gregg Moskowitz’s Interval Partners, Paul Tudor Jones’s Tudor Investment Corp, and Matthew Tewksbury’s Stevens Capital Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Genuine Parts Company (NYSE:GPC) but similarly valued. These stocks are Church & Dwight Co., Inc. (NYSE:CHD), TAL Education Group (NYSE:TAL), Tapestry, Inc. (NYSE:TPR), and XPO Logistics Inc (NYSE:XPO). All of these stocks’ market caps resemble GPC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CHD | 20 | 182754 | 3 |

| TAL | 25 | 839473 | -5 |

| TPR | 33 | 862676 | 8 |

| XPO | 44 | 3385038 | -3 |

| Average | 30.5 | 1317485 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.5 hedge funds with bullish positions and the average amount invested in these stocks was $1.32 billion. That figure was $292 million in GPC’s case. XPO Logistics Inc (NYSE:XPO) is the most popular stock in this table. On the other hand Church & Dwight Co., Inc. (NYSE:CHD) is the least popular one with only 20 bullish hedge fund positions. Genuine Parts Company (NYSE:GPC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard XPO might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.