At Insider Monkey, we think that an investor can outperform the market by following the aggregate moves of big hedge funds into the top picks they are bullish on. We track 750 hedge funds, and among them is Indus Capital, managed by David Kowitz and Sheldon Kasowitz, and we are going to take a look at four companies that were in its equity portfolio at the end of the June quarter, all of which delivered positive returns in the third quarter. Those stocks are Tata Motors Limited (ADR) (NYSE:TTM), China Biologic Products Inc (NASDAQ:CBPO), HDFC Bank Limited (ADR) (NYSE:HDB), and Cosan Limited (USA) (NYSE:CZZ).

David Kowitz and Sheldon Kasowitz’ Indus Capital had an equity portfolio worth $1.06 billion at the end of September, up from $1.03 billion at the end of June. The fund’s stocks delivered a weighted average return of 14.50% in the third quarter, based on its 28 long positions in companies that were worth $1 billion or more on June 30. Even though this way of calculating weighted average returns differs from the fund’s actual returns, because it doesn’t include shorts and other non-reported positions, it still provides us with a useful tool when it comes to estimating the fund’s investment expertise on the long side of its portfolio. With this in mind, let’s proceed with a look at the above-mentioned companies and their Q3 performances.

photofriday/Shutterstock.com

The first stock we are going to analyze today is a manufacturer of motor vehicles, Tata Motors Limited (ADR) (NYSE:TTM), which has advanced by 16.12% since the beginning of the year. Indus Capital lowered its stake in the company in the June quarter by 3%, reporting a position that was worth $54.42 million. In the following quarter, the stock returned 15.4%, but the fund may not have experienced that positive return entirely, since by the end of the quarter it had decreased its stake by 70%, to 455,388 shares, which were worth $18.21 million on September 30.

Heading into the third quarter of 2016, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, a 20% dip from one quarter earlier. More specifically, Fisher Asset Management was the largest shareholder of Tata Motors Limited (ADR) (NYSE:TTM), with a stake worth $331.5 million reported as of the end of June. Trailing Fisher Asset Management was AQR Capital Management, which amassed a stake valued at $71.2 million. Renaissance Technologies and Capital Growth Management also held valuable positions in the company.

Follow Tata Motors Ltd (NYSE:TTM)

Follow Tata Motors Ltd (NYSE:TTM)

Receive real-time insider trading and news alerts

In biopharmaceutical company China Biologic Products Inc (NASDAQ:CBPO), Indus Capital lowered its stake by 7% during the second quarter, reporting a position that amassed 3.59% of its equity portfolio and was worth around $37.13 million. The fund has to be pleased with the investment, despite trimming its stake slightly, seeing as the stock advanced by 17.1% in the following three months. By the end of the third quarter, the fund had further trimmed its stake by 29%, holding a position that was worth $30.53 million, counting 245,237 shares.

At the end of the second quarter, a total of 23 of the hedge funds tracked by Insider Monkey were bullish on this stock, same as in the first quarter of 2016. One of the largest stakes in China Biologic Products Inc (NASDAQ:CBPO) was held by Soros Fund Management, with a $25.2 million position. Other investors bullish on the company included Renaissance Technologies, York Capital Management, and PEAK6 Capital Management.

Follow China Biologic Products Inc. (NASDAQ:CBPO)

Follow China Biologic Products Inc. (NASDAQ:CBPO)

Receive real-time insider trading and news alerts

We’ll check out two more of the fund’s stock picks on the next page.

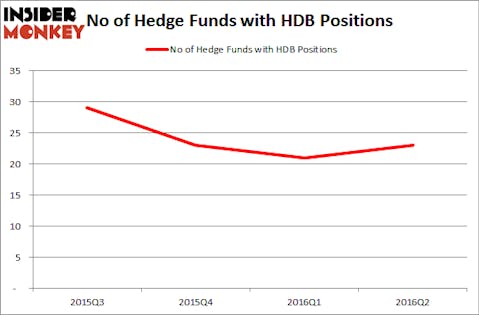

Over the past 12 months, HDFC Bank Limited (ADR) (NYSE:HDB) shares have advanced by 13.69%, while in the third quarter they delivered a positive return of 8.3%. The fund has been trimming its stake slightly, first lowering it by 2% in the June quarter, to 317,987 shares, and then by 9% in the third quarter, to 286,522 shares, worth around $20.6 million.

At the end of the second quarter, a total of 23 of the hedge funds in our database were long this stock, a gain of 10% from one quarter earlier. According to Insider Monkey’s hedge fund database, Fisher Asset Management, managed by Ken Fisher, held the most valuable position in HDFC Bank Limited (ADR) (NYSE:HDB). Coming in second wa Lone Pine Capital, managed by Stephen Mandel, which held a $390 million position. Some other hedge funds and institutional investors that were bullish comprised Ryan Pedlow’s Two Creeks Capital Management, John Armitage’s Egerton Capital Limited, and Richard Driehaus’ Driehaus Capital.

Follow H D F C Bank Ltd (NYSE:HDB)

Follow H D F C Bank Ltd (NYSE:HDB)

Receive real-time insider trading and news alerts

Indus Capital also lowered its stake in Cosan Limited (USA) (NYSE:CZZ) both in the June and September quarters, by 26% and 17%, respectively. The stock returned 9.8% in the third quarter, and by the end of it, the fund held a position that counted 2.53 million shares worth around $18.12 million, which comprised 1.71% of its equity portfolio’s value. At Q2’s end, it was one of 16 hedge funds in our system that were long the stock, a 20% fall from one quarter earlier. The largest stake in Cosan Limited (USA) (NYSE:CZZ) was held by Carlson Capital, which reported holding $45.7 million worth of stock as of the end of June. Other investors bullish on the company included Renaissance Technologies, Electron Capital Partners, and Arrowstreet Capital.

Follow Cosan Ltd (NYSE:CZZ)

Follow Cosan Ltd (NYSE:CZZ)

Receive real-time insider trading and news alerts

Disclosure: None