As we already know from media reports and hedge fund investor letters, many hedge funds lost money in October, blaming macroeconomic conditions and unpredictable events that hit several sectors, with healthcare among them. Nevertheless, most investors decided to stick to their bullish theses and their long-term focus allows us to profit from the recent declines. In particular, let’s take a look at what hedge funds think about Tellurian Inc. (NASDAQ:TELL) in this article.

Tellurian Inc. (NASDAQ:TELL) has experienced a decrease in support from the world’s most elite money managers lately. Our calculations also showed that TELL isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to check out the latest hedge fund action regarding Tellurian Inc. (NASDAQ:TELL).

What have hedge funds been doing with Tellurian Inc. (NASDAQ:TELL)?

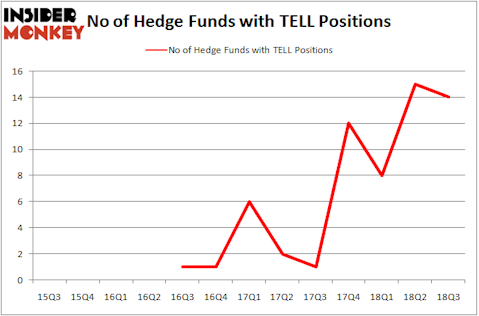

At the end of the third quarter, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -7% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in TELL over the last 13 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Jos Shaver’s Electron Capital Partners has the largest position in Tellurian Inc. (NASDAQ:TELL), worth close to $22.5 million, corresponding to 3.2% of its total 13F portfolio. Coming in second is Blackstart Capital, led by Brian Olson, Baehyun Sung, and Jamie Waters, holding a $16.1 million position; 3.7% of its 13F portfolio is allocated to the stock. Other hedge funds and institutional investors that are bullish include Steve Cohen’s Point72 Asset Management, Dmitry Balyasny’s Balyasny Asset Management and Israel Englander’s Millennium Management.

Since Tellurian Inc. (NASDAQ:TELL) has experienced a decline in interest from the smart money, logic holds that there was a specific group of fund managers that decided to sell off their entire stakes last quarter. It’s worth mentioning that Jonathan Barrett and Paul Segal’s Luminus Management sold off the largest position of the 700 funds monitored by Insider Monkey, comprising about $3.5 million in stock. Noam Gottesman’s fund, GLG Partners, also dumped its stock, about $0.8 million worth. These transactions are intriguing to say the least, as total hedge fund interest dropped by 1 funds last quarter.

Let’s now review hedge fund activity in other stocks similar to Tellurian Inc. (NASDAQ:TELL). These stocks are Tower Semiconductor Ltd. (NASDAQ:TSEM), trivago N.V. (NASDAQ:TRVG), Tanger Factory Outlet Centers Inc. (NYSE:SKT), and Argo Group International Holdings, Ltd. (NYSE:ARGO). All of these stocks’ market caps are similar to TELL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TSEM | 13 | 286560 | 0 |

| TRVG | 9 | 171444 | 2 |

| SKT | 11 | 71468 | -2 |

| ARGO | 13 | 74794 | 3 |

| Average | 11.5 | 151067 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.5 hedge funds with bullish positions and the average amount invested in these stocks was $151 million. That figure was $76 million in TELL’s case. Tower Semiconductor Ltd. (NASDAQ:TSEM) is the most popular stock in this table. On the other hand trivago N.V. (NASDAQ:TRVG) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Tellurian Inc. (NASDAQ:TELL) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.