Hedge funds run by legendary names like Nelson Peltz and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant out-performance. These stocks have been on a tear since the end of June, outperforming large-cap index funds by more than 10 percentage points. That’s why we pay special attention to hedge fund activity in these stocks.

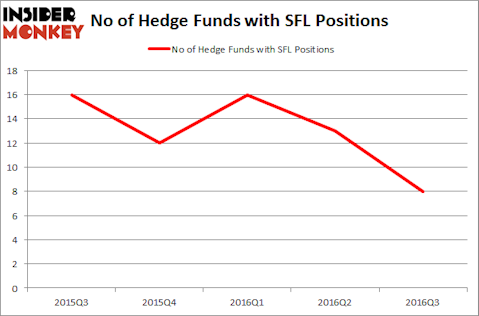

Ship Finance International Limited (NYSE:SFL) investors should be aware of a decrease in support from the world’s most successful money managers of late. There were 8 hedge funds in our database with SFL positions at the end of September. At the end of this article we will also compare SFL to other stocks including Chesapeake Lodging Trust (NYSE:CHSP), Rambus Inc. (NASDAQ:RMBS), and Actuant Corporation (NYSE:ATU) to get a better sense of its popularity.

Follow Sfl Corporation Ltd. (NYSE:SFL)

Follow Sfl Corporation Ltd. (NYSE:SFL)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

weerasak saeku/Shutterstock.com

How are hedge funds trading Ship Finance International Limited (NYSE:SFL)?

At the end of the third quarter, a total of 8 of the hedge funds tracked by Insider Monkey were bullish on this stock, down by 38% from the previous quarter. On the other hand, there were a total of 12 hedge funds with a bullish position in SFL at the beginning of this year. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Graham Capital Management, led by Kenneth Tropin, holds the largest position in Ship Finance International Limited (NYSE:SFL). Graham Capital Management has a $27 million position in the stock. The second most bullish fund manager is PEAK6 Capital Management, led by Matthew Hulsizer, which holds a $7.2 million call position. Remaining peers that hold long positions consist of Roger Ibbotson’s Zebra Capital Management and George Hall’a Clinton Group. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.