Looking for stocks with high upside potential? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 5.7% in the 12 months ending October 26 (including dividend payments). Conversely, hedge funds’ 30 preferred S&P 500 stocks (as of June 2014) generated a return of 15.1% during the same 12-month period, with 53% of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like PS Business Parks Inc (NYSE:PSB).

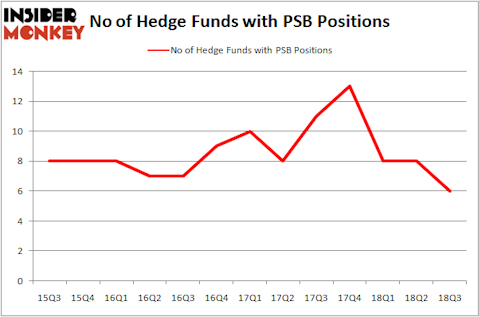

PS Business Parks Inc (NYSE:PSB) was in 6 hedge funds’ portfolios at the end of September. PSB investors should be aware of a decrease in hedge fund interest of late. There were 8 hedge funds in our database with PSB holdings at the end of the previous quarter. Our calculations also showed that PSB isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to take a peek at the recent hedge fund action regarding PS Business Parks Inc (NYSE:PSB).

How have hedgies been trading PS Business Parks Inc (NYSE:PSB)?

Heading into the fourth quarter of 2018, a total of 6 of the hedge funds tracked by Insider Monkey were long this stock, a change of -25% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards PSB over the last 13 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, GLG Partners held the most valuable stake in PS Business Parks Inc (NYSE:PSB), which was worth $32 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $17.4 million worth of shares. Moreover, Millennium Management, Two Sigma Advisors, and AQR Capital Management were also bullish on PS Business Parks Inc (NYSE:PSB), allocating a large percentage of their portfolios to this stock.

Seeing as PS Business Parks Inc (NYSE:PSB) has experienced bearish sentiment from the entirety of the hedge funds we track, it’s easy to see that there lies a certain “tier” of money managers that decided to sell off their positions entirely heading into Q3. At the top of the heap, Ken Griffin’s Citadel Investment Group sold off the largest position of the 700 funds tracked by Insider Monkey, valued at close to $0.7 million in stock. Michael Platt and William Reeves’s fund, BlueCrest Capital Mgmt., also dumped its stock, about $0.2 million worth. These transactions are intriguing to say the least, as total hedge fund interest was cut by 2 funds heading into Q3.

Let’s also examine hedge fund activity in other stocks similar to PS Business Parks Inc (NYSE:PSB). We will take a look at Qualys Inc (NASDAQ:QLYS), Laureate Education, Inc. (NASDAQ:LAUR), Helen of Troy Limited (NASDAQ:HELE), and Spirit Realty Capital Inc (NYSE:SRC). This group of stocks’ market values are closest to PSB’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| QLYS | 18 | 220821 | 1 |

| LAUR | 20 | 232602 | 6 |

| HELE | 12 | 155994 | -2 |

| SRC | 21 | 465528 | -8 |

| Average | 17.75 | 268736 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.75 hedge funds with bullish positions and the average amount invested in these stocks was $269 million. That figure was $61 million in PSB’s case. Spirit Realty Capital Inc (NYSE:SRC) is the most popular stock in this table. On the other hand Helen of Troy Limited (NASDAQ:HELE) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks PS Business Parks Inc (NYSE:PSB) is even less popular than HELE. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.