Does Liberty Broadband Corp (NASDAQ:LBRDA) represent a good buying opportunity at the moment? Let’s briefly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail unconceivably on some occasions, but their stock picks have been generating superior risk-adjusted returns on average over the years.

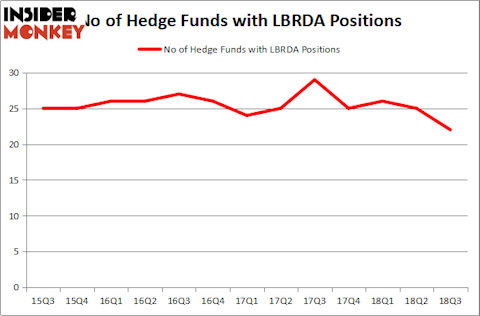

Liberty Broadband Corp (NASDAQ:LBRDA) has experienced a decrease in activity from the world’s largest hedge funds lately. LBRDA was in 22 hedge funds’ portfolios at the end of the third quarter of 2018. There were 25 hedge funds in our database with LBRDA holdings at the end of the previous quarter. Our calculations also showed that LBRDA isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most investors, hedge funds are viewed as slow, old investment vehicles of yesteryear. While there are over 8,000 funds with their doors open at the moment, We hone in on the leaders of this club, about 700 funds. It is estimated that this group of investors command most of all hedge funds’ total asset base, and by observing their highest performing investments, Insider Monkey has discovered numerous investment strategies that have historically defeated the broader indices. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to check out the fresh hedge fund action encompassing Liberty Broadband Corp (NASDAQ:LBRDA).

How have hedgies been trading Liberty Broadband Corp (NASDAQ:LBRDA)?

At the end of the third quarter, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock, a change of -12% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards LBRDA over the last 13 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, FPR Partners held the most valuable stake in Liberty Broadband Corp (NASDAQ:LBRDA), which was worth $116.6 million at the end of the third quarter. On the second spot was Eagle Capital Management which amassed $107.6 million worth of shares. Moreover, D E Shaw, Ashe Capital, and Bridger Management were also bullish on Liberty Broadband Corp (NASDAQ:LBRDA), allocating a large percentage of their portfolios to this stock.

Judging by the fact that Liberty Broadband Corp (NASDAQ:LBRDA) has experienced bearish sentiment from the smart money, logic holds that there lies a certain “tier” of funds that decided to sell off their entire stakes heading into Q3. Intriguingly, Glenn Russell Dubin’s Highbridge Capital Management dropped the biggest stake of all the hedgies monitored by Insider Monkey, comprising close to $9.8 million in stock, and Michael Platt and William Reeves’s BlueCrest Capital Mgmt. was right behind this move, as the fund dropped about $0.7 million worth. These transactions are intriguing to say the least, as total hedge fund interest was cut by 3 funds heading into Q3.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Liberty Broadband Corp (NASDAQ:LBRDA) but similarly valued. These stocks are Liberty Broadband Corp (NASDAQ:LBRDK), Omnicom Group Inc. (NYSE:OMC), Ball Corporation (NYSE:BLL), and Citrix Systems, Inc. (NASDAQ:CTXS). This group of stocks’ market valuations resemble LBRDA’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LBRDK | 37 | 3457184 | 3 |

| OMC | 19 | 725400 | 6 |

| BLL | 20 | 466727 | 0 |

| CTXS | 37 | 2448498 | 5 |

| Average | 28.25 | 1774452 | 3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.25 hedge funds with bullish positions and the average amount invested in these stocks was $1.77 billion. That figure was $607 million in LBRDA’s case. Liberty Broadband Corp (NASDAQ:LBRDK) is the most popular stock in this table. On the other hand Omnicom Group Inc. (NYSE:OMC) is the least popular one with only 19 bullish hedge fund positions. Liberty Broadband Corp (NASDAQ:LBRDA) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard LBRDK might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.