Is JD.com, Inc. (NASDAQ:JD) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to find the latest market-moving information.

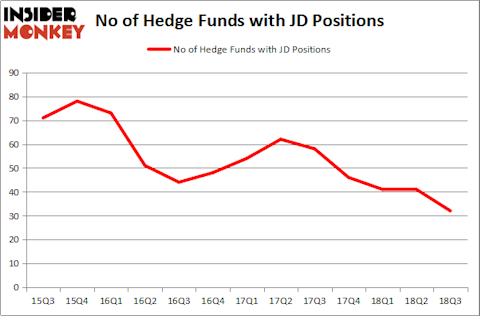

JD.com, Inc. (NASDAQ:JD) has experienced a decrease in enthusiasm from smart money recently. JD was in 32 hedge funds’ portfolios at the end of the third quarter of 2018, down from 41 hedge funds in our database with JD holdings at the end of the previous quarter. Among investors long JD, there weren’t many billionaires, and hence the stock is not among the 30 stocks billionaires are crazy about: Insider Monkey billionaire stock index. But, just because billionaires are not piling on JD, does that mean you shouldn’t purchase this stock? Absolutely not. We’ll try to find out if the stock is worth buying throughout the article.

In the eyes of most market participants, hedge funds are assumed to be underperforming, old financial tools of yesteryear. While there are over 8000 funds with their doors open at the moment, We choose to focus on the crème de la crème of this group, around 700 funds. These money managers direct the lion’s share of the hedge fund industry’s total capital, and by observing their best investments, Insider Monkey has unearthed a number of investment strategies that have historically outrun the market. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by 6 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 26.1% since February 2017 even though the market was up nearly 19% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Why are hedge funds investing in this stock? Hayden Capital shared its investment thesis recently. In its investor letter, the fund is discussing recent lawsuit against JD’s founder and CEO, Richard Liu, and some other problems the company is facing. More about it, you can read here:

“JD.com (JD): Over the past few months, there’s been a couple negative developments for our JD.com position. First, in early September news came out that Richard Liu (the founder & CEO) was accused of sexual assault while completing a course at the University of Minnesota, as part of the Carlson School of Management / Tsinghua University’s Doctor of Business Administration program. Most of our partners will already be familiar with the situation, so I’ll won’t rehash it. However those who aren’t can read up on the details here.

Since the initial reports, the police have finished their investigation, and no charges have been filed in the subsequent two months. Richard was released from police custody the next day, and is now working back in China. Additionally, his attorney, Joseph Friedberg, who has a pretty stellar reputation as one of the best criminal defense attorneys in Minnesota, even went so far as to state “I would bet my law license that he’s not going to be charged.”

The female student accuser, in the meantime, has retained two civil attorneys: Florin Roebig (a firm which earned its reputation in Florida Personal Injury cases and doesn’t seem to have much experience in sexual misconduct cases), and Hang & Associates (a small Flushing, NY based law firm, who’s specialty is unpaid overtime cases in the hospitality / restaurant industry, representing immigrant workers). Despite the odd choice of attorneys, my best guess is the likely outcome will be a civil settlement out of court between Richard and the accuser, in an effort to make this headline “go away quickly”.

The more concerning issue, however, is that the event highlighted a potential flaw in our investment process. After the news came out, I started digging a bit deeper into the personal reputation of Richard. In public,Richard is known for coming from a humble family background, having built JD from a small kiosk in Beijing to the $35 Billion business it is today, always treating his employees well (for example, calling his deliverymen “brothers”, and paying them above industry standards), and building JD.com with the idea of trust, integrity, and always playing the long-game.

However, the responses I got back from several sources after the incident, who are current or former employees, were contradictory to this image. In particular, these sources all had separate anecdotes for Richard’s inappropriate behavior, and how it’s a widely known secret within the company that he likes to “flirt with young trainees” (we can talk in more detail about these stories offline). During the initial research process when I was looking into the company, I had spent considerable time looking into the corporate culture of JD. But in hindsight I hadn’t verified the personal background of Richard, as hard as I should have. These rumors of personal character were knowable for those asking the right questions, and it was a mistake of the process to overlook this aspect.

Having said all of this, the next question is how much does Richard Liu’s personal life factor into JD.com as a company and as an investment? Judging by the stock’s initial reaction after this news broke, the market thinks it’s ~20% of the stock price.

However, I’d argue that there are other issues that JD is facing, which have a far larger impact on the company’s future value. Among them are JD’s lack of a data-driven culture vs. competitors (see previous footnote on culture), inability to court top tech talent due to this, Alibaba’s impressive ramp up in its Cainiao logistics capabilities (especially in Tier 1 cities) in the last few years, and the top-heavy management style of the company. JD is addressing some of these issues, such as implementing a rotating CEO program for its JD Mall division this summer, but it’s been slower than investors would like.

These factors are important, but as investors we also need to weigh the trade-off between the current state of the company and price too. The broader thesis outlined in our previous letters remains largely intact.

Simplistically, the company is on track to do ~$70BN in sales this year, and $100BN in 2020. Electronics and appliances make up ~75% of JD’s revenue mix, which due to the nature of the categories carry lower-margins vs. say apparel or general merchandise (see below for Alibaba’s TMall take-rates, as an example). If JD can simply maintain a 2 – 3% margin on this category, the profits by 2020 would reach at least $2BN. This would equate to a 16x EV/EBIT multiple, growing at 20% y/y.

Additional levers, such as category expansion into FMCG (similar margins, smaller order sizes, but higher order frequency / volume) or general merchandise (higher margins, smaller order sizes) would give the stock considerable upside optionality. This gets even more attractive if we back out the logistics and finance divisions, which have both raised external funding and may be individually listed at some point. Excluding these divisions, with JD’s stake worth ~$24BN (at the last round valuations), the core retail part of the business comes down to just a ~5x multiple.

Rest assured I’m watching these value-drivers closely, as competitive advantages change due to the intense competition in the industry. I promise to keep our Partners updated with any new developments.”

Let’s take a glance at what other smart money investors think about JD.com, Inc. (NASDAQ:JD)?

Heading into the fourth quarter of 2018, a total of 32 of the hedge funds tracked by Insider Monkey were long this stock, a change of -22% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards JD over the last 13 quarters. With hedge funds’ sentiment swirling, there exists a few key hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Chase Coleman’s Tiger Global Management LLC has the number one position in JD.com, Inc. (NASDAQ:JD), worth close to $1.32 billion, amounting to 6.2% of its total 13F portfolio. The second most bullish fund manager is Hillhouse Capital Management, managed by Lei Zhang, which holds a $553.4 million position; the fund has 14.7% of its 13F portfolio invested in the stock. Some other peers with similar optimism consist of Ken Fisher’s Fisher Asset Management, Robert Rodriguez and Steven Romick’s First Pacific Advisors LLC and Panayotis Takis Sparaggis’s Alkeon Capital Management.

Judging by the fact that JD.com, Inc. (NASDAQ:JD) has experienced a decline in interest from the aggregate hedge fund industry, we can see that there was a specific group of money managers that elected to cut their positions entirely heading into Q3. It’s worth mentioning that Philippe Laffont’s Coatue Management sold off the largest investment of all the hedgies monitored by Insider Monkey, comprising an estimated $492.4 million in stock, and William B. Gray’s Orbis Investment Management was right behind this move, as the fund dropped about $373.5 million worth. These transactions are important to note, as aggregate hedge fund interest dropped by 9 funds heading into Q3.

Let’s also examine hedge fund activity in other stocks similar to JD.com, Inc. (NASDAQ:JD). These stocks are BB&T Corporation (NYSE:BBT), Eaton Corporation plc (NYSE:ETN), Aon plc (NYSE:AON), and Baker Hughes, a GE company (NYSE:BHGE). All of these stocks’ market caps are similar to JD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BBT | 20 | 118410 | -1 |

| ETN | 38 | 965450 | 8 |

| AON | 30 | 3070022 | -7 |

| BHGE | 27 | 711079 | 7 |

As you can see these stocks had an average of 29 hedge funds with bullish positions and the average amount invested in these stocks was $1.22 billion. That figure was $2.97 billion in JD’s case. Eaton Corporation plc (NYSE:ETN) is the most popular stock in this table. On the other hand BB&T Corporation (NYSE:BBT) is the least popular one with only 20 bullish hedge fund positions. JD.com, Inc. (NASDAQ:JD) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ETN might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.