The elite funds run by legendary investors such as David Tepper and Dan Loeb make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentives to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at Construction Partners, Inc. (NASDAQ:ROAD) from the perspective of those elite funds.

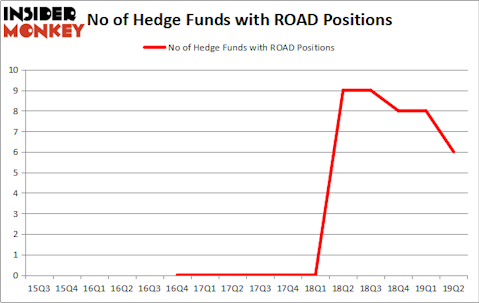

Construction Partners, Inc. (NASDAQ:ROAD) has seen a decrease in hedge fund interest in recent months. Our calculations also showed that ROAD isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

In addition to following the biggest hedge funds for investment ideas, we also share stock pitches from conferences, investor letters and other sources like this one where the fund manager is talking about two under the radar 1000% return potential stocks: first one in internet infrastructure and the second in the heart of advertising market. We use hedge fund buy/sell signals to determine whether to conduct in-depth analysis of these stock ideas which take days. Now we’re going to take a peek at the latest hedge fund action regarding Construction Partners, Inc. (NASDAQ:ROAD).

How have hedgies been trading Construction Partners, Inc. (NASDAQ:ROAD)?

At Q2’s end, a total of 6 of the hedge funds tracked by Insider Monkey were long this stock, a change of -25% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards ROAD over the last 16 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Royce & Associates was the largest shareholder of Construction Partners, Inc. (NASDAQ:ROAD), with a stake worth $11.9 million reported as of the end of March. Trailing Royce & Associates was Renaissance Technologies, which amassed a stake valued at $1.4 million. Two Sigma Advisors, Citadel Investment Group, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

Because Construction Partners, Inc. (NASDAQ:ROAD) has experienced bearish sentiment from hedge fund managers, we can see that there were a few fund managers who were dropping their full holdings heading into Q3. Interestingly, Joe Milano’s Greenhouse Funds said goodbye to the biggest stake of the “upper crust” of funds monitored by Insider Monkey, worth an estimated $1.9 million in stock, and Paul Marshall and Ian Wace’s Marshall Wace LLP was right behind this move, as the fund cut about $1.3 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest dropped by 2 funds heading into Q3.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Construction Partners, Inc. (NASDAQ:ROAD) but similarly valued. These stocks are Kura Oncology, Inc. (NASDAQ:KURA), Eagle Pharmaceuticals Inc (NASDAQ:EGRX), Northern Oil & Gas, Inc. (NYSEAMEX:NOG), and Genfit SA (NASDAQ:GNFT). This group of stocks’ market values are similar to ROAD’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KURA | 22 | 289681 | 5 |

| EGRX | 20 | 157855 | -3 |

| NOG | 19 | 87321 | -1 |

| GNFT | 6 | 46248 | -4 |

| Average | 16.75 | 145276 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $145 million. That figure was $15 million in ROAD’s case. Kura Oncology, Inc. (NASDAQ:KURA) is the most popular stock in this table. On the other hand Genfit SA (NASDAQ:GNFT) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Construction Partners, Inc. (NASDAQ:ROAD) is even less popular than GNFT. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on ROAD, though not to the same extent, as the stock returned 3.7% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.