The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors endured a torrid quarter, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Clovis Oncology Inc (NASDAQ:CLVS).

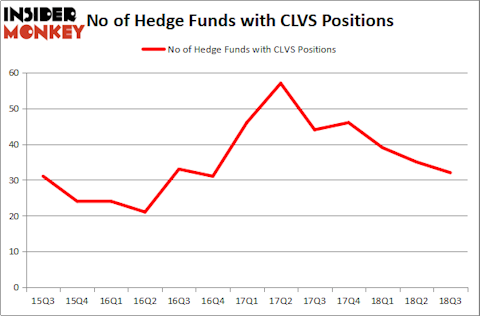

Clovis Oncology Inc (NASDAQ:CLVS) has seen a decrease in activity from the world’s largest hedge funds in recent months. CLVS was in 32 hedge funds’ portfolios at the end of the third quarter of 2018. There were 35 hedge funds in our database with CLVS positions at the end of the previous quarter. Our calculations also showed that CLVS isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are a multitude of methods shareholders employ to appraise their holdings. A couple of the best methods are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the top investment managers can outperform the S&P 500 by a very impressive amount (see the details here).

We’re going to take a peek at the key hedge fund action encompassing Clovis Oncology Inc (NASDAQ:CLVS).

How are hedge funds trading Clovis Oncology Inc (NASDAQ:CLVS)?

At Q3’s end, a total of 32 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -9% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in CLVS over the last 13 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, William Leland Edwards’s Palo Alto Investors has the number one position in Clovis Oncology Inc (NASDAQ:CLVS), worth close to $153.3 million, amounting to 6.2% of its total 13F portfolio. Coming in second is Point State Capital, managed by Zach Schreiber, which holds a $86.4 million position; 1.1% of its 13F portfolio is allocated to the company. Remaining members of the smart money that hold long positions include Samuel Isaly’s OrbiMed Advisors, Christopher James’s Partner Fund Management and Jeremy Green’s Redmile Group.

Since Clovis Oncology Inc (NASDAQ:CLVS) has experienced falling interest from the smart money, logic holds that there lies a certain “tier” of hedgies who sold off their full holdings in the third quarter. Intriguingly, Stanley Druckenmiller’s Duquesne Capital sold off the largest investment of all the hedgies tracked by Insider Monkey, totaling about $21.9 million in stock. John W. Rende’s fund, Copernicus Capital Management, also said goodbye to its stock, about $6.4 million worth. These bearish behaviors are interesting, as total hedge fund interest was cut by 3 funds in the third quarter.

Let’s go over hedge fund activity in other stocks similar to Clovis Oncology Inc (NASDAQ:CLVS). These stocks are Gray Television, Inc. (NYSE:GTN), Innoviva, Inc. (NASDAQ:INVA), Mazor Robotics Ltd – ADR (NASDAQ:MZOR), and Badger Meter, Inc. (NYSE:BMI). This group of stocks’ market caps resemble CLVS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GTN | 22 | 261837 | -2 |

| INVA | 22 | 220079 | -2 |

| MZOR | 8 | 10500 | 2 |

| BMI | 9 | 107161 | 3 |

| Average | 15.25 | 149894 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.25 hedge funds with bullish positions and the average amount invested in these stocks was $150 million. That figure was $674 million in CLVS’s case. Gray Television, Inc. (NYSE:GTN) is the most popular stock in this table. On the other hand Mazor Robotics Ltd – ADR (NASDAQ:MZOR) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Clovis Oncology Inc (NASDAQ:CLVS) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.