Is Cellectis SA (NASDAQ:CLLS) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to find the latest market-moving information.

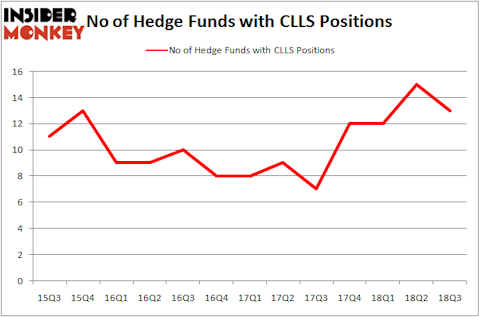

Cellectis SA (NASDAQ:CLLS) has seen a decrease in hedge fund sentiment recently. Our calculations also showed that CLLS isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s check out the key hedge fund action surrounding Cellectis SA (NASDAQ:CLLS).

What have hedge funds been doing with Cellectis SA (NASDAQ:CLLS)?

At Q3’s end, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a change of -13% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards CLLS over the last 13 quarters. With the smart money’s capital changing hands, there exists an “upper tier” of notable hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

The largest stake in Cellectis SA (NASDAQ:CLLS) was held by Adage Capital Management, which reported holding $22.6 million worth of stock at the end of September. It was followed by Armistice Capital with a $16.9 million position. Other investors bullish on the company included Point72 Asset Management, Citadel Investment Group, and Water Street Capital.

Due to the fact that Cellectis SA (NASDAQ:CLLS) has experienced bearish sentiment from the smart money, logic holds that there was a specific group of fund managers who sold off their entire stakes last quarter. Intriguingly, Ori Hershkovitz’s Nexthera Capital sold off the biggest investment of all the hedgies watched by Insider Monkey, totaling about $15.5 million in stock, and Bain Capital’s Brookside Capital was right behind this move, as the fund dropped about $3.1 million worth. These bearish behaviors are important to note, as total hedge fund interest fell by 2 funds last quarter.

Let’s check out hedge fund activity in other stocks similar to Cellectis SA (NASDAQ:CLLS). These stocks are Emerald Expositions Events, Inc. (NYSE:EEX), FB Financial Corporation (NYSE:FBK), First Bancorp (NASDAQ:FBNC), and Kadant Inc. (NYSE:KAI). This group of stocks’ market valuations are similar to CLLS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EEX | 10 | 11933 | 5 |

| FBK | 10 | 131713 | -2 |

| FBNC | 16 | 133231 | 0 |

| KAI | 14 | 100315 | 0 |

| Average | 12.5 | 94298 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.5 hedge funds with bullish positions and the average amount invested in these stocks was $94 million. That figure was $66 million in CLLS’s case. First Bancorp (NASDAQ:FBNC) is the most popular stock in this table. On the other hand Emerald Expositions Events, Inc. (NYSE:EEX) is the least popular one with only 10 bullish hedge fund positions. Cellectis SA (NASDAQ:CLLS) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard FBNC might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.