Amid an overall market correction, many stocks that smart money investors were collectively bullish on tanked during the fourth quarter. Among them, Amazon and Netflix ranked among the top 30 picks and both lost around 20%. Facebook, which was the second most popular stock, lost 14% amid uncertainty regarding the interest rates and tech valuations. Nevertheless, our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

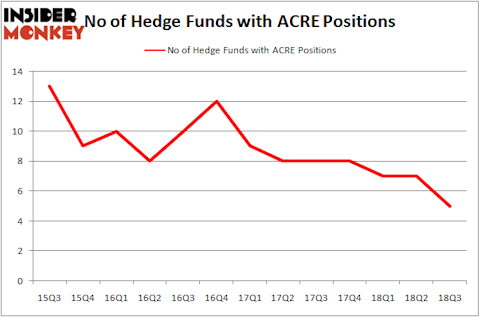

Ares Commercial Real Estate Corp (NYSE:ACRE) shareholders have witnessed a decrease in hedge fund interest in recent months. Our calculations also showed that ACRE isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to take a glance at the latest hedge fund action surrounding Ares Commercial Real Estate Corp (NYSE:ACRE).

What have hedge funds been doing with Ares Commercial Real Estate Corp (NYSE:ACRE)?

At Q3’s end, a total of 5 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -29% from the second quarter of 2018. By comparison, 8 hedge funds held shares or bullish call options in ACRE heading into this year. With hedgies’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

The largest stake in Ares Commercial Real Estate Corp (NYSE:ACRE) was held by Millennium Management, which reported holding $2.8 million worth of stock at the end of September. It was followed by D E Shaw with a $2.7 million position. Other investors bullish on the company included Renaissance Technologies, Two Sigma Advisors, and Citadel Investment Group.

Judging by the fact that Ares Commercial Real Estate Corp (NYSE:ACRE) has witnessed bearish sentiment from hedge fund managers, it’s safe to say that there were a few hedgies that decided to sell off their entire stakes in the third quarter. It’s worth mentioning that Dmitry Balyasny’s Balyasny Asset Management dumped the largest stake of the 700 funds watched by Insider Monkey, worth an estimated $0.4 million in stock. Matthew Hulsizer’s fund, PEAK6 Capital Management, also said goodbye to its stock, about $0 million worth. These transactions are interesting, as aggregate hedge fund interest fell by 2 funds in the third quarter.

Let’s check out hedge fund activity in other stocks similar to Ares Commercial Real Estate Corp (NYSE:ACRE). These stocks are Century Bancorp, Inc. (NASDAQ:CNBKA), One Madison Corporation (NYSE:OMAD), Syros Pharmaceuticals, Inc. (NASDAQ:SYRS), and Amyris Inc (NASDAQ:AMRS). This group of stocks’ market values resemble ACRE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CNBKA | 3 | 11234 | 0 |

| OMAD | 14 | 48556 | 2 |

| SYRS | 9 | 46456 | -1 |

| AMRS | 11 | 23384 | 2 |

| Average | 9.25 | 32408 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.25 hedge funds with bullish positions and the average amount invested in these stocks was $32 million. That figure was $10 million in ACRE’s case. One Madison Corporation (NYSE:OMAD) is the most popular stock in this table. On the other hand Century Bancorp, Inc. (NASDAQ:CNBKA) is the least popular one with only 3 bullish hedge fund positions. Ares Commercial Real Estate Corp (NYSE:ACRE) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard OMAD might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.