RiverPark Advisors, an investment advisory firm and sponsor of the RiverPark family of mutual funds, released its “RiverPark Large Growth Fund” third quarter 2023 investor letter. A copy of the same can be downloaded here. In the third quarter, markets performed poorly, and the S&P 500 index (“S&P”) and the Russell 1000 Growth Index (RLG) declined -3.27% and -3.13%, respectively and Institutional Class (RPX) declined -4.11%. Year to date, RPX has returned 26.59% compared to the SPX and the RLG’s 13.07% and 24.98% returns, respectively. In addition, please check the fund’s top five holdings to know its best picks in 2023.

RiverPark Advisors highlighted stocks like Equinix, Inc. (NASDAQ:EQIX) in the third quarter 2023 investor letter. Equinix, Inc. (NASDAQ:EQIX) is a digital infrastructure company. On November 16, 2023, Equinix, Inc. (NASDAQ:EQIX) stock closed at $780.37 per share. One-month return of Equinix, Inc. (NASDAQ:EQIX) was 10.88%, and its shares gained 21.94% of their value over the last 52 weeks. Equinix, Inc. (NASDAQ:EQIX) has a market capitalization of $73.264 billion.

RiverPark Advisors made the following comment about Equinix, Inc. (NASDAQ:EQIX) in its Q3 2023 investor letter:

“Equinix, Inc. (NASDAQ:EQIX): EQIX, a position we have held before, is a REIT that provides a global web of network-neutral, multi-tenant data centers that allow enterprises to bring together and interconnect the infrastructure required to compete in the digital economy. The company operates 248 data centers in 32 countries and 72 markets. These datacenters sit on top of the cable infrastructure and house the internet service provider equipment that connects and powers the internet.

The company charges tenants rent for colocation space, plus metered power and interconnects utilized. EQIX’s revenue growth is driven by price increases, greater cross-connect utilization, and new data center development. We believe the company can compound revenue at more than 10% a year over the next five years, and more than double Funds From Operations (FFO). We re-initiated a small position in August.”

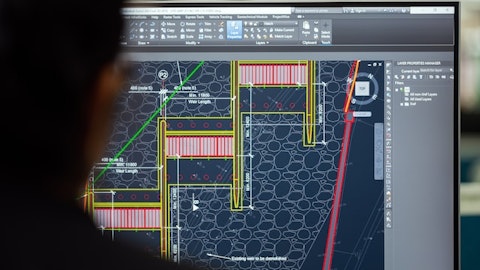

A team of software engineers in a digital workspace collaborating on a financial technology software solution.

Equinix, Inc. (NASDAQ:EQIX) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 44 hedge fund portfolios held Equinix, Inc. (NASDAQ:EQIX) at the end of second quarter which was 39 in the previous quarter.

We discussed Equinix, Inc. (NASDAQ:EQIX) in another article and shared the list of best commercial real estate stocks to buy according to hedge funds. In addition, please check out our hedge fund investor letters Q3 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 18 Cheapest Warm Places to Retire in the World

- Jim Cramer Recommends Selling These 10 Stocks

- Top 20 Most Valuable Defense Companies in the World

Disclosure: None. This article is originally published at Insider Monkey.