While the market driven by short-term sentiment influenced by the accomodative interest rate environment in the US, virus news and stimulus talks, many smart money investors are starting to get cautious towards the current bull run since March and hedging or reducing many of their long positions. Some fund managers are betting on Dow hitting 30,000 to generate strong returns. However, as we know, big investors usually buy stocks with strong fundamentals that can deliver gains both in bull and bear markets, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Global Water Resources, Inc. (NASDAQ:GWRS).

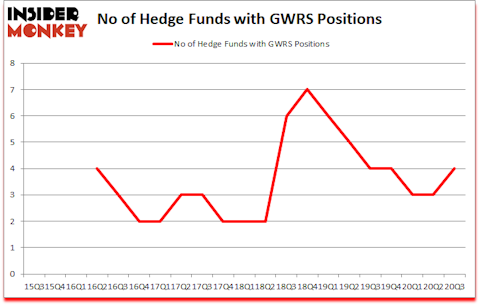

Global Water Resources, Inc. (NASDAQ:GWRS) has experienced an increase in enthusiasm from smart money in recent months. Global Water Resources, Inc. (NASDAQ:GWRS) was in 4 hedge funds’ portfolios at the end of September. The all time high for this statistics is 7. There were 3 hedge funds in our database with GWRS holdings at the end of June. Our calculations also showed that GWRS isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

To most investors, hedge funds are seen as worthless, outdated investment vehicles of yesteryear. While there are more than 8000 funds in operation at present, Our researchers look at the crème de la crème of this club, approximately 850 funds. Most estimates calculate that this group of people manage most of all hedge funds’ total capital, and by observing their matchless picks, Insider Monkey has discovered numerous investment strategies that have historically exceeded the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy outpaced the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Our portfolio of short stocks lost 13% since February 2017 (through November 17th) even though the market was up 65% during the same period. We just shared a list of 6 short targets in our latest quarterly update .

Ken Griffin of Citadel Investment Group

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost real estate prices. So, we recommended this real estate stock to our monthly premium newsletter subscribers. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Now let’s take a glance at the fresh hedge fund action surrounding Global Water Resources, Inc. (NASDAQ:GWRS).

What does smart money think about Global Water Resources, Inc. (NASDAQ:GWRS)?

At third quarter’s end, a total of 4 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 33% from the second quarter of 2020. By comparison, 4 hedge funds held shares or bullish call options in GWRS a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Renaissance Technologies, holds the largest position in Global Water Resources, Inc. (NASDAQ:GWRS). Renaissance Technologies has a $3.3 million position in the stock, comprising less than 0.1%% of its 13F portfolio. Coming in second is Royce & Associates, led by Chuck Royce, holding a $1.1 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Other professional money managers that are bullish contain Israel Englander’s Millennium Management, Ken Griffin’s Citadel Investment Group and . In terms of the portfolio weights assigned to each position Royce & Associates allocated the biggest weight to Global Water Resources, Inc. (NASDAQ:GWRS), around 0.01% of its 13F portfolio. Renaissance Technologies is also relatively very bullish on the stock, dishing out 0.0033 percent of its 13F equity portfolio to GWRS.

With a general bullishness amongst the heavyweights, some big names have jumped into Global Water Resources, Inc. (NASDAQ:GWRS) headfirst. Millennium Management, managed by Israel Englander, initiated the most valuable position in Global Water Resources, Inc. (NASDAQ:GWRS). Millennium Management had $0.6 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also initiated a $0.1 million position during the quarter.

Let’s also examine hedge fund activity in other stocks similar to Global Water Resources, Inc. (NASDAQ:GWRS). We will take a look at Calithera Biosciences Inc (NASDAQ:CALA), Fiesta Restaurant Group Inc (NASDAQ:FRGI), Evelo Biosciences, Inc. (NASDAQ:EVLO), HOOKIPA Pharma Inc. (NASDAQ:HOOK), Rimini Street, Inc. (NASDAQ:RMNI), NextCure, Inc. (NASDAQ:NXTC), and Fidus Investment Corp (NASDAQ:FDUS). This group of stocks’ market caps are similar to GWRS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CALA | 14 | 46957 | 0 |

| FRGI | 14 | 100160 | 0 |

| EVLO | 3 | 7804 | -3 |

| HOOK | 7 | 34432 | -2 |

| RMNI | 9 | 99016 | 1 |

| NXTC | 13 | 54862 | -3 |

| FDUS | 5 | 6368 | 1 |

| Average | 9.3 | 49943 | -0.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.3 hedge funds with bullish positions and the average amount invested in these stocks was $50 million. That figure was $5 million in GWRS’s case. Calithera Biosciences Inc (NASDAQ:CALA) is the most popular stock in this table. On the other hand Evelo Biosciences, Inc. (NASDAQ:EVLO) is the least popular one with only 3 bullish hedge fund positions. Global Water Resources, Inc. (NASDAQ:GWRS) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for GWRS is 27.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks gained 30.7% in 2020 through November 27th and still beat the market by 16.1 percentage points. A small number of hedge funds were also right about betting on GWRS as the stock returned 21.9% since the end of the third quarter (through 11/27) and outperformed the market by an even larger margin.

Follow Global Water Resources Inc. (NASDAQ:GWRS)

Follow Global Water Resources Inc. (NASDAQ:GWRS)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.