At Insider Monkey, we pore over the filings of nearly 866 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of March 31st. In this article, we will use that wealth of knowledge to determine whether or not The Wendy’s Company (NASDAQ:WEN) makes for a good investment right now.

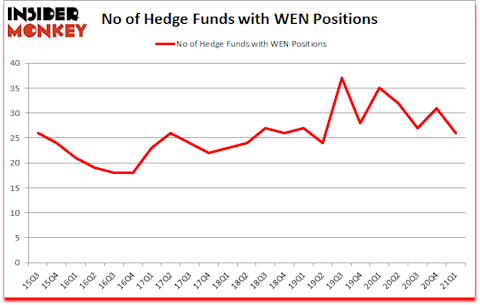

The Wendy’s Company (NASDAQ:WEN) was in 26 hedge funds’ portfolios at the end of March. The all time high for this statistic is 37. WEN investors should pay attention to a decrease in hedge fund sentiment recently. There were 31 hedge funds in our database with WEN positions at the end of the fourth quarter. Our calculations also showed that WEN isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

According to most shareholders, hedge funds are viewed as slow, outdated financial tools of years past. While there are more than 8000 funds with their doors open today, We choose to focus on the bigwigs of this club, approximately 850 funds. It is estimated that this group of investors shepherd bulk of the hedge fund industry’s total capital, and by keeping an eye on their top investments, Insider Monkey has identified a few investment strategies that have historically outstripped the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy exceeded the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, economists warn of inflation flare up. So, we are checking out this backdoor gold play that has hit peak gains of 718% in a little over a year. We go through lists like the 10 best battery stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Now let’s take a look at the key hedge fund action surrounding The Wendy’s Company (NASDAQ:WEN).

Do Hedge Funds Think WEN Is A Good Stock To Buy Now?

Heading into the second quarter of 2021, a total of 26 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -16% from one quarter earlier. By comparison, 35 hedge funds held shares or bullish call options in WEN a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Nelson Peltz’s Trian Partners has the biggest position in The Wendy’s Company (NASDAQ:WEN), worth close to $539.5 million, comprising 6.4% of its total 13F portfolio. The second most bullish fund manager is Peter Rathjens, Bruce Clarke and John Campbell of Arrowstreet Capital, with a $110 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that hold long positions comprise John Overdeck and David Siegel’s Two Sigma Advisors, D. E. Shaw’s D E Shaw and Renaissance Technologies. In terms of the portfolio weights assigned to each position Trian Partners allocated the biggest weight to The Wendy’s Company (NASDAQ:WEN), around 6.38% of its 13F portfolio. Horizon Asset Management is also relatively very bullish on the stock, earmarking 0.9 percent of its 13F equity portfolio to WEN.

Because The Wendy’s Company (NASDAQ:WEN) has faced bearish sentiment from hedge fund managers, we can see that there is a sect of hedgies that decided to sell off their full holdings in the first quarter. At the top of the heap, Dmitry Balyasny’s Balyasny Asset Management dropped the biggest position of the 750 funds monitored by Insider Monkey, totaling close to $34.7 million in stock. Gregg Moskowitz’s fund, Interval Partners, also sold off its stock, about $15.6 million worth. These moves are interesting, as total hedge fund interest dropped by 5 funds in the first quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as The Wendy’s Company (NASDAQ:WEN) but similarly valued. We will take a look at B2Gold Corp (NYSE:BTG), Zhihu Inc. (NYSE:ZH), Element Solutions Inc. (NYSE:ESI), DCP Midstream LP (NYSE:DCP), Simpson Manufacturing Co, Inc. (NYSE:SSD), Semtech Corporation (NASDAQ:SMTC), and Open Lending Corporation (NASDAQ:LPRO). This group of stocks’ market caps resemble WEN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BTG | 18 | 313091 | -4 |

| ZH | 23 | 94311 | 23 |

| ESI | 33 | 624419 | 4 |

| DCP | 4 | 20645 | 1 |

| SSD | 25 | 239346 | 0 |

| SMTC | 21 | 209600 | 4 |

| LPRO | 33 | 511506 | -1 |

| Average | 22.4 | 287560 | 3.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.4 hedge funds with bullish positions and the average amount invested in these stocks was $288 million. That figure was $1019 million in WEN’s case. Element Solutions Inc. (NYSE:ESI) is the most popular stock in this table. On the other hand DCP Midstream LP (NYSE:DCP) is the least popular one with only 4 bullish hedge fund positions. The Wendy’s Company (NASDAQ:WEN) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for WEN is 59. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through July 9th and still beat the market by 6.7 percentage points. Hedge funds were also right about betting on WEN, though not to the same extent, as the stock returned 14.1% since Q1 (through July 9th) and outperformed the market as well.

Follow Wendy's Co (NASDAQ:WEN)

Follow Wendy's Co (NASDAQ:WEN)

Receive real-time insider trading and news alerts

Suggested Articles:

- How to Best Use Insider Monkey To Increase Your Returns

- 15 Biggest Lithium Mining Companies In The World

- 15 Billionaires Who Came From Nothing

Disclosure: None. This article was originally published at Insider Monkey.