The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We at Insider Monkey have plowed through 873 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of June 30th. In this article we look at what those investors think of Kraton Corporation (NYSE:KRA).

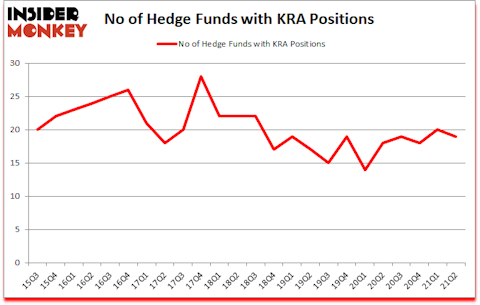

Kraton Corporation (NYSE:KRA) investors should pay attention to a decrease in enthusiasm from smart money recently. Kraton Corporation (NYSE:KRA) was in 19 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic is 28. There were 20 hedge funds in our database with KRA holdings at the end of March. Our calculations also showed that KRA isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

Today there are a multitude of gauges stock market investors employ to grade stocks. A couple of the less known gauges are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the top picks of the top fund managers can beat the broader indices by a significant margin (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website.

Chuck Royce of Royce & Associates

Now let’s take a glance at the new hedge fund action surrounding Kraton Corporation (NYSE:KRA).

Do Hedge Funds Think KRA Is A Good Stock To Buy Now?

Heading into the third quarter of 2021, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -5% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in KRA over the last 24 quarters. With hedge funds’ sentiment swirling, there exists a select group of key hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

The largest stake in Kraton Corporation (NYSE:KRA) was held by Rubric Capital Management, which reported holding $53.3 million worth of stock at the end of June. It was followed by Royce & Associates with a $26.3 million position. Other investors bullish on the company included Halcyon Asset Management, Millennium Management, and Nishkama Capital. In terms of the portfolio weights assigned to each position Rubric Capital Management allocated the biggest weight to Kraton Corporation (NYSE:KRA), around 3.35% of its 13F portfolio. Halcyon Asset Management is also relatively very bullish on the stock, dishing out 2.04 percent of its 13F equity portfolio to KRA.

Since Kraton Corporation (NYSE:KRA) has faced declining sentiment from the entirety of the hedge funds we track, logic holds that there lies a certain “tier” of hedgies that decided to sell off their full holdings by the end of the second quarter. Interestingly, Dan Rasmussen’s Verdad Advisers sold off the biggest position of the “upper crust” of funds tracked by Insider Monkey, comprising about $8.2 million in stock, and Dmitry Balyasny’s Balyasny Asset Management was right behind this move, as the fund dumped about $6.5 million worth. These bearish behaviors are interesting, as total hedge fund interest dropped by 1 funds by the end of the second quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Kraton Corporation (NYSE:KRA) but similarly valued. We will take a look at Immunovant, Inc. (NASDAQ:IMVT), Ferroglobe PLC (NASDAQ:GSM), AngioDynamics, Inc. (NASDAQ:ANGO), TPG RE Finance Trust, Inc. (NYSE:TRTX), SI-BONE, Inc. (NASDAQ:SIBN), So-Young International Inc. (NASDAQ:SY), and Fortuna Silver Mines Inc. (NYSE:FSM). This group of stocks’ market valuations are similar to KRA’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IMVT | 21 | 99203 | -5 |

| GSM | 19 | 145796 | 3 |

| ANGO | 22 | 155307 | 7 |

| TRTX | 10 | 32371 | 2 |

| SIBN | 28 | 202365 | 2 |

| SY | 5 | 14330 | -1 |

| FSM | 14 | 21601 | 2 |

| Average | 17 | 95853 | 1.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $96 million. That figure was $132 million in KRA’s case. SI-BONE, Inc. (NASDAQ:SIBN) is the most popular stock in this table. On the other hand So-Young International Inc. (NASDAQ:SY) is the least popular one with only 5 bullish hedge fund positions. Kraton Corporation (NYSE:KRA) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for KRA is 54.8. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and still beat the market by 1.6 percentage points. Hedge funds were also right about betting on KRA as the stock returned 41.1% since the end of Q2 (through 10/22) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Kraton Corp (NYSE:KRA)

Follow Kraton Corp (NYSE:KRA)

Receive real-time insider trading and news alerts

Suggested Articles:

- 12 Biggest 3D Companies In The World

- 15 Largest Employee Owned Companies

- 15 Fastest Growing Dividend Stocks

Disclosure: None. This article was originally published at Insider Monkey.