Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Barrick Gold Corporation (NYSE:GOLD).

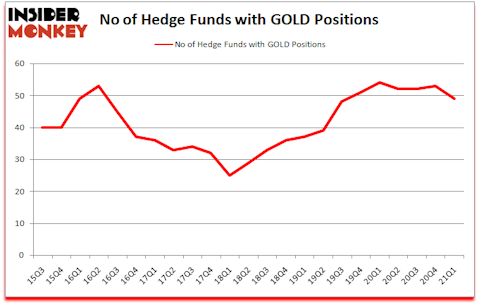

Barrick Gold Corporation (NYSE:GOLD) was in 49 hedge funds’ portfolios at the end of March. The all time high for this statistic is 54. GOLD shareholders have witnessed a decrease in support from the world’s most elite money managers recently. There were 53 hedge funds in our database with GOLD positions at the end of the fourth quarter. Our calculations also showed that GOLD isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

In today’s marketplace there are a large number of indicators stock traders put to use to grade publicly traded companies. Two of the most under-the-radar indicators are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the top picks of the elite investment managers can trounce the market by a significant margin (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

Dmitry Balyasny of Balyasny Asset Management

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation, which is why we are checking out this inflation play. We go through lists like 10 best gold stocks to buy to identify promising stocks. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind let’s view the latest hedge fund action surrounding Barrick Gold Corporation (NYSE:GOLD).

Do Hedge Funds Think GOLD Is A Good Stock To Buy Now?

Heading into the second quarter of 2021, a total of 49 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -8% from the fourth quarter of 2020. On the other hand, there were a total of 54 hedge funds with a bullish position in GOLD a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Renaissance Technologies has the largest position in Barrick Gold Corporation (NYSE:GOLD), worth close to $203.6 million, amounting to 0.3% of its total 13F portfolio. The second most bullish fund manager is Kerr Neilson of Platinum Asset Management, with a $151.9 million position; the fund has 3.4% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors with similar optimism consist of Ken Griffin’s Citadel Investment Group, D. E. Shaw’s D E Shaw and Israel Englander’s Millennium Management. In terms of the portfolio weights assigned to each position Oldfield Partners allocated the biggest weight to Barrick Gold Corporation (NYSE:GOLD), around 9.76% of its 13F portfolio. Odey Asset Management Group is also relatively very bullish on the stock, setting aside 9.3 percent of its 13F equity portfolio to GOLD.

Since Barrick Gold Corporation (NYSE:GOLD) has faced declining sentiment from the smart money, it’s safe to say that there is a sect of hedgies that decided to sell off their full holdings in the first quarter. At the top of the heap, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital said goodbye to the largest stake of the 750 funds tracked by Insider Monkey, worth close to $291.7 million in stock. Daniel Lascano’s fund, Lomas Capital Management, also said goodbye to its stock, about $49 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest was cut by 4 funds in the first quarter.

Let’s check out hedge fund activity in other stocks similar to Barrick Gold Corporation (NYSE:GOLD). We will take a look at AFLAC Incorporated (NYSE:AFL), Chewy, Inc. (NYSE:CHWY), Marathon Petroleum Corp (NYSE:MPC), The Allstate Corporation (NYSE:ALL), LyondellBasell Industries NV (NYSE:LYB), International Flavors & Fragrances Inc (NYSE:IFF), and Banco Bilbao Vizcaya Argentaria SA (NYSE:BBVA). This group of stocks’ market values are similar to GOLD’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AFL | 36 | 343937 | 1 |

| CHWY | 32 | 433780 | -6 |

| MPC | 46 | 1966638 | 3 |

| ALL | 41 | 893928 | 3 |

| LYB | 47 | 891913 | 20 |

| IFF | 55 | 3602931 | 22 |

| BBVA | 7 | 211912 | -2 |

| Average | 37.7 | 1192148 | 5.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 37.7 hedge funds with bullish positions and the average amount invested in these stocks was $1192 million. That figure was $1306 million in GOLD’s case. International Flavors & Fragrances Inc (NYSE:IFF) is the most popular stock in this table. On the other hand Banco Bilbao Vizcaya Argentaria SA (NYSE:BBVA) is the least popular one with only 7 bullish hedge fund positions. Barrick Gold Corporation (NYSE:GOLD) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for GOLD is 72. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 17.4% in 2021 through June 18th and still beat the market by 6.1 percentage points. Hedge funds were also right about betting on GOLD, though not to the same extent, as the stock returned 5.8% since Q1 (through June 18th) and outperformed the market as well.

Follow Barrick Gold Corp (NYSE:GOLD)

Follow Barrick Gold Corp (NYSE:GOLD)

Receive real-time insider trading and news alerts

Suggested Articles:

- How to Best Use Insider Monkey To Increase Your Returns

- 10 Best Railroad Stocks to Buy in 2021

- Billionaire Lee Cooperman’s Top 10 Stock Picks

Disclosure: None. This article was originally published at Insider Monkey.