Does Conagra Brands, Inc. (NYSE:CAG) represent a good buying opportunity at the moment? Let’s briefly check the hedge fund sentiment towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail unconceivably on some occasions, but their stock picks have been generating superior risk-adjusted returns on average over the years.

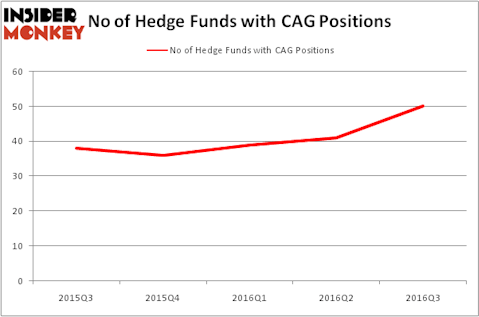

Conagra Brands, Inc. (NYSE:CAG) was included in the equity portfolios of 50 funds tracked by us at the end of September. CAG investors should be aware of an increase in activity from the world’s largest hedge funds in recent months, as there had been 41 hedge funds in our database with CAG holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as ICICI Bank Limited (ADR) (NYSE:IBN), Credit Suisse Group AG (ADR) (NYSE:CS), and Newmont Mining Corp (NYSE:NEM) to gather more data points.

Follow Conagra Brands Inc. (NYSE:CAG)

Follow Conagra Brands Inc. (NYSE:CAG)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Copyright: wavebreakmediamicro / 123RF Stock Photo

Keeping this in mind, let’s take a peek at the key action regarding Conagra Brands, Inc. (NYSE:CAG).

How are hedge funds trading Conagra Brands, Inc. (NYSE:CAG)?

At the end of the third quarter, a total of 50 of the hedge funds tracked by Insider Monkey were long this stock, up by 22% from one quarter earlier. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Barry Rosenstein’s JANA Partners has the largest position in Conagra Brands, Inc. (NYSE:CAG), worth close to $837.9 million, amounting to 14.7% of its total 13F portfolio. Other professional money managers that hold long positions include Phill Gross and Robert Atchinson’s Adage Capital Management, Cliff Asness’s AQR Capital Management and Dan Loeb’s Third Point.