Investors do not wait. Get ready for Active Management now!

Now is the time for investors to incorporate quantitative tools to empower their portfolio management. Any change in the direction of any of the principal components of earnings growth such as sales growth, gross margins, operating or financing costs, may be important indicators about future direction of the growth rate of the company. Micron Technology, Inc. (NASDAQ:MU) is exhibiting a clear sell pattern.

Iaroslav Neliubov/Shutterstock.com

Q1 2020 hedge fund letters, conferences and more

How to Spot a Winner!

A quality buy pattern requires:

- Low & flat to rising gross margin

- High & flat to falling SG&A and interest costs

- Higher sales growth

- Falling inventories & receivables

- Depressed share price

- Depressed valuation

How to Spot a Loser!

A quality sell pattern requires:

- High & flat to falling gross margin

- Low & flat to rising SG&A and interest costs

- Lower sales growth

- Rising inventories & receivables

- Extended share price

- Extended valuation

Micron Technology Inc $44.160 SELL This Rich Company Getting Worse

*Not investment advice

Micron Technology Inc has been a profitable company with persistently high cash return on total capital of 10.8% on average over the past 21 years. Over the long term the shares of Micron Technology Inc have advanced by 199% relative to the broad market index.

The shares have been very highly correlated with trends in Growth Factors. The dominant factor in the Growth group is Net Shareholder Wealth which has been 89% correlated with the share price.

Currently, sales growth is negative (-32.8%); slightly higher than last quarter but very low in the history of the company.

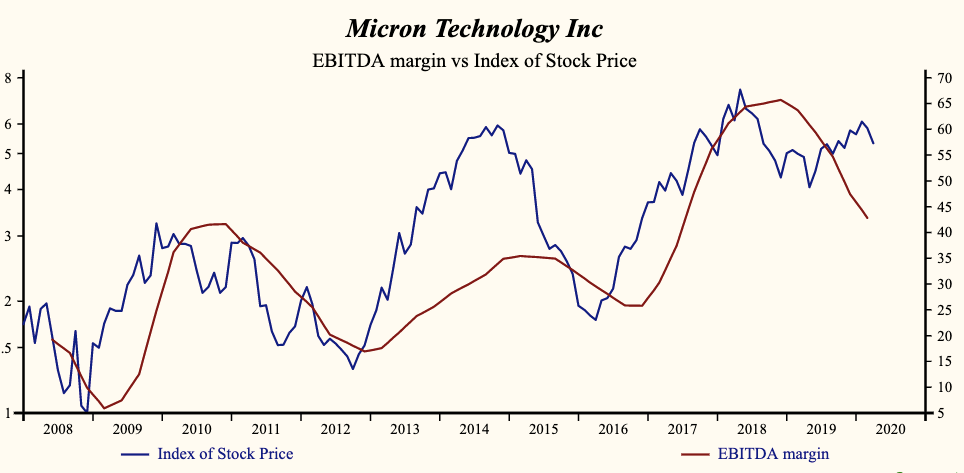

The company is recording a high and falling gross profit margin which has been 82% correlated with the share price. Inventory relative to sales continue to rise putting further pressure on the gross margin. Costs also continue to rise as demonstrated by rising SG&A expenses. That implies that the company has limited scope for further cost containment and that the rising costs are slowing the EBITD growth rate relative to sales. Lower gross margins and higher SG&A expenses are producing a deceleration in EBITD relative to sales which has been 80% correlated with the direction of the share price. Interest costs are low in the record of the company and rising. Higher interest costs not only slow cash flow growth but are often associated with lower valuation.

More recently, the shares of Micron Technology Inc have advanced by 19% since the May, 2019 low. The shares are trading at lower-end of the volatility range in a 11-month rising relative share price trend. The recent dip in share price implies that there will most likely be a near future opportunity to sell the shares of this evidently decelerating company.

The more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.

By

Pierre Raymond is a 25-year veteran of the Financial Services industry. Driven by his passion for financial technology he has transitioned from being a quantitative stock picker, to an award-winning hedge fund manager, credit risk manager to currently a multipurpose risk IT banking consultant. Pierre is the cofounder of Global Equity Analytics & Research Services LLC (GEARS) and a current partner at OTOS Wealth Systems Inc.

Disclosure: None