“Sweet dreams (are made of this),” the Allen Toussaint song sung memorably by the Eurythmics’ Annie Lennox is something people yearn for across the seven seas. Over 100 different chronic sleep disorders affect at least 30 million Americans over 13.

Maybe you’ve missed an occasional night’s sleep, but for many it’s a serious health and safety issue and the most precious commodity around. Serious enough that the market for the sleep-deprived for both prescription and OTC medicines, white noise machines, bedding etc. is a multi-billion dollar industry.

Sleep may be elusive but several companies claim their products are the answer to your tossing and turning. First among them are the mattress stocks Select Comfort Corp. (NASDAQ:SCSS), Tempur-Pedic International Inc. (NYSE:TPX), and springs manufacturer Leggett & Platt, Inc. (NYSE:LEG).

Sweet dreams or nightmare stocks?

If your mattress is a third as old as the 1983 Sweet Dreams video you probably need a new one. However, bed sets being put forth by Select Comfort Corp. (NASDAQ:SCSS) and Tempur-Pedic International Inc. (NYSE:TPX) are guaranteed for 20-25 years. They ought to be as they can cost as much as an economy car. Top-of-the line Sleep Number beds, owned by Select Comfort, run $4,699 on sale while premium Tempur-Pedics can run up to $7,999.

Tempur Sealy racks up loads of complaints for its Tempur-Pedic International Inc. (NYSE:TPX) beds citing chemical smells, lumpiness, mold, and customer service nightmares. Granted, mattresses are a very personal consumer durable, but overall ratings weren’t at all good for Tempur-Pedic beds.

Tempur Sealy also owns Stearns & Foster as part of the Sealy and Tempur-Pedic International Inc. (NYSE:TPX) merger in May 2013. Sealy and Stearns and Foster are primarily innerspring brands although Sealy (and several other companies) are offering hybrid innerspring/gel foam mattresses which are getting buzz as better for one’s sex life.

Sleeplikethedead.com, an independent, non-compensated review site, gives a 78% owner satisfaction rating for Select Comfort Corp. (NASDAQ:SCSS)’s Sleep Number beds. But Tempur-Pedic numbers are slightly better at 81% owner satisfaction improving due to the company’s introduction of lower price point memory foam mattresses. In general, innerspring mattresses like Sealy’s Posturepedic and Stearns & Foster brands have lower owner satisfaction scores at 65% and 59% respectively.

You’re wondering why the emphasis on reviews… because mattresses and mattress stores make up a significant number of complaints to the Better Business Bureau. Consumer Reports noted that 40% of mattress buyers experience buyers’ remorse and urges 30 days of due diligence when mattress shopping.

Both Tempur Sealy and Sleep Number have significant privately held competition with many of those like Bedinabox.com and Ikea getting much higher satisfaction ratings at slightly lower price points. Number three in the industry, Simmons Bedding, is a major competitor as it offers both Simmons and Serta brand mattresses. Costco‘s private label mattresses outperformed Tempur-Pedic in the Consumer Reports 2013 ranking.

Do you want to get into bed with them?

The bedding industry is challenging at best with Simmons entering bankruptcy in 2009 only to emerge owned by the same private equity firm that owns Serta. These are big ticket items that consumers need but only seven-ten years at a stretch. They don’t call mattresses consumer durables for nothing…they’re supposed to last.

Tempur Sealy, after the merger, is now the largest global bedding manufacturer, but trades at a 45.22 trailing P/E compared to Select Comfort Corp. (NASDAQ:SCSS)’s 19.51 and the PEGs are 1.32 and 1.35 respectively. Margins and sales have been declining at Tempur Sealy. The next earnings release will be critical to discover if expected $40 million in cost saving synergies is working out.

Tempur-Pedic International Inc. (NYSE:TPX) is already up 84% over the last year and price/book is an astounding 102.03 with a 14.80% short interest. Total debt is $2 billion to $91.50 million total cash. All that would keep me tossing and turning.

TPX Return on Equity data by YCharts

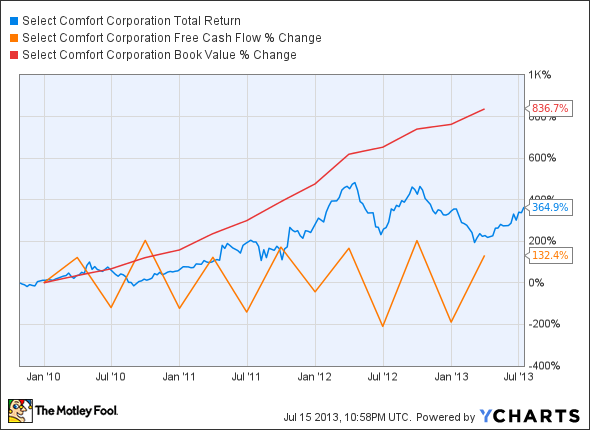

Select Comfort Corp. (NASDAQ:SCSS) is a better value at a lower P/E and Piper Jaffray reiterated its Outperform on July 11 with a $31 price target citing its new Dual Temp line, its most recent innovation, gaining traction expecting it to outperform for the rest of the year.

Select Comfort also has no debt, a corporate governance risk score of 1 (the best), and price/book is 7.29. However, this mattress space is cutthroat and very economically sensitive.

SCSS Total Return Price data by YCharts

Sleep soundly with a Dividend Aristocrat

You could sleep like a baby with Dividend Aristocrat Leggett & Platt, Inc. (NYSE:LEG) with a yield of 3.60%. The company has raised their yield for 42 consecutive years and also has been buying back stock.This is probably the best way to play this space as Leggett & Platt makes most of the innersprings for these companies.

They are also benefiting from this hybrid mattress trend as it makes the trademarked Comfort Core fabric encased spring for Ultimate Hybrid Mattresses sold by various mattress companies.

Leggett & Platt, Inc. (NYSE:LEG) operates as a diversified manufacturer of furniture innards, springs and such, as well as making automotive, office, and aerospace seating and components and retail furnishings like shelves and display units. As a double play on both a housing and auto industry resurgence and a search for yield the market has taken it up 52.36% in the last year.This has also taken up the short interest to 7.60% although it is decreasing.

The PEG is 1.35 and the price/book at 3.22. The trailing P/E is 18.67. Its main competition is Genuine Cast Parts on automotive and office products and and Flexsteel Industries, Inc. (NASDAQ:FLXS) on residential and commercial furnishings.

However, the company is further diversifying with purchases like Western Pneumatic Tube, an aerospace supplier, and selling off non-growth drivers. The company has solid free cash flow and improving margins with 15.00% five year EPS growth expected. It is well-suited for a retirement portfolio.

Caveats are: steel is their main raw material so steel prices are a continuing concern, debt is high but manageable, and dividend yield growth is not thrilling.

LEG Dividend data by YCharts

How did you sleep?

You’ve probably slept fitfully if you own the mattress companies, with their ups and downs. Going forward results could be lumpy. You don’t need 30 days due diligence to see Select Comfort is better than Tempur Sealy. However, Leggett & Platt, Inc. (NYSE:LEG) is the best choice if you want to sleep at night.

AnnaLisa Kraft has no position in any stocks mentioned. The Motley Fool owns shares of Tempur-Pedic International.

The article Which Stock Will Help You Sleep at Night? originally appeared on Fool.com and is written by AnnaLisa Kraft.

AnnaLisa is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.