3. Inflation and Interest Rates

Inflation is another risk. In particular, Realty Income’s pre-agreed upon rent increases may not keep pace with inflation. Consider the following quote from the company’s annual report:

Inflation may adversely affect our financial condition and results of operations. Although inflation has not materially impacted our results of operations in the recent past, increased inflation could have a more pronounced negative impact on any variable rate debt we incur in the future and on our results of operations. During times when inflation is greater than increases in rent, as provided for in our leases, rent increases may not keep up with the rate of inflation. Likewise, even though net leases reduce our exposure to rising property expenses due to inflation, substantial inflationary pressures and increased costs may have an adverse impact on our tenants if increases in their operating expenses exceed increases in revenue, which may adversely affect the tenants’ ability to pay rent.

And while inflation has not been an issue lately, some hawkish Federal Reserve members are increasingly nervous, and markets are increasingly expecting rates to rise which could have significant negative impacts on Realty Income.

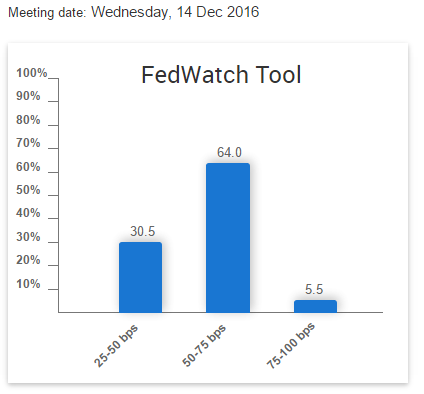

Note: Based on CME Group 30-Day Fed Fund futures prices, which have long been used to express the market’s views on the likelihood of changes in U.S. monetary policy, the CME Group FedWatch tool allows you to view the probability of FOMC rate moves for upcoming meetings.

Conclusion

Realty Income Corp (NYSE:O) has an impressive track record of big safe growing monthly dividend payments, and a stock price that has exhibited lower than average volatility. We believe it has the financial wherewithal to keep paying and increasing the dividend. However, we also believe it is less likely for Realty Income’s dividend and stock price to appreciate as attractively in the future as they have in the past. Despite the risks and challenges, we’ve still ranked Realty Income #9 on our list of Top 10 Big Dividend REITs Worth Considering because the recent price decline has made the valuation more reasonable, and the big steady dividend is worthwhile for many income-focused investors.

Note: This article was written by Blue Harbinger. At Blue Harbinger, our mission is to help you identify exceptional investment opportunities while avoiding the high costs and conflicts of interest that are prevalent throughout the industry. We offer additional free reports and a premium subscription service at BlueHarbinger.com. If you are ever in the Naperville, IL, USA area, our founder (Mark D. Hines) is happy to meet you at a local coffeehouse to talk about investments. Please feel free to get in touch.