The elite funds run by legendary investors such as Dan Loeb and David Tepper make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentive to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at Achillion Pharmaceuticals, Inc. (NASDAQ:ACHN) from the perspective of those elite funds.

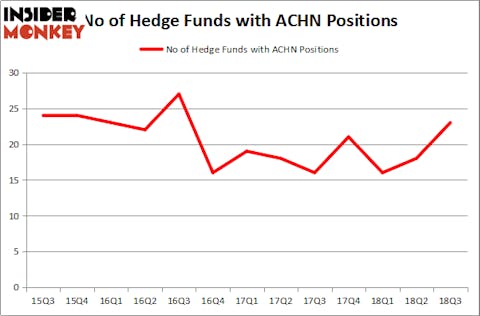

Is Achillion Pharmaceuticals, Inc. (NASDAQ:ACHN) the right investment to pursue these days? Investors who are in the know are turning bullish. The number of long hedge fund positions rose by 5 and at the end of the third quarter there were 23 investors long the stock. Check if the company was in the list of 30 most popular stocks among hedge funds.

To the average investor there are tons of signals stock market investors employ to assess their stock investments. A couple of the most useful signals are hedge fund and insider trading interest. We have shown that, historically, those who follow the top picks of the elite hedge fund managers can beat the broader indices by a significant amount (see the details here).

RA Capital Management held by Peter Kolchinsky shared his Achillion investment thesis in the 2016 Q2 investor letter. Here is what he said:

“On the rare occasion that we own a stock that is widely held by our peers, we have to wonder what we know that the crowd does not; for example, one of our large holdings, Achillion, is owned by 9 other funds that we track and is undergoing a transition from a focus on Hepatitis C (HCV) to the feld of complement-mediated disorders. Therefore, the data show that Achillion is reasonably widely owned (compared to our other holdings), but from talking to sell-side analysts and listening to the questions asked by investors in group meetings, we suspect that they own Achillion primarily for HCV and do not yet see the even greater value of the complement program that we see. The next 6-9 months should change that if the complement trials continue on track.”

It turned out that Kolchinsky was wrong about the stock because, since his investment thesis was published, the stock price has lost 62.5% and it is currently trading at $3. Is it now undervalued? Is it the right time to buy?

Let’s view the key hedge fund action surrounding Achillion Pharmaceuticals, Inc. (NASDAQ:ACHN).

Hedge fund activity in Achillion Pharmaceuticals, Inc. (NASDAQ:ACHN)

At the end of the third quarter, a total of 23 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 28% from the second quarter of 2018. By comparison, 21 hedge funds held shares or bullish call options in ACHN heading into this year. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

Among these funds, Citadel Investment Group held the most valuable stake in Achillion Pharmaceuticals, Inc. (NASDAQ:ACHN), which was worth $15.4 million at the end of the third quarter. On the second spot was Rock Springs Capital Management which amassed $8.8 million worth of shares. Moreover, Armistice Capital, MAK Capital One, and Point72 Asset Management were also bullish on Achillion Pharmaceuticals, Inc. (NASDAQ:ACHN), allocating a large percentage of their portfolios to this stock.

With a general bullishness among the heavyweights, some big names have been driving this bullishness. MAK Capital One, managed by Michael Kaufman, initiated the biggest position in Achillion Pharmaceuticals, Inc. (NASDAQ:ACHN). MAK Capital One had $7.2 million invested in the company at the end of the quarter. Steve Cohen’s Point72 Asset Management also initiated a $6.6 million position during the quarter. The other funds with new positions in the stock are Ori Hershkovitz’s Nexthera Capital, Opus Point Partners Management, and James A. Silverman’s Opaleye Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Achillion Pharmaceuticals, Inc. (NASDAQ:ACHN) but similarly valued. We will take a look at Pennantpark Floating Rate Capital Ltd (NASDAQ:PFLT), Inovio Pharmaceuticals Inc (NYSEAMEX:INO), Enphase Energy Inc (NASDAQ:ENPH), and Replimune Group, Inc. (NASDAQ:REPL). This group of stocks’ market valuations are similar to ACHN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PFLT | 5 | 12888 | -2 |

| INO | 8 | 5802 | 0 |

| ENPH | 19 | 64630 | 1 |

| REPL | 9 | 79637 | 9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10 hedge funds with bullish positions and the average amount invested in these stocks was $41 million. That figure was $85 million in ACHN’s case. Enphase Energy Inc (NASDAQ:ENPH) is the most popular stock in this table. On the other hand Pennantpark Floating Rate Capital Ltd (NASDAQ:PFLT) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Achillion Pharmaceuticals, Inc. (NASDAQ:ACHN) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio at this point in time.

Disclosure. None