The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 866 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their March 31st holdings, data that is available nowhere else. Should you consider Prudential Financial Inc (NYSE:PRU) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

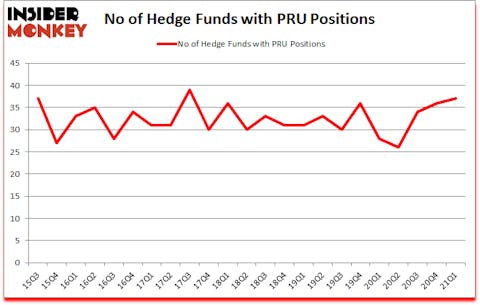

Is Prudential Financial Inc (NYSE:PRU) a cheap investment now? The best stock pickers were buying. The number of long hedge fund positions advanced by 1 recently. Prudential Financial Inc (NYSE:PRU) was in 37 hedge funds’ portfolios at the end of the first quarter of 2021. The all time high for this statistic is 39. Our calculations also showed that PRU isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings). There were 36 hedge funds in our database with PRU holdings at the end of December.

In today’s marketplace there are dozens of tools stock traders can use to analyze publicly traded companies. Two of the most underrated tools are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the top picks of the best investment managers can trounce their index-focused peers by a very impressive margin (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best battery stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind let’s review the key hedge fund action surrounding Prudential Financial Inc (NYSE:PRU).

Do Hedge Funds Think PRU Is A Good Stock To Buy Now?

At Q1’s end, a total of 37 of the hedge funds tracked by Insider Monkey were long this stock, a change of 3% from the fourth quarter of 2020. On the other hand, there were a total of 28 hedge funds with a bullish position in PRU a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Arrowstreet Capital was the largest shareholder of Prudential Financial Inc (NYSE:PRU), with a stake worth $285.4 million reported as of the end of March. Trailing Arrowstreet Capital was Adage Capital Management, which amassed a stake valued at $41.2 million. Prana Capital Management, Marshall Wace LLP, and Mountain Road Advisors were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Mountain Road Advisors allocated the biggest weight to Prudential Financial Inc (NYSE:PRU), around 7.35% of its 13F portfolio. Prana Capital Management is also relatively very bullish on the stock, designating 3.15 percent of its 13F equity portfolio to PRU.

Consequently, key money managers have jumped into Prudential Financial Inc (NYSE:PRU) headfirst. Capital Growth Management, managed by Ken Heebner, created the largest position in Prudential Financial Inc (NYSE:PRU). Capital Growth Management had $20.5 million invested in the company at the end of the quarter. Benjamin A. Smith’s Laurion Capital Management also initiated a $13.6 million position during the quarter. The other funds with new positions in the stock are Paul Tudor Jones’s Tudor Investment Corp, Alec Litowitz and Ross Laser’s Magnetar Capital, and Bruce Kovner’s Caxton Associates LP.

Let’s now review hedge fund activity in other stocks similar to Prudential Financial Inc (NYSE:PRU). We will take a look at Roblox Corporation (NYSE:RBLX), Cintas Corporation (NASDAQ:CTAS), Xcel Energy Inc (NASDAQ:XEL), Lufax Holding Ltd (NYSE:LU), Phillips 66 (NYSE:PSX), PPG Industries, Inc. (NYSE:PPG), and Alcon Inc. (NYSE:ALC). This group of stocks’ market caps match PRU’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RBLX | 46 | 3387779 | 46 |

| CTAS | 32 | 582628 | -4 |

| XEL | 18 | 200349 | -10 |

| LU | 9 | 208197 | -2 |

| PSX | 24 | 290593 | -2 |

| PPG | 25 | 173679 | -9 |

| ALC | 23 | 753974 | -1 |

| Average | 25.3 | 799600 | 2.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.3 hedge funds with bullish positions and the average amount invested in these stocks was $800 million. That figure was $635 million in PRU’s case. Roblox Corporation (NYSE:RBLX) is the most popular stock in this table. On the other hand Lufax Holding Ltd (NYSE:LU) is the least popular one with only 9 bullish hedge fund positions. Prudential Financial Inc (NYSE:PRU) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for PRU is 72.3. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 19.3% in 2021 through June 25th and still beat the market by 4.8 percentage points. Hedge funds were also right about betting on PRU as the stock returned 15.8% since the end of Q1 (through 6/25) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Prudential Financial Inc (NYSE:PRU)

Follow Prudential Financial Inc (NYSE:PRU)

Receive real-time insider trading and news alerts

Suggested Articles:

- How to Best Use Insider Monkey To Increase Your Returns

- 25 Worst Major Cities for Allergies in 2020

- 10 Best Stocks Under $5 in 2021

Disclosure: None. This article was originally published at Insider Monkey.