The Russell 2000 ETF (IWM) has shot up by 38% since hitting a 52-week low on February 11, easily outdistancing the S&P 500 ETF (SPY)’s 19% gains during that time. Nor is the small-cap rally likely to be over. History shows that after periods of 15% or greater declines in the Russell 2000 ETF, it has responded with average gains of nearly 100%. In fact, only once did the rebound run come in below 60% gains. It’s no wonder then that hedge funds appear to be aggressively putting their money back into small-cap stocks. In this article, we’ll look at their Q3 trading habits in regards to Pentair plc. Ordinary Share (NYSE:PNR).

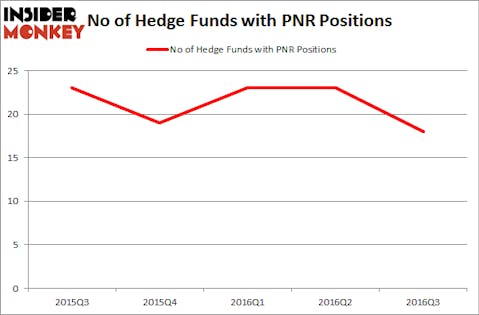

Pentair plc. Ordinary Share (NYSE:PNR) was in 18 hedge funds’ portfolios at the end of the third quarter of 2016. PNR has experienced a decrease in hedge fund sentiment lately. There were 23 hedge funds in our database with PNR holdings at the end of the previous quarter. At the end of this article we will also compare PNR to other stocks including Cintas Corporation (NASDAQ:CTAS), Hasbro, Inc. (NASDAQ:HAS), and Harris Corporation (NYSE:HRS) to get a better sense of its popularity.

Follow Pentair Plc (NYSE:PNR)

Follow Pentair Plc (NYSE:PNR)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

solarseven/Shutterstock.com

With all of this in mind, we’re going to take a gander at the fresh action encompassing Pentair plc. Ordinary Share (NYSE:PNR).

What have hedge funds been doing with Pentair plc. Ordinary Share (NYSE:PNR)?

Heading into the fourth quarter of 2016, a total of 18 of the hedge funds tracked by Insider Monkey were bullish on this stock, down by 22% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards PNR over the last 5 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Nelson Peltz’s Trian Partners has the number one position in Pentair, Ltd. Registered Share (NYSE:PNR), worth close to $921 million, corresponding to 9% of its total 13F portfolio. On Trian Partners’ heels is Ian Simm of Impax Asset Management, with a $32 million position; the fund has 1.5% of its 13F portfolio invested in the stock. Other members of the smart money with similar optimism include Joel Greenblatt’s Gotham Asset Management, Paul Marshall and Ian Wace’s Marshall Wace LLP and Ken Griffin’s Citadel Investment Group. We should note that Impax Asset Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.