At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

Pebblebrook Hotel Trust (NYSE:PEB) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 11 hedge funds’ portfolios at the end of the third quarter of 2018. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Aspen Insurance Holdings Limited (NYSE:AHL), Edgewell Personal Care Company (NYSE:EPC), and Mimecast Limited (NASDAQ:MIME) to gather more data points.

According to most stock holders, hedge funds are seen as slow, old investment tools of the past. While there are over 8,000 funds trading at the moment, Our experts look at the elite of this club, about 700 funds. These investment experts orchestrate the lion’s share of the smart money’s total capital, and by paying attention to their matchless equity investments, Insider Monkey has formulated a few investment strategies that have historically outstripped the S&P 500 index. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by 6 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s analyze the recent hedge fund action encompassing Pebblebrook Hotel Trust (NYSE:PEB).

Hedge fund activity in Pebblebrook Hotel Trust (NYSE:PEB)

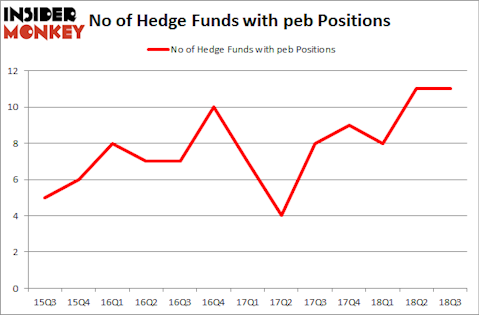

At the end of the third quarter, a total of 11 of the hedge funds tracked by Insider Monkey were long this stock, no change from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards PEB over the last 13 quarters. With the smart money’s sentiment swirling, there exists a select group of noteworthy hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

The largest stake in Pebblebrook Hotel Trust (NYSE:PEB) was held by Long Pond Capital, which reported holding $27.8 million worth of stock at the end of September. It was followed by Balyasny Asset Management with a $16.3 million position. Other investors bullish on the company included Renaissance Technologies, Millennium Management, and Echo Street Capital Management.

Because Pebblebrook Hotel Trust (NYSE:PEB) has experienced bearish sentiment from the entirety of the hedge funds we track, it’s safe to say that there is a sect of funds who sold off their entire stakes heading into Q3. At the top of the heap, Steve Cohen’s Point72 Asset Management dropped the largest stake of the “upper crust” of funds watched by Insider Monkey, totaling about $4.8 million in stock, and Paul Tudor Jones’s Tudor Investment Corp was right behind this move, as the fund sold off about $0.5 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Pebblebrook Hotel Trust (NYSE:PEB) but similarly valued. These stocks are Aspen Insurance Holdings Limited (NYSE:AHL), Edgewell Personal Care Company (NYSE:EPC), Mimecast Limited (NASDAQ:MIME), and Allscripts Healthcare Solutions Inc (NASDAQ:MDRX). All of these stocks’ market caps resemble PEB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AHL | 20 | 447059 | -4 |

| EPC | 18 | 264616 | -3 |

| MIME | 26 | 540249 | 6 |

| MDRX | 20 | 249789 | -2 |

| Average | 21 | 375428 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $375 million. That figure was $106 million in PEB’s case. Mimecast Limited (NASDAQ:MIME) is the most popular stock in this table. On the other hand Edgewell Personal Care Company (NYSE:EPC) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks Pebblebrook Hotel Trust (NYSE:PEB) is even less popular than EPC. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.