Before we spend days researching a stock idea we’d like to take a look at how hedge funds and billionaire investors recently traded that stock. S&P 500 Index ETF (SPY) lost 8.7% through October 26th. Forty percent of the S&P 500 constituents were down more than 10%. The average return of a randomly picked stock in the index is -9.5%. This means you (or a monkey throwing a dart) have less than an even chance of beating the market by randomly picking a stock. On the other hand, the top 25 most popular S&P 500 stocks among hedge funds had an average loss of 8.8%. In this article, we will take a look at what hedge funds think about Park National Corporation (NYSEAMEX:PRK).

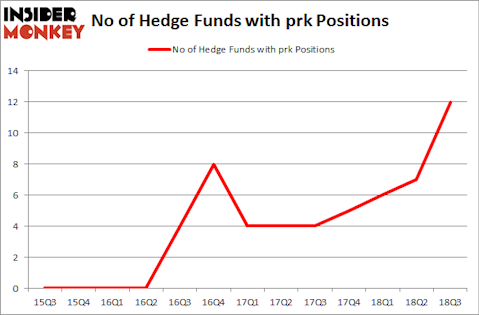

Is Park National Corporation (NYSEAMEX:PRK) a buy here? Prominent investors are betting on the stock. The number of long hedge fund positions increased by 5 in recent months. Our calculations also showed that prk isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are a lot of signals investors can use to evaluate stocks. A pair of the less utilized signals are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the top picks of the best investment managers can beat the market by a significant amount (see the details here).

Let’s take a glance at the latest hedge fund action encompassing Park National Corporation (NYSEAMEX:PRK).

What does the smart money think about Park National Corporation (NYSEAMEX:PRK)?

At the end of the third quarter, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, a change of 71% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards PRK over the last 13 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Renaissance Technologies, managed by Jim Simons, holds the most valuable position in Park National Corporation (NYSEAMEX:PRK). Renaissance Technologies has a $10.8 million position in the stock, comprising less than 0.1%% of its 13F portfolio. Sitting at the No. 2 spot is Millennium Management, led by Israel Englander, holding a $2.7 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Some other members of the smart money that hold long positions comprise Paul Marshall and Ian Wace’s Marshall Wace LLP, Ken Griffin’s Citadel Investment Group and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital.

With a general bullishness amongst the heavyweights, key money managers have jumped into Park National Corporation (NYSEAMEX:PRK) headfirst. Millennium Management, managed by Israel Englander, initiated the largest position in Park National Corporation (NYSEAMEX:PRK). Millennium Management had $2.7 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also initiated a $2.3 million position during the quarter. The other funds with new positions in the stock are Peter Muller’s PDT Partners, Brandon Haley’s Holocene Advisors, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Park National Corporation (NYSE:PRK) but similarly valued. These stocks are Redfin Corporation (NASDAQ:RDFN), Ship Finance International Limited (NYSE:SFL), Apptio, Inc. (NASDAQ:APTI), and Cosan Limited (NYSE:CZZ). This group of stocks’ market caps resemble PRK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RDFN | 12 | 145803 | 4 |

| SFL | 12 | 65416 | -4 |

| APTI | 25 | 321667 | 5 |

| CZZ | 13 | 97937 | -4 |

| Average | 15.5 | 157706 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.5 hedge funds with bullish positions and the average amount invested in these stocks was $158 million. That figure was $21 million in PRK’s case. Apptio, Inc. (NASDAQ:APTI) is the most popular stock in this table. On the other hand Redfin Corporation (NASDAQ:RDFN) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Park National Corporation (NYSE:PRK) is even less popular than RDFN. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.