Two years ago, we wrote a note on PAR Technology Corporation (PAR) titled PAR: A Framework for $30. The stock got within a whisker of $30 and now subsequently pulled back to $21.75 as of August 21st, 2019.

Since we wrote that note, a lot has happened:

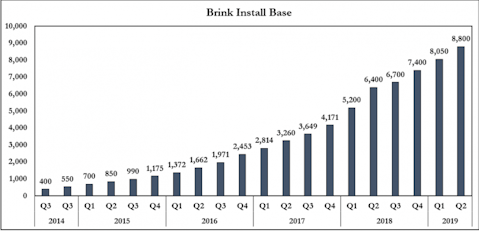

– Brink has gone from 3,260 units to 8,800 units

– New CEO Savneet Singh has brought a renewed sense of urgency, improved strategic vision and sharpened the company’s focus on ROIC

– The company has raised $80 million dollars via convertible debt

– They have started announcing lucrative JV partnerships to enhance the Brink ecosystem

– They are pursuing a large new opportunity that has presented itself: Payment processing

Given all the changes at the company, we thought it would make sense to share an update on how we are currently thinking about PAR and its opportunity set, as it remains one of our core portfolio holdings.

Our Base Case price target is now $42.50 (96% upside from current) and we see a reasonable path to $60-$80+ over the next few years with strong execution from new CEO Savneet Singh. The short-term setup for the stock has also improved, as we believe Q2 was a trough quarter and key metrics will begin reaccelerating in the back half of the year and into 2020. Finally, we believe the odds of permanent capital loss are drastically reduced at the current price of $21.75, and that Brink’s momentum would have to continue to materially decline over the next couple years to cause that negative outcome.

Summary:

To return to the premise of our previous note, we believe the basic calculus for PAR’s price can still be driven by three main factors:

1) How many restaurants will Brink Point of Sale (POS) cloud software be in?

2) What will be the average annual subscription fee per restaurant (ARPU)?

3) What EV/Sales multiple should Brink/PAR get off this restaurant base and ARPU?

Getting these three KPIs approximately right and then using reasonably conservative assumptions on the rest of the businesses, one can home in on the underlying value of the stock, as we believe Brink is–by far–the largest value driver for the company.

Question 1: How many restaurants will Brink be in?

To quote Howard Marks, “the most important thing is” Brink’s unit count, as the ARPU and Payments opportunity will be amplified by the size of the install base. The chart below shows where we are now.

Although unit growth has slowed to around 45% in the most recent quarter, we believe there are compelling reasons to believe it will reaccelerate in the back half of the year. First, management commentary:

“We expect Q3, but particularly in Q4 to really be the acceleration that we’ve been talking about. We raised the money in April and as I mentioned, we just brought in our first set of hires. And so we expect that to take a few months, have a lot of impact, but we’ve had a lot of changes in advance of that where we will see some of that impact in Q3 and starting in Q4 we will see – we believe there will be a great acceleration that will continue well into 2020.” – Savneet Singh, Q2 Conference Call

So, Q3 will be better than Q2, Q4 will be better than Q3, and 2020 will be better than 2019. We like that setup. Although Savneet is not specifically referring to unit growth in this quote (more Brink holistically), we believe part of the commentary is around an uptick in unit growth. The sections below dive a little deeper into how we think about the various unit growth opportunities, and our comfort in PAR’s visibility.

Tier 1 QSRs

While the company has not put out an official press release, we believe that Dairy Queen will begin rolling out Brink in their stores in the back half of the year because we have noticed an uptick in Dairy Queen job postings involving Brink. Dairy Queen has over 5,000 units in the US/Canada, meaning a full roll out of Dairy Queen will increase Brink’s unit count by over 50%. As we discuss later, we also believe Dairy Queen has materially better contract terms than their first major Tier 1 rollout, Arby’s. We estimate a full roll out of Dairy Queen will be worth, in of itself, $10-$15 million in annual recurring revenue, and will be a contributor to the back-half growth PAR is projecting. While the rollout will take some time, as we understand it there are incentives being given to Dairy Queen franchisors to take the plunge.

What else will drive the unit growth in the back half of 2019, 2020, and beyond?

We continue to believe Brink is sitting on a huge pipeline of potential Tier 1 and Tier 2 customers and we have evidence that one of their large hardware customers, CKE Brands (Hardees and Carl’s Jr., ~3,800 units), has been strongly considering the Brink platform. CKE is interesting because the former CIO of Arby’s, Darla Morse, is now the CIO of CKE brands, and both of those companies are owned by Roark Capital. We estimate Roark Capital has over 20,000 stores under their Inspire and Focus portfolios (which includes Sonic, Buffalo Wild Wings, Jimmy Johns, and many more). We believe the great deal Arby’s got from PAR was a foot in the door to get onto many of Roark Capital’s restaurants.

As it relates to CKE, we have seen some recent hires/roles on LinkedIn that seem to indicate a ramp up in activity. The first screenshot below shows one new hire, the Director of IT for CKE, who was previously a Product Manager at Brink. The second screenshot shows an employee who is “highly involved in planning and execution of POS conversion to Crunchtime/Brink solution to all corporate restaurants.”

We have seen posts on social media stating that Panda Express (who also owns fast growing Just Salad) is piloting Brink. We have heard from POS consultants that Dunkin’ Donuts is interested in Brink. This makes some sense given Dunkin’ Donut’s sister company, Baskin Robbins, uses PAR’s legacy POS software, PixelPoint. Dunkin’ has ~7,700 units in the US and another 3,180 outside the US. We have heard (again, unsubstantiated) that a large pizza chain is considering either PixelPoint or Brink. The point is, we believe the pipeline is stuffed full, and Savneet reiterates that:

“The pipeline opportunity is healthier than it’s ever been in my tenure…I can’t comment on specific customers we haven’t announced, but what I can say is there is a lot of activity happening. I mentioned this on the call, but reiterate how much excitement we have as an organization around the changes that have been happening. It’s really people are jumping out of their chair because there is just a lot of potential opportunities out there. We will announce customer when we get the right to announce them. A lot of it is making sure that the customer is comfortable with what we want to say and how we want to say together. And so, we’ll announce customers when we get to the right, an agreement that we want to announce – that they too want to be announced…but qualitatively I can tell you the pipeline is extremely strong and we feel really, really excited about our opportunity to continue to sign more new logos going into 2020.”

A hindrance to actually signing a master service agreement and rolling out Brink is the company’s ability to:

a) Have implementation staff

b) Commit to features that the Tier 1 restaurant needs

After the company’s capital raise early this year, Savneet immediately sought out to ramp up hiring to accommodate larger and more implementations. More importantly, we believe Savneet has also ramped up R&D so that Brink can more confidently roll out the vision of the POS that the large Tier 1 restaurants want. The R&D efforts to more quickly roll out features in software should have a flywheel effect, as PAR is highly prioritizing updates that will be applicable across Tier 1 customer bases. Thus, if development can accelerate, it should also be able to accelerate a restaurant’s willingness to move forward with implementations more confidently.

As these two pieces come together we believe the pipeline can begin converting to contract signing and then rollout which should result in an acceleration of restaurant activations in 2020 and beyond.

Table Service, Fine Dining, Tier 4, and International

It’s interesting to note that Brink’s other software POS, PixelPoint, still has over 12,000 stores using it today. That’s 3,200 more than Brink currently! PixelPoint is known better for their Table Service, Fine Dining, Tier 4, and International penetration, all areas that Brink is weakest in but where management sees potential.

PixelPoint was horribly monetized as previous management sold perpetual licenses with very little maintenance, but we believe there is a material opportunity (sometime in the late 2020/2021 period) whereby the transition of moving customers from PixelPoint to Brink can begin to occur and accelerate. The sticking point to this happening sooner is, again, features. PixelPoint is still more robust than Brink in Table Service and International markets, an area where Brink has not focused on historically.

Nevertheless, we believe it’s possible that over the next 3-4 years PAR converts half of the PixelPoint customers to Brink, which would be another 6,000 or so stores that are very poorly monetized currently. Savneet notes that customers in table service are so enthused by Brink that they are waiting for Brink to get their table service up to par:

“The second reason I’m excited is as large restaurants come to us, many of them are table service and often times will tell us, I want Brink and I’ll wait until you have table services before I start my Point of Sale project. It’s again being driven by the customer…historically when asked, we suggested that our immediate addressable market was approximately 300,000 restaurants. This limited Brink to domestic enterprise QSR and fast casual concepts. It’s now clear that the market for potential restaurants far exceed 300,000 as inbound customer requests now span beyond QSR and fast casual and our existing customers continually request international Brink presence.”

The last point deserves reiteration: “…our existing customers continually request international Brink presence.” This makes sense given many Tier 1 chains have a large international market and, long term, wants all their restaurants under one POS roof.

Obviously, this makes the TAM substantially larger, as there are about 1 million restaurants in the United States and 6-7 million internationally who utilize a POS system currently. We believe that “internationalization” of Brink will not be as challenging as other players who might want to try to expand beyond the US (for instance, Toast). For one thing, PixelPoint is already able to serve international markets. Secondly, PAR serves their hardware customers in over 100 countries and thus has beachheads already established in most key international markets. Also, as we understand it, the entire SureCheck product was internationally capable from the get-go as their largest customer Walmart demanded it as part of the rollout. So, PAR has experience rolling out international operations from a few different vectors.

Finally, a note on Tier 4, or the true Mom and Pop restaurants. While this is a large market, it’s also by far the most competitive market. In this particular market, we believe Savneet is trying to utilize channel partners more effectively, while also keeping an eye on the Payments prize (discussed below). On the last call, Savneet talked about “weaponizing” his channel partners and also discussed the concept of a “Brink Lite” offering which would be more applicable to smaller chains. While at this point we are not modeling tremendous gains in market share here, we do believe the strategy is sound and that having a more cohesive go-to-market plan should help the company pick up more Tier 4 restaurants, particularly if they can engage their channel partners more effectively with a compelling message.

Organic Growth

We believe Brink’s installed restaurant base is quite attractive as the restaurants are either growing quite quickly (MOD’s pizza—443 units going to 1,000+ over the next 5 years, Sweetgreen—91 locations, just raised another $200 million and is opening 15+/year) or are large Tier 1 and hence will have very low churn. Some are both. For instance, Five Guys Burgers, one of their first large customers, has aggressive growth plans, with almost 1,500 locations now and another 1,500 in development.

Although a recession or downturn could slow the momentum on some of these chains, we do believe Savneet is hyper focused on getting fast growing chains onto the Brink platform, as the implied ROIC is much higher trying to get a 250 chain shop that’s going to 1,000 in a few years than potentially a stagnant 500 unit chain.

Summary on Units

Our point in walking through the Tier 1 opportunity, the expanded TAM, and the Organic Growth opportunity all are attempting to point to reasonable levels of visibility for growth over the next few years. At Voss we hate “hoping” when the numbers are not there yet (as they are not for PAR). To invest we want to have a very strong understanding of where the short term, medium term, and long term growth is going to come from. While it’s hard to pinpoint a ceiling, it seems reasonably likely to us that at worst things continue on at the pace they have been going (e.g. 500- 700 units a quarter), which we believe materially lowers the potential for permanent capital loss as Brink continues to scale.

On the other hand, as Savneet executes the playbook he is talking about, accelerating development release schedules, adding staff to increase implementation capacity, and launching into new markets, we believe we will see an uptick in installed units going from 700 a quarter to 1,500 or 2,000 a quarter…in fact, it’s really a matter of when, not if.

Question 2: What will the ARPU be?

The ARPU (or ASP) is the average revenue per user, or in this case, restaurant. It consists of both the software package and additional maintenance support revenue, and is what the restaurant pays on a monthly basis to PAR. In order to be able to pitch material ARPU growth, you either need to have a platform or you need to be the core application from which other applications can spring. In Brink’s case, it’s the latter. The POS is the “brains” of the restaurant by which all other systems are connected. It’s as close to an ERP as a restaurant will get, and hence we believe ARPU expansion is a real possibility. How big?

Compared to our first note, this is where we believe the greatest incremental opportunity lies, as Savneet has started to more specifically lay out how the company will materially improve ARPU. The “football field” chart below is a recent addition to PAR’s investor deck, and we think it is instructive towards the long-term opportunity.

PAR argues there is a clear path from going from ~$2,000 a year today to $8,000-$10,000 over the next several years, resulting in high margin incremental revenue. After all, in software building your base is the expensive part while the ARPU expansion is where you make your money. How will they move the ARPU so much higher? Four ways:

1. Right sizing pricing

2. Building out new products

3. Joint Venture relationships

4. Acquisitions

Improving Pricing

One major thing we got wrong in our original note was the ARPU on the first Tier 1 customer, Arby’s. We had seen solid ARPU’s from other large customers like Five Guy’s and while we assumed some decline in ARPU since Arby’s is so large and was the first to “take the plunge” as a Tier 1 customer, once Arby’s started rolling out it became apparent that Brink had given Arby’s pricing below our expectations.

Although we think there are still some legacy contracts signed before Savneet came on, and thus there could be some more “blips” in ARPU, it has been suggested on conference calls that Dairy Queen could be coming on at an ARPU materially above company average, which will be a good harbinger for Tier 1 customers to work off of in the future.

Savneet has even commented that there are a few large MSAs sitting on his desk, waiting to sign, but that he wants to improve pricing on before signing. We believe Brink’s competitive position will allow them to right size this pricing and that Arby’s will be, in general, the aberration.

Savneet has made it a point on both the Q1 and Q2 calls to talk about bookings signed in the quarter, and what ARPU those new bookings are coming in at:

“We continue to see higher ASPs for new bookings in the quarter through pricing modifications, value justification and improved customer qualification. New customers in second quarter signed on the average monthly subscription rate of approximately $200 per site.”

By our math, this $200 monthly ARPU ($2,400 annually) compares to their current aggregate ARPU of closer to $140 a month ($1,680). So just by “pricing modifications and value justification” they have raised ARPU by over 40% on new customers.

Building Out New Products, JVs and Acquisitions

As the football field concept shows, the actual cost of the POS software is about $140/month for a two terminal store, with some small upselling available with Kitchen Display Systems and Future Date Ordering. In order to get to $714 a month, new products will either need to be built (like PAR Pay), JV partnerships will need to be implemented (like ItsaCheckmate for Online Ordering, or Altametrics for workforce and supply chain management), or PAR will need to acquire partners.

Whether to build, partner, or buy additional functionality and features is obviously complex and a bit hard to model. For instance, buying a company has the advantage of acquiring a development team in addition to the product and revenues, but can also be dilutive to shareholders and can be a distraction if the cultures don’t jive. Building can take longer but has other benefits like sharing native code bases. We believe Savneet is highly attuned to the pros and cons of each and will employ all of them to some degree. We believe at least some of the cash hoard the company got in their capital raise will be used on acquisitions.

He has spoken about acquisitions on calls:

“Acquisition is an important piece of our growth strategy. We will use it to fill a product gaps and to expand the verticals that our customers continually ask going to service. Strategic acquisitions provide us the opportunity to manage the growth subscription rate and become even more important to our customers. Today we get invited to acquisition opportunities that we had to fight our way into just six months ago. Acquisition targets are often approaching PAR and Brink as a preferred partner, acknowledging the opportunity for partnership.”

The Wildcard: Merchant Services

When we wrote our previous note, we completely left Payment Processing (aka Merchant Services) off, because frankly the company had no product and had not announced work on a product. Now, with Savneet announcing on the Q2 call that a product is imminent for Q3, we can take a look at this opportunity in earnest. While we never like to ascribe too much value to a product that still does not technically exist, other POS company’s success in executing this straightforward playbook suggests that PAR Merchant Services will be worth something, it’s just a question of how much.

So what is PAR’s payment processing initiative? Essentially it is PAR injecting themselves into the lucrative credit card workflow, whereby a business gets charged 2-3% every time a customer uses a credit card. While the 2-3% stays relatively static, how that revenue gets chopped up can be more volatile, as several parties have claims on the revenue (Visa, the issuing bank, and merchant acquirers like First Data or Global Payments).

In recent years, software POS companies have successfully started getting pieces of this revenue, usually in the 4065 bps range, as the POS already has all the data and is in a natural position to process that payment data. A good example of an original pioneer is Mindbody (yoga studio and gym software) who, right before being acquired by Vista Equity in 2018, had 1/3rd of their revenue coming from “Payments” and 2/3’s of their revenue coming from software subscription.

More recently, direct comps to Brink, Lightspeed and Toast, have made payments a key part of their strategy. Toast, for instance, touts that 100% of their customers “take” payments and they get nearly 50 basis points (bps) of net fees. Lightspeed is targeting 65 bps of net take on credit card transactions.

What can we expect from PAR? Voss is somewhat tempering our expectations here in terms of customer penetration as compared to Toast, and the take rate as compared to Lightspeed. The reason is primarily target market. Toast and Lightspeed are more SMB focused, where it’s easier to convince companies to buy the software and then package that with payments. These customers are also less sophisticated, and so negotiating higher net processing fee is easier. PAR is focused on larger and fast-growing restaurant franchises, and so our assumption is it will be harder to get this business. However, we don’t think it’s impossible, as we once asked the Five Guys Burgers (>1500 units) CTO about this and he said, “Sure, as long as their prices are the same or lower.” If we look forward into the future, when Brink is in 30,000 restaurants, and assume a take rate in the 20-40% range with 30-50bps of payment processing revenues, it can result in some material annual EBITDA:

If they are able to achieve 40 bps at a 30% take rate on 30,000 restaurants, they can churn out almost $26 million in annual EBITDA ($32 mm in revenue), an amount we think would roughly cover their current EV right now (ex- Government business). Even at 30 bps and a 20% take rate, an incremental $13 million in EBITDA adds material upside to PAR. Most Payment Processors trade in the 15-20x EBITDA range, implying even $10 million in EBITDA (~$12 million in revenues) could have a material impact on PAR’s current valuation.

If they are able to achieve 40 bps at a 30% take rate on 30,000 restaurants, they can churn out almost $26 million in annual EBITDA ($32 mm in revenue), an amount we think would roughly cover their current EV right now (exGovernment business). Even at 30 bps and a 20% take rate, an incremental $13 million in EBITDA adds material upside to PAR. Most Payment Processors trade in the 15-20x EBITDA range, implying even $10 million in EBITDA (~$12 million in revenues) could have a material impact on PAR’s current valuation.

If we were to dream a little bit bigger and think about when PAR gets closer to 60,000 restaurants, which should push incremental EBITDA margins even higher, and perhaps PAR gets closer to 40% take rate on 50 bps, this business on its own could generate $100 million a year in incremental EBITDA.

Marketing and Data Analytics Dollars

Ultimately, we believe there is a large opportunity for PAR to get into the marketing and data analytics space to help their customers be more efficient and make their customer’s go to their stores more often. To explain simply, this could mean PAR taking 25% of a store’s advertising budget and running various marketing campaigns as PAR will be able to attribute more success on the campaigns than restaurants see from traditional media. We have spoken extensively to Jordan Thaeler at Whatsbusy, a data analytics and marketing company that uses algorithms to make recommendations on how restaurants owners can become more efficient and how they can drive traffic.

He argues that the POS is in pole position to take advantage of this given their access to data from all different areas. The POS is the only source to generally know exactly what a customer ordered (moreso than, say, the credit card companies). While we are not modeling revenue from this explicitly, yet, we do believe it’s on the longer term product roadmap and a primer from Jordan can be found here.

Question 3: What multiple should Brink get?

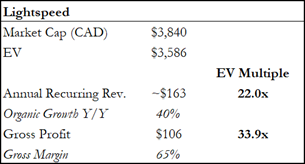

The POS space is in landgrab mode, and the valuations are indicative of that. The best public comp to Brink is Lightspeed, a POS software and payments provider to the retail industry headquartered in Canada.

Below is a snapshot on Lightspeed:

At 22x NTM ARR and 34x NTM Gross Profit ARR, Lightspeed is being given a premium valuation, although not necessarily out of whack with the general software universe. If we look at a scatterplot of EV/Sales (FY2) and organic growth rate (FY2/FY1) of 125 software companies, we get the following basic framework (Lightspeed is actually slightly below trendline):

Essentially, if you’re growing at 40-50%, you should get a 15-18x forward multiple. This one factor alone has an r2 of 0.525.

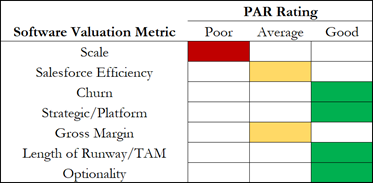

Now of course there are a number of things that can put you above or below trend, including scale, salesforce efficiency, churn, gross margin, Rule of 40, strategic value, acceleration/deceleration, length of runway, TAM, and many other things, but it’s a fairly good quick and dirty method.

We believe an industry leading cloud POS product targeting low churn Tier 1 and Tier 2 customers should score quite well on most of these factors except for scale at this point, and we believe Savneet is working on improving salesforce efficiency and gross margin:

For additional frame of reference, private competitor Toast raised another $250 million in March at a valuation of $2.7 billion. While we believe Toast is growing somewhat faster than Brink now, Toast is already generating a large share of their revenues from Payments, something PAR is just now starting. We do not believe Toast is in materially more actual units than Brink. Toast, as we understand it, is also burning gobs of cash to achieve their growth, so Brink likely has better efficiency metrics given their relatively shoestring budget.

Putting the Questions Together

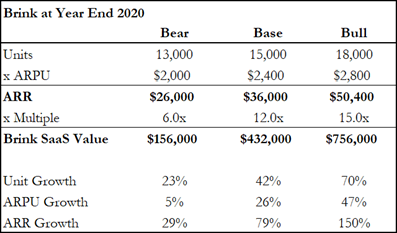

We started this note by saying an overly simplified way of valuing Brink is estimating unit growth, ARPU, and a reasonable multiple to apply to that resulting ARR. Below is a table where we lay out our 2020 forecasts for units, ARPU, and multiple in a Bear, Base, and Bull Case.

Note we estimate the current ARPU at ~$1,875 on a current unit count of 8,800.

In the analysis below, we take these values and come up with a framework for valuing PAR in total.

Valuing PAR – Base Case

Our Base Case is for accelerating Brink ARR in the back half of 2019 and into 2020. While management has talked to returning to “historical growth rates”, which would be 80-100%, our Base Case assumes the lower end of this range, vs. the slower 40% witnessed in the last quarter. Critically, although we think unit growth could exceed 40%, we are keeping it at around 40% in 2020, while our more aggressive Base Case forecast is for 26% ARPU growth. Our 12x ARR multiple is a material discount to Lightspeed’s multiple, which we believe is reasonable given the complexity of PAR’s story and the lower scale.

Assuming we are right on 50% ARR growth acceleration in 2020, Brink would exit 2020 running at roughly $33 million ARR (excluding Payments revenue), with some ongoing signs of scaling the business. Below is a Sum of Total Parts, which we feel is appropriate given the Government business ultimately being divested.

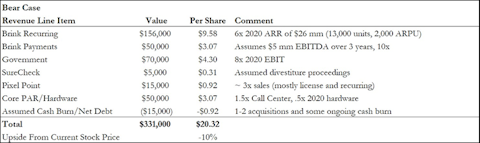

Valuing PAR – Bear Case

In the Bear Case we actually slow down Brink’s growth to 29%, with only slight ARPU gains and 25% unit growth. Given our visibility into their backlog and pipeline, this would be a pretty severe disappointment, but could certainly happen in certain cases such as a prolonged global recession where restaurants pause their IT investments or if competition becomes more pervasive.

In this case, we give Brink a $156 mm valuation and essentially hack the rest of our SOTP line items, resulting in 10% downside from the August 21st price.

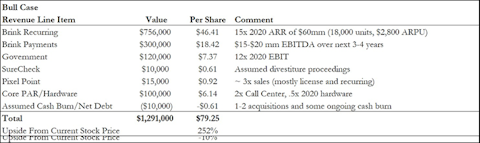

Valuing PAR – Bull Case

In this case we more material up the unit acceleration to 70%, while also accelerating ARPU gains and Payments uptake. For this scenario to work, PAR will have to roll out three larger Tier 1 customers by the end of 2020, most likely, and will have to get material uptake on their upsell initiatives like PAR Pay and start getting material revenue from their JV initiatives.

The Blue Sky Case

Savneet has laid out a compelling 5-6-year vision whereby Brink can get to 50-80k units, with an ARPU in the $8,000$10,000 range. We believe he is including Payments revenue, and likely a couple of acquisitions, so it’s a little hard to model this completely, but we think it’s worthwhile to consider what the company could look like in 5-6 years’ time and let readers discount it back at their own rate.

Below is a sensitivity table showing what Brink’s ARR could be under different unit levels and different ARPU scenarios:

For reference, 80,000 units would be 1% of total global restaurants with a POS system, 8% of North American Restaurants, or 22% of QSR/Casual/Fast Casual North American restaurants.

On the lower end of the scale, with just 40,000 units at $6,000 annual ARPU, PAR would produce $240 million of annual recurring revenue, an amount we believe would be worth at least 5x ARR (or 3-4x total sales, compare to Lightspeed at 22x NTM ARR).

Disclosures and Notices: This report is provided by Voss Capital, LLC (“Voss”) for informational purposes only. The information contained herein reflects the opinions and projections of Voss as of the date of publication, which are subject to change without notice at any time subsequent to the date of issue. All information provided is for informational purposes only and should not be deemed as investment advice or a recommendation to purchase or sell any specific security. Data included in this letter comes from company filings and presentations, analyst reports and Voss’ estimates. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any data presented. Certain information contained in this letter constitutes “forward-looking statements” which can be identified by the use of forward looking terminology such as “may,” will,” “should,” “expect,” “attempt,” “anticipate,” “project,” “estimate, or “seek” or the negatives thereof or other variations thereon or comparable terminology.

Voss Capital is long PAR. This report is dated August 22, 2019. It is initially published in the new issue of Insider Monkey’s monthly newsletter. Insider Monkey may have recommended long or short positions in this stock. Read our Terms of Use for additional disclosures.