The 800+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the second quarter, which unveil their equity positions as of June 30th. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Osisko Gold Royalties Ltd (NYSE:OR).

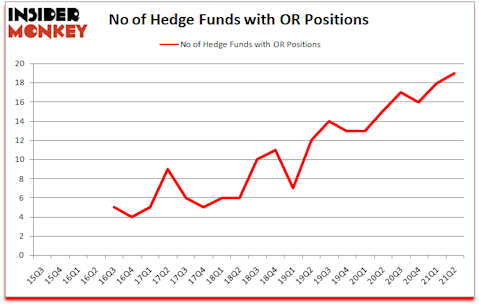

Osisko Gold Royalties Ltd (NYSE:OR) has experienced an increase in activity from the world’s largest hedge funds of late. Osisko Gold Royalties Ltd (NYSE:OR) was in 19 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic was previously 18. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that OR isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

To most stock holders, hedge funds are perceived as worthless, old investment tools of years past. While there are greater than 8000 funds trading at present, Our researchers choose to focus on the moguls of this group, about 850 funds. These hedge fund managers preside over the lion’s share of all hedge funds’ total capital, and by paying attention to their matchless stock picks, Insider Monkey has discovered a few investment strategies that have historically outperformed the broader indices. Insider Monkey’s flagship short hedge fund strategy defeated the S&P 500 short ETFs by around 20 percentage points annually since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website.

Eric Sprott of Sprott Asset Management

Keeping this in mind we’re going to go over the key hedge fund action encompassing Osisko Gold Royalties Ltd (NYSE:OR).

Do Hedge Funds Think OR Is A Good Stock To Buy Now?

At Q2’s end, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of 6% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards OR over the last 24 quarters. With hedge funds’ capital changing hands, there exists a few key hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Sprott Asset Management, managed by Eric Sprott, holds the number one position in Osisko Gold Royalties Ltd (NYSE:OR). Sprott Asset Management has a $70.2 million position in the stock, comprising 4.1% of its 13F portfolio. Coming in second is Millennium Management, led by Israel Englander, holding a $48.5 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Some other peers that hold long positions encompass Peter Franklin Palmedo’s Sun Valley Gold, Murray Stahl’s Horizon Asset Management and Renaissance Technologies. In terms of the portfolio weights assigned to each position Sprott Asset Management allocated the biggest weight to Osisko Gold Royalties Ltd (NYSE:OR), around 4.1% of its 13F portfolio. Courage Capital is also relatively very bullish on the stock, earmarking 2.92 percent of its 13F equity portfolio to OR.

As aggregate interest increased, some big names were breaking ground themselves. Prescott Group Capital Management, managed by Phil Frohlich, created the largest position in Osisko Gold Royalties Ltd (NYSE:OR). Prescott Group Capital Management had $1.7 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also initiated a $0.9 million position during the quarter. The other funds with new positions in the stock are Mika Toikka’s AlphaCrest Capital Management and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Osisko Gold Royalties Ltd (NYSE:OR) but similarly valued. These stocks are Dycom Industries, Inc. (NYSE:DY), Telecom Argentina S.A. (NYSE:TEO), Piedmont Office Realty Trust, Inc. (NYSE:PDM), Big Lots, Inc. (NYSE:BIG), Mueller Water Products, Inc. (NYSE:MWA), Cornerstone Building Brands, Inc. (NYSE:CNR), and Winnebago Industries, Inc. (NYSE:WGO). This group of stocks’ market values match OR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DY | 18 | 209153 | -1 |

| TEO | 13 | 36323 | 4 |

| PDM | 13 | 84856 | 0 |

| BIG | 23 | 202650 | 3 |

| MWA | 22 | 289760 | 2 |

| CNR | 20 | 153153 | -7 |

| WGO | 24 | 376249 | -6 |

| Average | 19 | 193163 | -0.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $193 million. That figure was $206 million in OR’s case. Winnebago Industries, Inc. (NYSE:WGO) is the most popular stock in this table. On the other hand Telecom Argentina S.A. (NYSE:TEO) is the least popular one with only 13 bullish hedge fund positions. Osisko Gold Royalties Ltd (NYSE:OR) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for OR is 63.3. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and surpassed the market again by 1.6 percentage points. Unfortunately OR wasn’t nearly as popular as these 5 stocks (hedge fund sentiment was quite bearish); OR investors were disappointed as the stock returned -8.8% since the end of June (through 10/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2021.

Follow Osisko Gold Royalties Ltd (NYSE:OR)

Follow Osisko Gold Royalties Ltd (NYSE:OR)

Receive real-time insider trading and news alerts

Suggested Articles:

- 11 Best Lithium and Battery Stocks To Buy

- 25 Worst Cities For Allergies

- 10 Best Stocks for Beginners with Little Money

Disclosure: None. This article was originally published at Insider Monkey.