Almost two years ago, I wrote about the San Francisco Giants beating the Kansas City Royals in game 7 of the World Series, the annual championship series of Major League Baseball in North America. Of the 57 runs scored in that series, only two were home runs.

I don’t think we’ll see only two home runs between the Chicago Cubs and the Cleveland Indians this year! In Game 1 of the 2016 World Series, catcher Roberto Perez hit two home runs to back up a shut-out performance by starting pitcher Corey Kluber and reliever Andrew Miller. The Indians won 6-0.

Asif Islam / Shutterstock.com

In case you’re wondering what baseball has got to do with dividend growth investing, I use the term home run to describe any position in my portfolio that has crossed the 100% mark in total returns.

Today, I’m happy to announce that I’ve scored another home run with DivGro! While my goal with DivGro is to build a growing dividend income stream, it is fun to see some stocks perform well enough to become home run stocks!

In my days as a trader, I often sold half of my shares when a position became a home run position. I justified the action by saying that now I’m playing with “house” money. I no longer think that way. In fact, I’m more than happy to hang on to home runs and to continue collecting the growing dividends.

Here is a list of my previous home run stocks, some of which I’ve sold with the goal of preparing DivGro for covered call options trading:

– Home run #1: General Dynamics Corporation (NYSE:GD) – up 139% (38% annualized)

– Home run #2: Nippon Telegraph & Telephone Corp (ADR) (NYSE:NTT) – closed for 125% gain (37% annualized)

– Home run #3: Digital Realty Trust, Inc. (NYSE:DLR) – closed for 102% gain (44% annualized)

– Home run #4: Altria Group Inc (NYSE:MO) – up 99% (33% annualized)

– Home run #5: Reynolds American, Inc. (NYSE:RAI) – up 102% (43% annualized)

– Home run #6: Main Street Capital Corporation (NYSE:MAIN) – up 101% (28% annualized)

Home Run #7

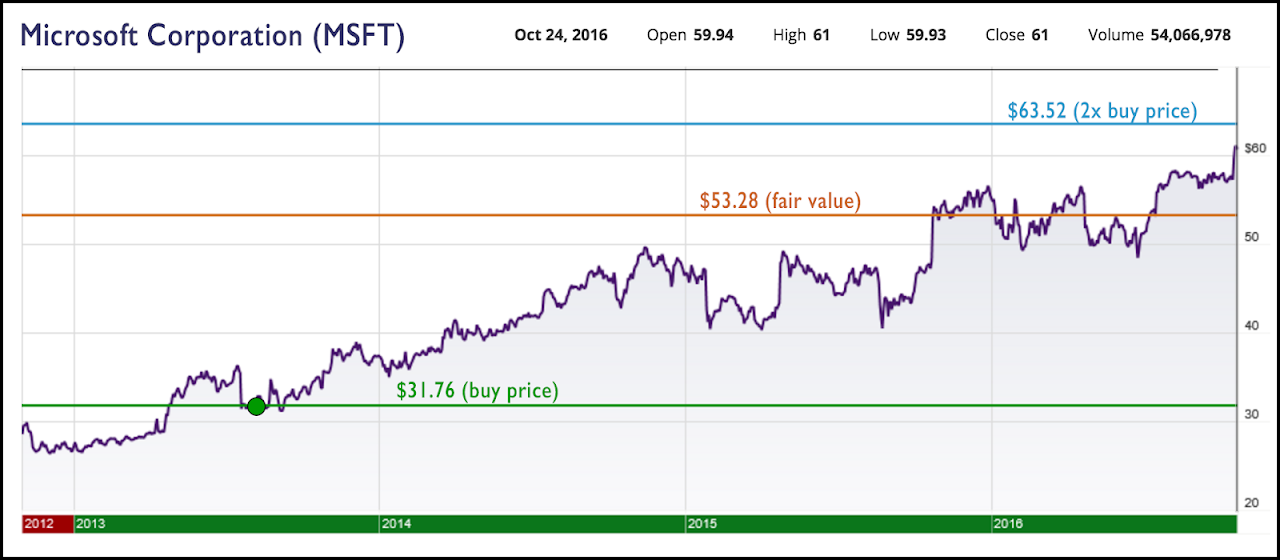

My 7th home run stock is Microsoft Corporation (NASDAQ:MSFT). I bought 80 shares at $31.76 per share in August 2013, with a starting yield on cost (YoC) of 2.9%. Microsoft Corporation (NASDAQ:MSFT) now trades above $60 and after several dividend increases, my YoC is 4.9%. Payback is 12.7%, meaning I’ve received 12.7% of my original investment back in the form of dividends.

Follow Microsoft Corp (NASDAQ:MSFT)

Follow Microsoft Corp (NASDAQ:MSFT)

Receive real-time insider trading and news alerts

Microsoft Corporation (NASDAQ:MSFT) is trading 14% above my fair value estimate of $53.28. The stock has a streak of 15 years of dividend increases and an impressive 10-year dividend growth rate of 15%. Microsoft is one of only two companies with a AAA credit rating. (Johnson & Johnson (NYSE:JNJ) is the other company).

I mentioned before that Chowder, a Seeking Alpha contributor, advocates buying shares of a great dividend growth stock that continues to experience higher earnings expectations, even as the share price rises to meet fair value. He calls the strategy dollar-cost averaging up. He argues that fair value estimates will increase with higher earnings expectations and that the stock price will follow. The strong often get stronger.

My sixth home run stock, MAIN, is one example where I’ve continued to add shares at higher prices:

The chart is a little outdated (September 5), but illustrates the point. It shows five occasions when I bought shares of MAIN. My average cost basis is $21.71 and my average YoC is 10.2%. With MAIN trading at $34.17 per share, the stock currently yields 6.5%.

Returning to the earlier questions, should I buy more shares of a home run stock even if doing so would increase my average cost basis and reduce my average YoC? Assuming the stock trades at or below fair value, I don’t see any reason to shy away from buying more shares. In fact, I like the idea of dollar-cost averaging up, especially if I get to increase my investment in great dividend growth stocks that are experiencing higher earnings expectations.

Note: FerdiS manages and writes about DivGro, his portfolio of dividend growth stocks created in January 2013. Please visit divgro.blogspot.com.