Masters Capital Management is an Atlanta-based investment fund founded in 1994 by Mike Masters. The fund reported holding $4.98 billion in managed 13F securities as of the end of the third quarter. Masters Capital’s stock picks returned 13.21% in the third quarter from its 13 long positions in companies which have a market cap of at least $1 billion, and some of its favorite stocks include Metlife Inc (NYSE:MET), Delta Air Lines, Inc. (NYSE:DAL), YRC Worldwide, Inc. (NASDAQ:YRCW), and Credit Suisse Group AG (ADR) (NYSE:CS).

According to our research, an investor can beat the market by investing in the top picks of big hedge funds. We follow around 750 funds, among which is Masters Capital Management. For example, in the third quarter, 627 out of 660 funds in our database returned positive gains from their long positions in companies which had a market cap of at least $1 billion on June 30. Let’s check out the aforementioned stocks now and see how they performed in the third quarter, and what the general smart money sentiment towards them was.

Chris Parypa Photography / Shutterstock.com

Masters Capital Management shrunk its holding in Delta Air Lines, Inc. (NYSE:DAL) by 50% in the third quarter, concluding the period with 1 million shares of the company, which were valued at $39.36 million at the end of September. In the second quarter, the fund had increased its holding in the company by 81%, amassing a total of 2 million shares of the company, having a total worth of about $72.86 million. The stake was profitable for the fund, as the stock returned 8.6% in the September quarter.

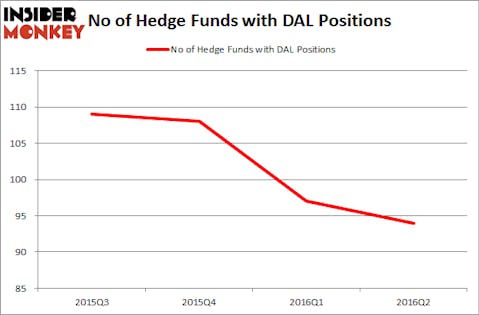

At the end of the second quarter, a total of 94 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 3% drop from the first quarter of 2016. Lansdowne Partners was the largest shareholder of Delta Air Lines, Inc. (NYSE:DAL), with a stake worth $964.5 million reported as of the end of June. Trailing Lansdowne Partners was PAR Capital Management, which amassed a stake valued at $417.7 million. Iridian Asset Management, OZ Management, and Stelliam Investment Management also held valuable positions in the company.

Follow Delta Air Lines Inc. (NYSE:DAL)

Follow Delta Air Lines Inc. (NYSE:DAL)

Receive real-time insider trading and news alerts

During the third quarter, Masters Capital Management unloaded 31% of its stake in Metlife Inc (NYSE:MET). At the end of September, the fund reported having over 1 million shares of the company, whose stock returned 12.6% in the third quarter. The total worth of the fund’s stake in Metlife was $44.43 million on September 30.

At the end of the second quarter, 45 of the hedge funds that we follow held long positions in this stock, a 10% decline from one quarter earlier. Of the funds tracked by Insider Monkey, Ric Dillon’s Diamond Hill Capital has the biggest position in Metlife Inc (NYSE:MET), worth close to $293 million. Sitting at the No. 2 spot is Pzena Investment Management, led by Richard S. Pzena, holding a $244.6 million position. Remaining peers that are bullish consist of Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and Cliff Asness’ AQR Capital Management.

Follow Metlife Inc (NYSE:MET)

Follow Metlife Inc (NYSE:MET)

Receive real-time insider trading and news alerts

We’ll check out two more of the fund’s stock picks on the next page.