Dividend investing is not only about yields, ratios and payments. It’s very important to analyze the business behind the numbers, its competitive strength and the fundamentals that generate and sustain the cash flows for those dividend payments. For investors in the hunt for rock solid dividend companies, natural monopolies can be a smart alternative.

I some business areas, it just doesn’t make sense to have more than one player from a business perspective. These are industries in which the business opportunity is attractive when there is one company exploiting it, but increased competition would ruin it for everyone. Think about airports, some utilities or railroads for example — there wouldn’t be enough demand for two companies covering the same market.

Full Steam Ahead

Norfolk Southern Corp. (NYSE:NSC) operates 21,000 miles of track in 22 eastern states, the District of Columbia and the province of Ontario, Canada. Norfolk Southern Corp. (NYSE:NSC) is a big player in coal transport, which represents nearly 30% of revenue, and the company has also been increasing its presence in businesses like auto parts and intermodal transportation over the last years.

Nobody in their right mind would think of building another railroad in the same territory that the company covers, the costs would be enormous and splitting the demand in two would probably mean that both players would lose money. Trains still compete against trucks, but the railroads have a structural cost advantage that is determinant when it comes to transporting commodities like coal.

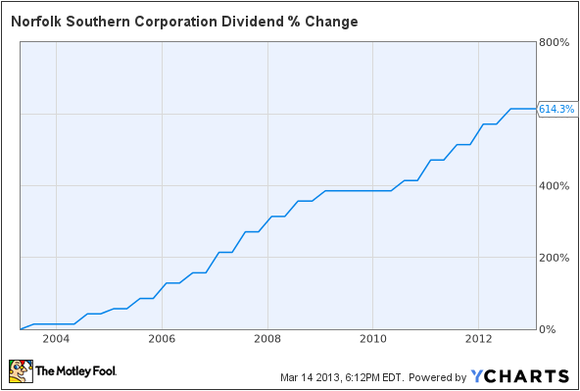

Norfolk Southern Corp. (NYSE:NSC) is a well-managed company with solid profitability ratios, and a healthy cash flow generation track record. The company pays a 2.7% dividend yield, and it has been able to consistently increase its dividend payments over the last years.

Turning Trash into Energy

Waste Management, Inc. (NYSE:WM) owns a leadership position in the stable and profitable business of waste collection with 271 active landfills and 294 transfer stations in the US. Most people don’t like to have landfills near their home, so it’s especially complicated to the required permissions to open new landfills. This means that Waste Management, Inc. (NYSE:WM), which already owns the landfills, has in its hands in a dirty but very valuable asset.

In case these this sounds too boring and unglamorous, the company is expanding rapidly into recycling. Waste Management, Inc. (NYSE:WM) owns 22 plants that turn trash into renewable energy, and it has been acquiring smaller players in the recycling business in order to increase volume and profitability in this segment.

While the trash collection business provides recurrent and stable cash flows, extracting value from post collection volumes by selling it as energy and raw materials can create some exciting growth opportunities in the middle term while at the same time increasing profitability. If that weren’t enough, Waste Management pays a big fat dividend yield of 4%.

A Pipeline of Dividends

Enterprise Products Partners L.P. (NYSE:EPD) is the biggest listed master limited partnership in the U.S. The company transports and processes natural gas, natural gas liquids, crude oil, refined products and petrochemicals. It has a unique and integrated asset base across the midstream value chain: Enterprise Products Partners L.P. (NYSE:EPD) gathers natural gas from wellheads from the Rockies to the offshore Gulf of Mexico, it operates gas processing plants, transports both natural gas and NGLs, provides storage and fractionation for NGLs, and markets natural gas and NGLs to the petrochemical industry.

Competitors would hardly choose to replicate such an enormous and strategic asset base. Instead, different players in this industry usually work together via joint ventures and complementary projects. The company is in the process of developing a new 270-mile pipeline header system that will deliver ethane to petrochemical plants in the U.S. Gulf Coast region, and it’s in a privileged position to benefit from increasing demand for natural gas liquids over the next years.

Master limited partnerships don’t pay taxes at the corporate level, and this lowers their cost of capital in comparison to their incorporated peers. Another implication of this partnership structure is that companies are required to pay distributions in relationship to their distributable cash flows, a similar concept to free cash flows. In Enterprise Products Partners L.P. (NYSE:EPD)’s case, this means a dividend yield of 4.6% at current prices.

Bottom Line

Natural monopolies are a very special kind of business, and they provide a remarkably robust and durable source of competitive advantage. These three companies combine the fundamental qualities of natural monopolies with rock solid dividend payments, and this makes them attractive opportunities for investors in the hunt for unusually solid dividend plays.

The article Three Natural Monopolies for Dividend Investors originally appeared on Fool.com and is written by Andrés Cardenal.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.