Nokia Corporation (ADR) (NYSE:NOK) investors were taken on a roller coaster ride recently, after rumors swirled regarding a possible takeover of the Finnish handset maker. Recent reports reveal that Nokia Corporation (ADR) (NYSE:NOK)’s handset business was nearly acquired by Microsoft Corporation(NASDAQ:MSFT), but talks broke down over the final asking price earlier this month. Another report, which was later discredited as a false rumor, claimed that Chinese smartphone giant Huawei was interested in acquiring Nokia Corporation (ADR) (NYSE:NOK) as well.

Considering that Nokia Corporation (ADR) (NYSE:NOK) stock has bounced back more than 50% over the past twelve months, could an imminent takeover be in the works, as Nokia Corporation (ADR) (NYSE:NOK)’s industry peers and competitors realize that the company might not be on sale forever? Let’s break down the facts and figures to see if Nokia Corporation (ADR) (NYSE:NOK) could be a worthy takeover target for a larger rival.

Rising from the ashes

Nokia’s decline has been well documented by financial media. The company, once the largest handset manufacturer in the world, had its world turned upside down by the release of Apple Inc. (NASDAQ:AAPL)’s seminal iPhone in 2007 and the subsequent deluge of Google Inc (NASDAQ:GOOG) Android handsets that followed in 2008.

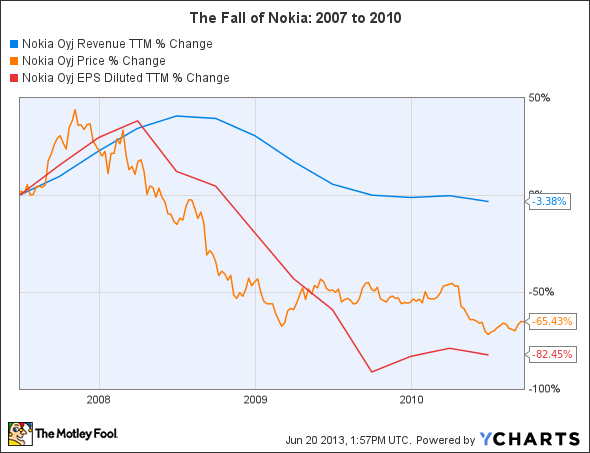

The company’s Finnish management was too proud to admit defeat and halt support for its aging Symbian operating system, so it continued to release unpopular, dated products, bleeding market share as its top and bottom line growth crumbled. Between the release of the iPhone in June 2007 and CEO Olli-Pekka Kallsvuo’s departure in September 2010, shares of Nokia lost 65% of their value as earnings per share plummeted 82%. On the following chart, the impact of Apple Inc. (NASDAQ:AAPL) and Google Inc (NASDAQ:GOOG) devices on its growth its clearly marked by a precipitous decline starting in early 2008.

Yet appointing Stephen Elop, a Canadian executive from Microsoft Corporation(NASDAQ:MSFT), as the first foreign CEO of Nokia was a bold and wise move. Although Elop’s appointment and subsequent partnership with his former employer, Microsoft, was harshly criticized by several Nokia executives who departed the company in protest, hiring Elop was the right play at the right time.

Although Nokia’s shares continued to lose value, plunging another 61% after his appointment, the bleeding appears to have stopped after fairly positive reviews and sales of its flagship Windows Phone 8 handset, the Lumia 920. Its new variants, which include the aluminum-cased 935 and the slimmer 928, have also been met with favorable reviews.

Improving sales

A recent report from research firm IDC indicates that global shipments of Microsoft’s Windows Phones, led by Nokia’s Lumia series, have surpassed Research In Motion Ltd (NASDAQ:BBRY) and claimed the third place spot behind Android and iOS.

Operating System | 1Q 2012 Market Share | 1Q 2013 Market Share |

Android | 59.1% | 75.0% |

iOS | 23.0% | 17.3% |

Windows Phone | 2.0% | 3.2% |

BlackBerry OS | 6.4% | 2.9% |

Linux | 2.4% | 1.0% |

Symbian | 6.8% | 0.6% |

Source: IDC

It’s clear that the growth of Windows Phone has come at the expense of iOS, Research In Motion Ltd (NASDAQ:BBRY) and Linux. During the first quarter, 7 million Windows Phones were sold, compared to 6.3 million BlackBerry units.

BlackBerry is struggling to stay relevant with the Z10, which features a full touch screen, and its newly released Q10, which is equipped with its traditional QWERTY keyboard. Sales of the Z10 have been weak, and the handset is now sold at steep discounts at Amazon.com, Inc. (NASDAQ:AMZN) and Costco Wholesale Corporation (NASDAQ:COST), indicating tepid demand. BlackBerry investors are hoping that the Q10 sells better than the Z10, on the hope that users were waiting for a new BlackBerry with a keyboard, and not a touchscreen.

To exacerbate BlackBerry’s woes, Nokia sold 55 million low-margin feature phones during the first quarter. Sales of these cheaper feature phones, which run on Symbian, are usually sold in developing nations, where Nokia has established a strong foothold. Symbian will finally be discontinued this summer, which indicates that some of these Nokia faithful will eventually upgrade to Windows Phone 8. Nokia’s smartphones currently account for 80% of the Windows Phone market, well ahead of HTC or Samsung.

Is a takeover imminent?

If these catalysts for future global growth start to kick in, then Nokia shares might not be cheap for much longer, since the stock is currently trading with a price-to-book ratio of 1.26. However, a potential suitor has to be financially stable enough to handle the gloomier aspects of Nokia’s financials, which look bleak compared to even BlackBerry.

5-year PEG Ratio | Total Cash | Total Debt | Debt to Equity | Return on Equity (ttm) | Profit Margin | Qty. Revenue Growth (y-o-y) | |

Nokia | 17.16 | 13.51B | 7.28B | 62.65 | -24.00% | -8.54% | -20.40% |

BlackBerry | N/A | 2.65B | No debt | No debt | -6.42% | -5.83% | -41.30% |

Source: Yahoo! Finance, 6/20/2013

On paper, Nokia looks terrible. However, the company’s recent growth in the smartphone market, the suspension of its dividend, and its sustained popularity in developing and emerging markets indicate that the worst could already be behind it.

It’s notable that Microsoft was only interested in acquiring Nokia’s device business, which houses its handset business, and not its Nokia Siemens Networks (NSN) business, which is a joint venture with.

NSN was notably Nokia’s only profitable business segment last quarter, and currently accounts for nearly half of the company’s top line. NSN is the world’s fourth largest telecom equipment manufacturer, which is poised to capitalize on rising demand for telecom equipment to build 3G, 4G and LTE networks. However, Siemens has recently been shopping around its share of NSN at it cuts back on its non-core assets, which has cast doubt on the future of the joint venture.

It would make a lot of sense for Microsoft to purchase Nokia, since the combined operations could eliminate a lot of redundancies in technology and personnel, which could yield considerable synergies. One of Nokia’s biggest problems as a standalone company is its free cash flow, which has declined 84% over the past five years. Merging its operations with Microsoft, which has seen its free cash flow rise 205% over the same period, would be a great strategy which could produce better handsets through higher R&D investments.

The Foolish Bottom Line

No one expects Nokia to topple Apple or Samsung. Yet the fact that Windows Phone has claimed a distant third place in the smartphone race should be encouraging to shareholders. Nokia has finally produced a smartphone that people are willing to buy, and this could attract the attention of the bigger fish in the sea.

For now, I believe that there’s not much downside at these levels for Nokia shareholders, but plenty of upside.

Nokia’s been struggling in a world of Apple and Android smartphone dominance. However, the company has banked its future on its next generation of Windows smartphones.

The article Nokia Continues to Rise From the Ashes originally appeared on Fool.com.

Leo Sun owns shares of Nokia. The Motley Fool owns shares of Microsoft. Leo is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.