Is NextEra Energy, Inc. (NYSE:NEE) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy league graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

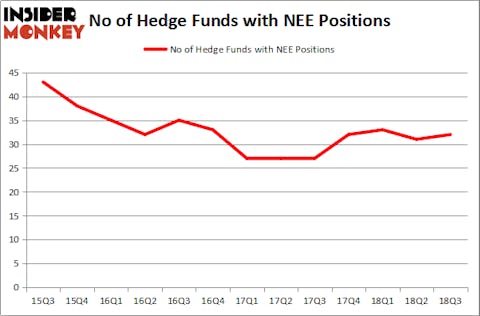

NextEra Energy, Inc. (NYSE:NEE) was in 32 hedge funds’ portfolios at the end of the third quarter of 2018. NEE has experienced an increase in enthusiasm from smart money in recent months. There were 31 hedge funds in our database with NEE holdings at the end of the previous quarter. Our calculations also showed that NEE isn’t among the 30 most popular stocks among hedge funds.

Today there are numerous metrics market participants use to grade their stock investments. Two of the less known metrics are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the top picks of the best investment managers can outclass the market by a significant amount (see the details here).

We’re going to check out the key hedge fund action surrounding NextEra Energy, Inc. (NYSE:NEE).

How are hedge funds trading NextEra Energy, Inc. (NYSE:NEE)?

Heading into the fourth quarter of 2018, a total of 32 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 3% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in NEE over the last 13 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, AQR Capital Management was the largest shareholder of NextEra Energy, Inc. (NYSE:NEE), with a stake worth $416.3 million reported as of the end of September. Trailing AQR Capital Management was Renaissance Technologies, which amassed a stake valued at $166 million. Adage Capital Management, Zimmer Partners, and D E Shaw were also very fond of the stock, giving the stock large weights in their portfolios.

As one would reasonably expect, key hedge funds have been driving this bullishness. OZ Management, managed by Daniel S. Och, assembled the most outsized position in NextEra Energy, Inc. (NYSE:NEE). OZ Management had $19.8 million invested in the company at the end of the quarter. Peter J. Hark’s Shelter Harbor Advisors also made a $18.4 million investment in the stock during the quarter. The other funds with brand new NEE positions are Andrew Weiss’s Weiss Asset Management, Glenn Russell Dubin’s Highbridge Capital Management, and Matthew Tewksbury’s Stevens Capital Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as NextEra Energy, Inc. (NYSE:NEE) but similarly valued. These stocks are Petroleo Brasileiro S.A. – Petrobras (NYSE:PBR), Sony Corporation (NYSE:SNE), Vale SA (NYSE:VALE), and Starbucks Corporation (NASDAQ:SBUX). This group of stocks’ market valuations match NEE’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PBR | 28 | 2056204 | 0 |

| SNE | 27 | 709311 | 3 |

| VALE | 35 | 2585315 | 3 |

| SBUX | 33 | 934942 | -9 |

| Average | 30.75 | 1571443 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.75 hedge funds with bullish positions and the average amount invested in these stocks was $1.57 billion. That figure was $1.16 billion in NEE’s case. Vale SA (NYSE:VALE) is the most popular stock in this table. On the other hand Sony Corporation (NYSE:SNE) is the least popular one with only 27 bullish hedge fund positions. NextEra Energy, Inc. (NYSE:NEE) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard VALE might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.