Earlier this month, News Corp (NASDAQ:NWSA)‘s investors formally approved the separation of the company’s publishing and entertainment business. A separate corporate entity comprising the publishing unit will be created and the entertainment unit, consisting of film and television operations, will be renamed. The two companies will begin their separate trading from July 1.

The two companies

Last month, News Corp (NASDAQ:NWSA)’s board approved the separation of businesses into two distinct companies, one focusing on the newspaper and book-publication business, including Dow Jones Newswires, New York Post, HarperCollins,The Wall Street Journal and other British and Australian publications. It will be called the New News Corporation. The other will be its entertainment arm, which will be called 21st Century Fox. It includes the 20th Century Fox movie studio, Fox broadcast and cable channels and other entertainment properties.

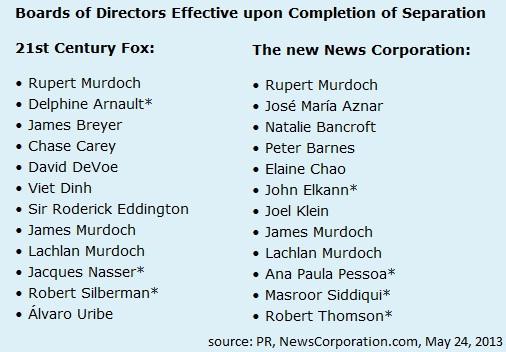

The board of the two companies will have 12 directors each, including Rupert Murdoch and his sons Lachlan and James, who will sit on the two boards. The company is getting seven new directors – as indicated by a * in the picture below — who weren’t a part of the previous News Corp (NASDAQ:NWSA)’s board. The most prominent new entrant will be Ford Motor Company (NYSE:F)’s former CEO and BHP Billiton Limited (ADR) (NYSE:BHP)‘s chairman Jacques Nasser.

The current shareholders will receive one share of the new News Corp against every four shares of News Corp. News Corp will also implement a $500 million stock repurchase for new News Corp once the separation is complete.

News Corp (NASDAQ:NWSA) has also adopted a one-year “poison pill” provision aimed at preventing further divisions and protecting the interest of shareholders, particularly Rupert Murdoch and his family members. The current shareholders can purchase new shares at a 50% discount if anyone acquires at least a 15% stake in the new News Corp and 21st Century Fox.

This appears to be one of the lessons Mr. Murdoch has learned when, nearly nine years ago, John Malone acquired 16.3% voting shares of the firm and was ultimately able to secure Mr. Murdoch’s stake in DirectTV against his holding.

The company’s publishing arm has struggled, dragging the income of News Corp (NASDAQ:NWSA). Last year, News Corp booked $2.8 billion in impairment charges, mainly due to its publication unit. In the current quarter, News Corp’s income will take a hit of between $1.2 billion and $1.4 billion as pre-tax charges related to write downs of the publishing unit’s assets.

Meanwhile, its shares have risen by 23.8% in the last six months in anticipation of the split. By comparison, the S&P 500 ETF (SPY) has trailed far behind, showing a rise of 14% in the corresponding period.

In its last quarterly results, News Corp managed to beat both top- and bottom-line estimates. Its quarterly income increased threefold to $2.8 billion, or $1.22 per share. Earnings received the boost due to one-time gains and strong performance of cable networks. Adjusted earnings were $0.36 per share, beating the market’s estimates by $0.01. Revenue rose by 13.5% to $9.5 billion from $8.4 billion in the same quarter last year.

However, operating income of the publishing business fell by 34.6% while revenue dropped by 4.3% on the back of falling ad revenue, particularly of the Australian newspapers.

| Segments | 2012(In Millions) | 2013(In Millions) | % Change |

|---|---|---|---|

| Cable Network Programming | $846 | $993 | 17.4% |

| Filmed Entertainment | $272 | $289 | 6.3% |

| Television | $171 | $196 | 14.6% |

| Direct Broadcast Satellite TV | $40 | -$11 | -127.5% |

| Publishing | $130 | $85 | -34.6% |

The new News Corp will have a market cap of $10 billion–that is almost equal to the quarterly revenue of the current News Corp.

The new News Corp (NASDAQ:NWSA) will start fresh with approximately $2.6 billion cash and zero debt. The company believes that with the resources at its disposal, it is in a better position than its peers, such as Gannett Co., Inc. (NYSE:GCI) and The New York Times Company (NYSE:NYT), to expand its business through strategic acquisitions.