In a perfect storm, the combination of several events combines in a way that creates a worst-case scenario. When these events occur, they can have devastating implications. In 2012, a combination of macroeconomic events and management moves put Nabors Industries Ltd. (NYSE:NBR) into the eye of a perfect storm, and now the company hopes to steer to better waters. Let’s check in with Nabors to see what put it in this predicament and how it plans to get out.

To understand how the company got where it is, we need to jump into the Wayback Machine, all the way to 2008. Fresh off of the financial collapse, crude oil was trading just below $35, its lowest since 2004. With oil prices so low, exploration and production companies couldn’t justify drilling for new sources. Nabors Industries Ltd. (NYSE:NBR) therefore suspended all new build plans and even had to terminate contracts on 16 rigs that were in the process of being built.

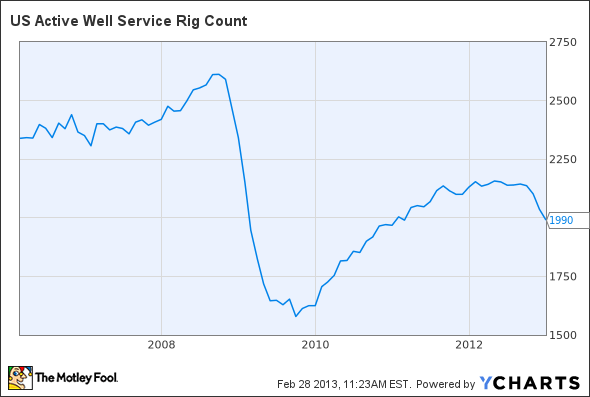

With its capital budget cut down to next to nothing, Nabors Industries Ltd. (NYSE:NBR) was caught on its heels when the oil and gas boom started to take off in the United States. Thanks to advancements in horizontal drilling and hydraulic fracturing, E&P companies set off on a gold rush-like fervor. But Nabors couldn’t respond to the industry’s needs fast enough because its build pipeline was decimated going back to 2008.

US Active Well Service Rig Count data by YCharts

To raise as much capital as possible so it could start building out again, Nabors Industries Ltd. (NYSE:NBR) secured contracts for the longest terms possible. At the time, that strategy seemed to make sense, since it helped to address the problems the company was facing at the time. The problem, though, was that almost all of these contracts expired in 2012. So the company found itself with over 118 of its contracts maturing in the midst of the lowest natural gas prices in 12 years. So, just as in 2008, the company was stuck without many clients wanting to drill.

Batten down the hatches

Despite last year’s difficult conditions, the company was able to survive it with a gain on the year of $0.57 EPS, about one third less than 2011. If there is any solace in these numbers, it’s that Nabors wasn’t the only one to suffer. These same industry conditions also led Halliburton Company (NYSE:HAL) to post an 8% drop income from 2011. The only big winners in the oil services space in 2012 were some of the more niche players, such as U.S. Silica Holdings Inc(NYSE:SLCA), that are delivering specialized products geared for unconventional oil and gas exploration.

Nabors has gone to great lengths to rein in its capital expenditures. Capex for 2012 was $700 million less than in 2012, and Nabors CEO Anthony Petrello has made it clear that management will be very prudent with its capital program going forward. While there have certainly been some snafus from Nabors’ management, one thing it should be commended for is the building of the PACE-X rig. It’s been an industry darling, as well as one of the more successful parts of the Nabors rig fleet. These new rigs, which are much better suited for the popular pad drilling technique, have a utilization rate of 92%, the highest in Nabors’ fleet.

What a Fool believes

Nabors management has done a decent job of navigating this company through a rather difficult macroeconomic situation and coming out with a strong financial position. The company seems to have the pulse of unconventional shale drilling with its PACE-X rig and its team effort with Caterpillar Inc. (NYSE:CAT) to design pumping systems that will be able to run on a multitude of fuels. This could come in handy, especially in regions like the Bakken, which is flaring off more than one-third of its natural gas.

Nabors still has some things to be concerned about going forward. The company plans to cut its international capital expenditures by 60%, which could come back to haunt it. A recent report from Barclays shows that capital expenditures for oil exploration and production will remain flat in North America, while the international market plans to expand by more 9%. That sets Nabors in stark contrast with one of its major competitors, National-Oilwell Varco, Inc. (NYSE:NOV) , 94% of whose rig backlog is destined for international markets. So it appears that Nabors hopes to gain stronger revenue through improved market share in the U.S. (NYSE:SLCA), a much tougher path to chart.

The article 2012 Brought a Perfect Storm for This Oil Services Company originally appeared on Fool.com.

Fool contributor Tyler Crowe has no position in any stocks mentioned. You can follow him at Fool.com under the handle TMFDirtyBird, on Google +, or on Twitter@TylerCroweFool.The Motley Fool recommends Halliburton and National Oilwell Varco.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.