Insider Monkey has processed numerous 13F filings of hedge funds and famous investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds and investors’ positions as of the end of the third quarter. You can find write-ups about an individual hedge fund’s trades on several financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of eBay Inc (NASDAQ:EBAY) based on that data.

Is eBay Inc (NASDAQ:EBAY) a great investment now? The best stock pickers are in a bearish mood. The number of long hedge fund bets were cut by 5 in Q3. At the end of this article we will also compare EBAY to other stocks including NXP Semiconductors NV (NASDAQ:NXPI), Humana Inc (NYSE:HUM), and Imperial Oil Limited (USA) (NYSEAMEX:IMO) to get a better sense of its popularity.

Follow Ebay Inc (NASDAQ:EBAY)

Follow Ebay Inc (NASDAQ:EBAY)

Receive real-time insider trading and news alerts

Katherine Welles / Shutterstock.com

What have hedge funds been doing with eBay Inc (NASDAQ:EBAY)?

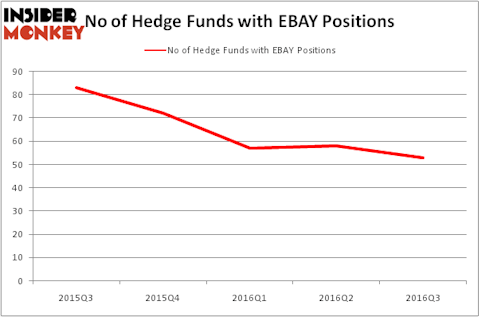

At the end of the third quarter, a total of 53 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 9% decline from the second quarter of 2016, and well below its levels from a year ago, when it was held by over 80 hedge funds.

When looking at the institutional investors followed by Insider Monkey, Stephen Mandel’s Lone Pine Capital has the biggest position in eBay Inc (NASDAQ:EBAY), worth close to $1.09 billion, amounting to 4.9% of its total 13F portfolio. The second-most bullish fund manager is AQR Capital Management, led by Cliff Asness, holding a $366.1 million position. Other professional money managers with similar optimism encompass David Cohen and Harold Levy’s Iridian Asset Management, Robert Pitts’ Steadfast Capital Management, and Israel Englander’s Millennium Management.

Judging by the fact that eBay Inc (NASDAQ:EBAY) has faced falling interest from the entirety of the hedge funds we track, logic holds that there were a few hedge funds who were dropping their entire positions heading into Q4. At the top of the heap, David Blood and Al Gore’s Generation Investment Management cut the largest investment of all the hedgies followed by Insider Monkey, comprising about $106.1 million in stock, while Mehdi Mahmud’s First Eagle Investment Management was right behind this move, as the fund sold off about $45.3 million worth of stock. These transactions are interesting, as total hedge fund interest fell by 5 funds heading into Q4.

Let’s now take a look at hedge fund activity in other stocks similar to eBay Inc (NASDAQ:EBAY). These stocks are NXP Semiconductors NV (NASDAQ:NXPI), Humana Inc (NYSE:HUM), Imperial Oil Limited (USA) (NYSEAMEX:IMO), and Dollar General Corp. (NYSE:DG). All of these stocks’ market caps resemble EBAY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NXPI | 78 | 2623678 | 21 |

| HUM | 66 | 5948125 | 2 |

| IMO | 6 | 76445 | -3 |

| DG | 53 | 1173695 | 0 |

As you can see these stocks had an average of 50.75 hedge funds with bullish positions and the average amount invested in these stocks was $2.46 billion. That figure was $3.71 billion in EBAY’s case. NXP Semiconductors NV (NASDAQ:NXPI) is the most popular stock in this table. On the other hand Imperial Oil Limited (USA) (NYSEAMEX:IMO) is the least popular one with only 6 bullish hedge fund positions. eBay Inc (NASDAQ:EBAY) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Given eBay’s recent loss of hedge fund support, NXPI might be a better candidate to consider a long position.

Disclosure: None