Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we follow the hedge fund activity in the small-cap space.

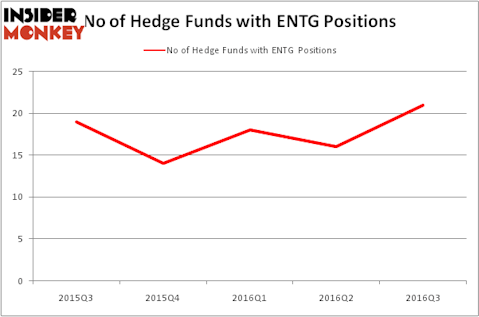

Is Entegris Inc (NASDAQ:ENTG) the right investment to pursue these days? Hedge funds are taking an optimistic view. The number of long hedge fund positions rose by 5 lately. ENTG was in 21 hedge funds’ portfolios at the end of the third quarter of 2016. There were 16 hedge funds in our database with ENTG positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Platform Specialty Products Corp (NYSE:PAH), Silicon Laboratories (NASDAQ:SLAB), and Hawaiian Holdings, Inc. (NASDAQ:HA) to gather more data points.

Follow Entegris Inc (NASDAQ:ENTG)

Follow Entegris Inc (NASDAQ:ENTG)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

What have hedge funds been doing with Entegris Inc (NASDAQ:ENTG)?

At Q3’s end, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 31% boost from one quarter earlier. Hedge fund ownership of ENTG has been volatile, but did hit a yearly high on September 30. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Thomas E. Claugus’ GMT Capital has the number one position in Entegris Inc (NASDAQ:ENTG), worth close to $240.3 million, accounting for 4.9% of its total 13F portfolio. The second largest stake is held by RGM Capital, led by Robert G. Moses, holding a $67.8 million position; the fund has 7.6% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors with similar optimism contain Mariko Gordon’s Daruma Asset Management, Jim Simons’ Renaissance Technologies and Israel Englander’s Millennium Management.